Fitch downgrades the US’s coveted trible A credit rating. The US dollar, Treasury yields and Asian stocks stumbled after that. In addition, confidence in the economy decreased and interest in safe-haven bullion increased. Gold prices rose on Wednesday as a result of these developments. Analysts and experts explain what awaits gold next.

Fitch downgrades US, gold prices rise

After the Wall Street close on Tuesday, Fitch downgraded the US government’s credit rating from AAA to AA+, citing financial deterioration and increasing general government debt burden over the next three years. Edward Meir, precious metals analyst doing research for Marex, comments on the development as follows:

The markets went wild when S&P last downgraded in 2011. But we’re not seeing the same kind of reaction right now. Still, everything is worth watching.

ANZ: This will limit the upward movement of gold

Investors remain focused on Friday’s July nonfarm payrolls report. This data is an important barometer of the health of the US economy. Meanwhile, US central bankers are expressing hope that they can beat inflation without crashing the job market. But they also say doing so will require keeping interest rates higher for a while.

ANZ analysts assess that changing expectations about the Fed’s final interest rate may limit the upward movement of gold in the near term after the US central bank left the door open for a new increase in September.

Six prices will eventually rise above $2,000

cryptocoin.com According to the data released on Tuesday, vacancies in the US fell to the lowest level in the last two years in June. However, it remained at levels consistent with tight labor market conditions. Meanwhile, US manufacturing stabilized at weaker levels in July, thanks to the gradual improvement in new orders. All eyes are now on the US nonfarm payrolls report for July, due Friday. Edward Moya, senior market analyst at OANDA, comments on the impact on gold prices as follows:

Gold prices are easing as the US dollar rises. There is also some profit taking ahead of the nonfarm payrolls report to be released later this week… If we see inflation come down, I think the Fed will not raise rates at the next meeting… Gold prices may be range-bound in the near term. But eventually it will go over $2,000.

Inflation is under control, but the risk of recession still exists!

The Fed believes that inflation will not return to the target before 2025 and that interest rates should be kept high for longer. A new research report from WisdomTree suggests that inflation is already under control. It also highlights that the risk of recession is still rising. According to Nitesh Shah, Head of Commodities and Macroeconomic Research at WisdomTree Europe, the current path the Fed is taking may well exceed its inflation target. It is possible that this will drag the US economy into recession. Shah highlights the following in his latest Gold Outlook report:

US inflation is indisputably falling hard. However, the old shelter data in the Consumer Price Index (CPI) calculation masks the truth… This single variable change will dramatically change the Fed’s inflation rhetoric. Thus, it will show that the Fed should increase interest rates.

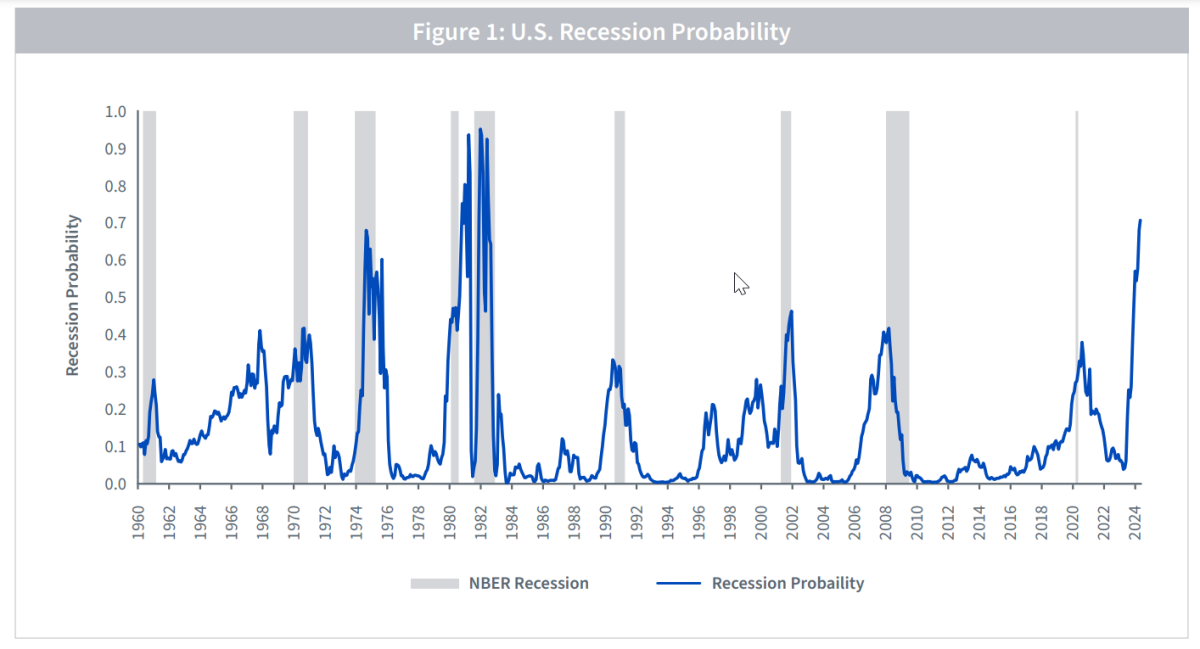

When recession risk is measured by yield curve inversion, Shah sees a 70% probability of the US economy entering a recession by mid-2024.

In this case, gold prices perform positively.

The Fed’s Bank of New York model has a pretty good track record of detecting past recessions. That’s why it’s hard to ignore this warning sign, Shah says. He also adds that investors should consider gold a “defensive asset” as recession risks rise. This is an important factor for gold prices. Shah points out that gold has a history of performing well during times of economic stress. In this context, he comments:

As can be seen in Figure 2 below, when the composite leading indicators (Figure 3) turn strongly negative, gold prices perform positively while stocks tend to be negative. Gold also outperforms Treasuries, which are seen as competing defense assets.

