Although Bitcoin moves below the level of $ 28,868 on the daily chart, it is above the closings, but after the daily close, we made an upward movement to the level of PWO $ 30,120 the other day, and the price remained below the $ 29,500 and WO (weekly open) levels again with the selling pressure it faced here.

For now, $28,868 is a very important daily level. Below that, the price will tend to test the fibonacci 0.5 level I marked in red. Accumulation above the $29,500 level is very important.

Bitcoin 4-hour chart

I’m looking at the 4-hour chart a little more simply. We cleared the liquidity of the $28,600 level and surged to the $30,120 level. But for now, we are below the weekly opening (WO). The scenario that we can look at positively; the price is above the $28,900 level. In closings below this level during the day, the price will tend to test the liquidity areas below.

Ethereum daily chart

Ethereum is trading below the daily opening levels, but it is positive that the price has not closed below the 1.800 levels for a long time. Looking at the chart below, the $1,834 and $1,818 levels are seen as strong support zones. In the loss of this region, price imbalances below will tend to repair the price imbalance.

On the other hand, we can see an upward movement up to $1,900 in the daytime and daily closes above $1,856 resistance.

After clearing the liquidity of $1,811, the price made an upward move as far as $1,880. The $1,835 level we are currently looking at is our support area, accumulation above this level will be extremely important. 4-hour closes below this zone will force the price to go down.

Especially if the $1,811 support is lost, we can see the price at $1,700. We can follow the level of WO as resistance and an important level. Closes above the $1,850 level will be positive.

DXY Dollar index

Looking at the DXY chart, we can see the bullish move. Although it moved below the 100 level, it jumped over the 102 level with yesterday and today’s data.

If the daily chart is below 102.73, it is possible to test 102 again. If we can see a 102 move in DXY, we might see a bounce in the crypto market.

Closes below 102.50 during the day and on a daily basis will be positive for Bitcoin.

DXY 4-hour chart

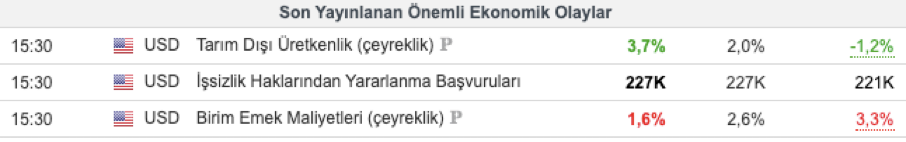

Before moving on to the chart, let’s take a look at the data announced today.

Applications to benefit from non-agricultural productivity (quarterly) unemployment benefits and unit labor costs were announced.

Positive non-agricultural productivity, neutral benefit from unemployment benefits, and negative unit labor cost quarterly did not have much effect on the DXY side.

Looking at the post-data chart

It falls below the daily opening level. Below this level, the red zone must be lost. If closings occur under the red zone, we can see a decrease to 102.14 and MO (montly open). With this decline, I hope the crypto market will be positively affected.

Thank you to everyone who has read this far and to the Coinkolik family.