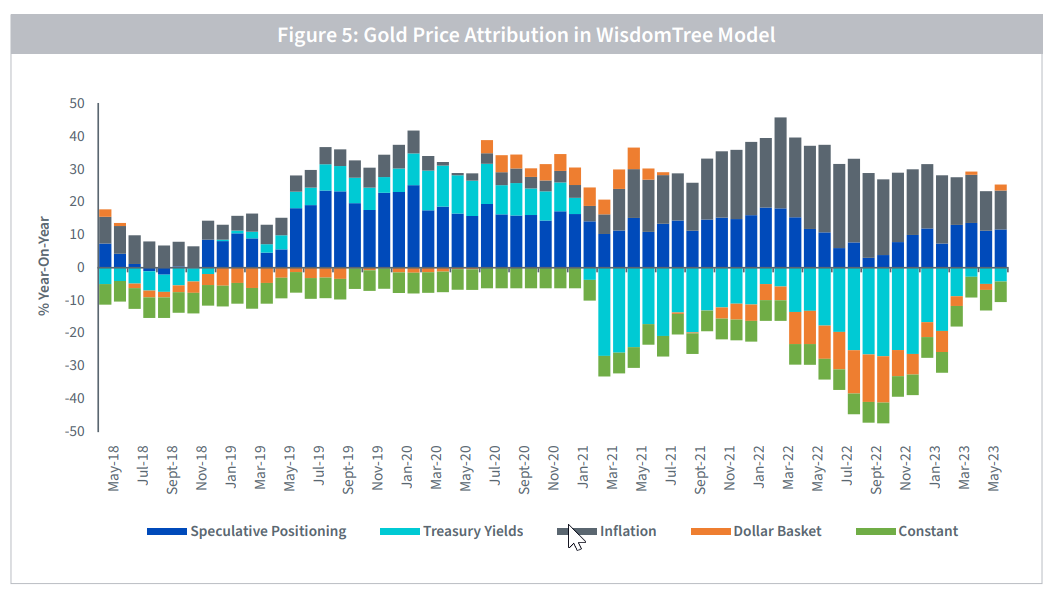

The increase in investor sentiment towards gold stopped

Using WisdomTree’s quantitative gold model, Shah looks at what has driven gold lately. “We can see that inflation has moderated, thus providing less support to gold prices compared to last year. The recovery in investor sentiment towards gold (measured by speculative positioning) has largely stalled. The extension of the debt ceiling and the mini-banking crisis (yet) surviving without any significant systemic impact have softened investor demand for the metal.” says. However, he adds that the decline of the US dollar compared to 2022 acts as a support for gold.

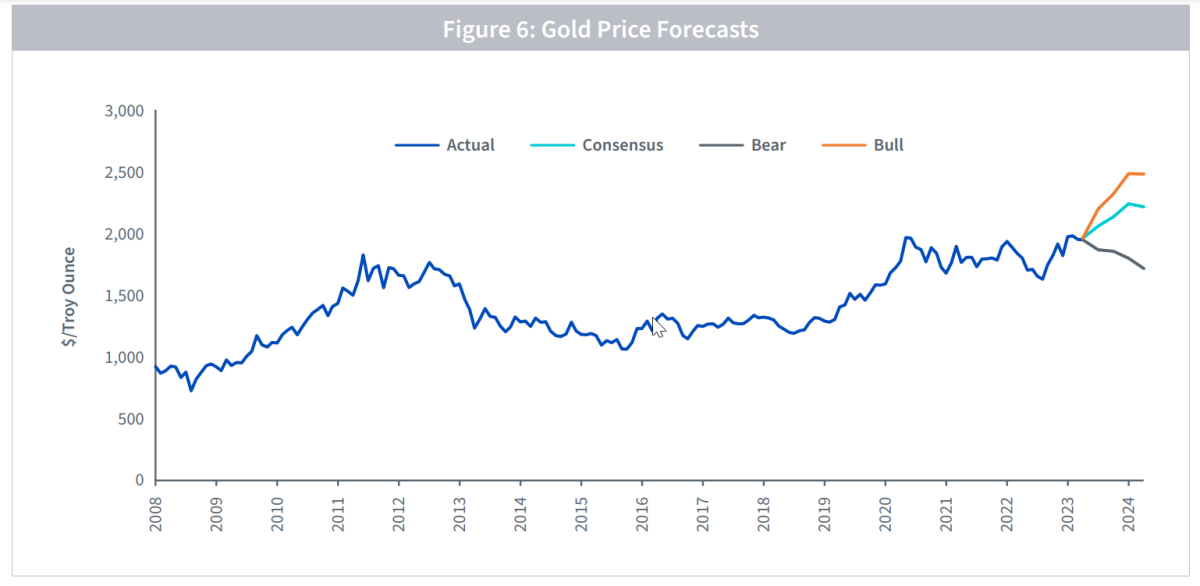

Shah then uses the same model to generate forecasts for gold prices “consistent with various macroeconomic scenarios.” “Our consensus scenario takes the average views of the Bloomberg Survey of Professional Economists on forecasts for inflation, US dollar and Treasury yields,” he writes. Based on this, he makes the following assessment:

Consensus expects inflation to continue to decline, the US dollar to depreciate and bond yields to continue falling. Without a consensus forecast on gold price sentiment, we cut speculative positioning from the high near 180,000 in June 2023 to the conservative 100,000, which is close to the long-term average. The risk is clearly upside should a recession or financial dislocation occur this year.