While the crypto money market experienced a slight loss of momentum, it was a matter of curiosity which levels would be observed in the new week. In this article, we will convey the expectations for Bitcoin (BTC), XRP and Ethereum (ETH). Here are the details…

What’s next for XRP?

Before BTC and ETH, we will talk about XRP. cryptocoin.com As we reported, XRP experienced an unexpected rise by climbing to $ 50 in Gemini. This significant price increase was revealed by the relisting announcement by Gemini. The crypto community has been eagerly awaiting the results of the US Securities and Exchange Commission’s (SEC) interim appeal against Judge Torres’ decision in the case. Gemini exchange relisted the XRP token on August 10, causing the XRP price to skyrocket. Observers noted the bizarre situation where no XRP tokens were offered for sale at one point in the exchange’s order book. A trader put a stock of XRP for sale at $50, causing the price to rise. This is due to various factors such as price manipulation, a glitch, or illiquidity.

Weekly BTC, XRP and ETH Forecast: These are the Numbers!

Weekly BTC, XRP and ETH Forecast: These are the Numbers!Gemini later announced a scheduled maintenance that temporarily halts deposits and withdrawals. After the glitch was fixed, the XRP price dropped to around $0.6363, making it compatible with other exchange platforms. Meanwhile, the XRP community continues to speculate about the repercussions of the SEC’s interim appeal on XRP holders. Attorney John Deaton has commented on the potential outcome of the appeal. Deaton says that while Judge Torres is likely to accept the appeal, he could make his decision “appeal-proof.” It also believes that it can secure XRP’s non-security status regardless of the outcome of the appeal.

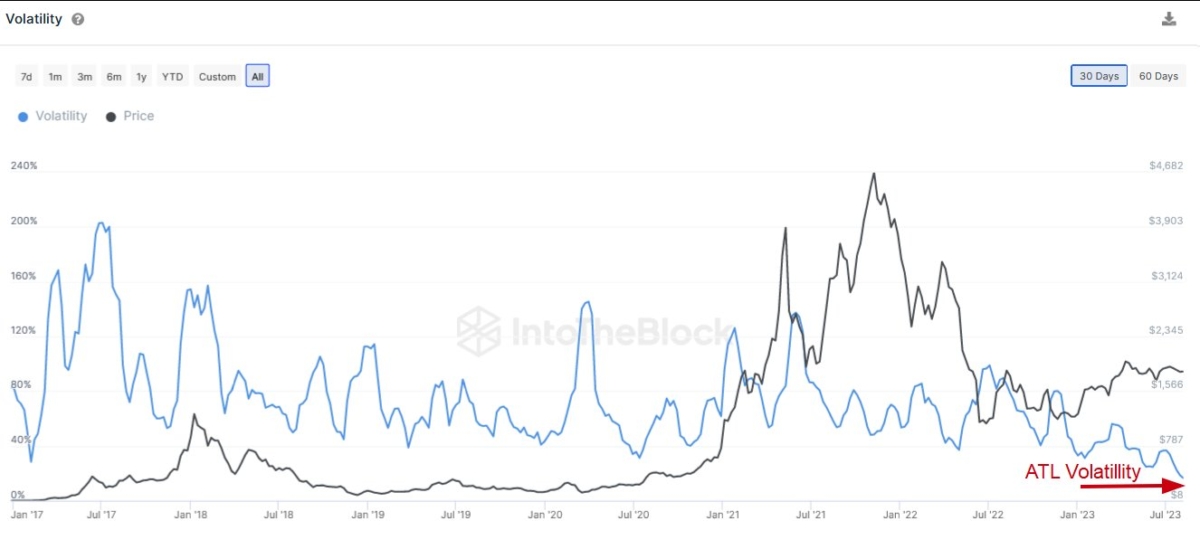

Low volatility alert for Ethereum

Before the BTC analysis, an Ethereum analysis draws attention. According to analyst Ekta Mourya, Ethereum’s recent low volatility has been a notable event in the crypto space. As volatility declines, historical models show an increase in adoption among owners. This phenomenon usually indicates that investors are starting to have more confidence in the stability of the asset. However, current volatility levels are strikingly low. This unique combination of low volatility and positive on-chain metrics is critical. Because there is a possibility that it will herald an important price movement in the near future.

An important on-chain metric, the MVRV rate is gaining attention among Ethereum enthusiasts. This ratio, which is calculated by dividing the market value of the asset by its actual value, gives an idea of the potential profits that can be obtained from the sale of the asset. According to data from Santiment, Ethereum’s MVRV rate shows that the asset is below its value as of August 11. This impairment could potentially attract more buying interest and contribute to an upside price trajectory.

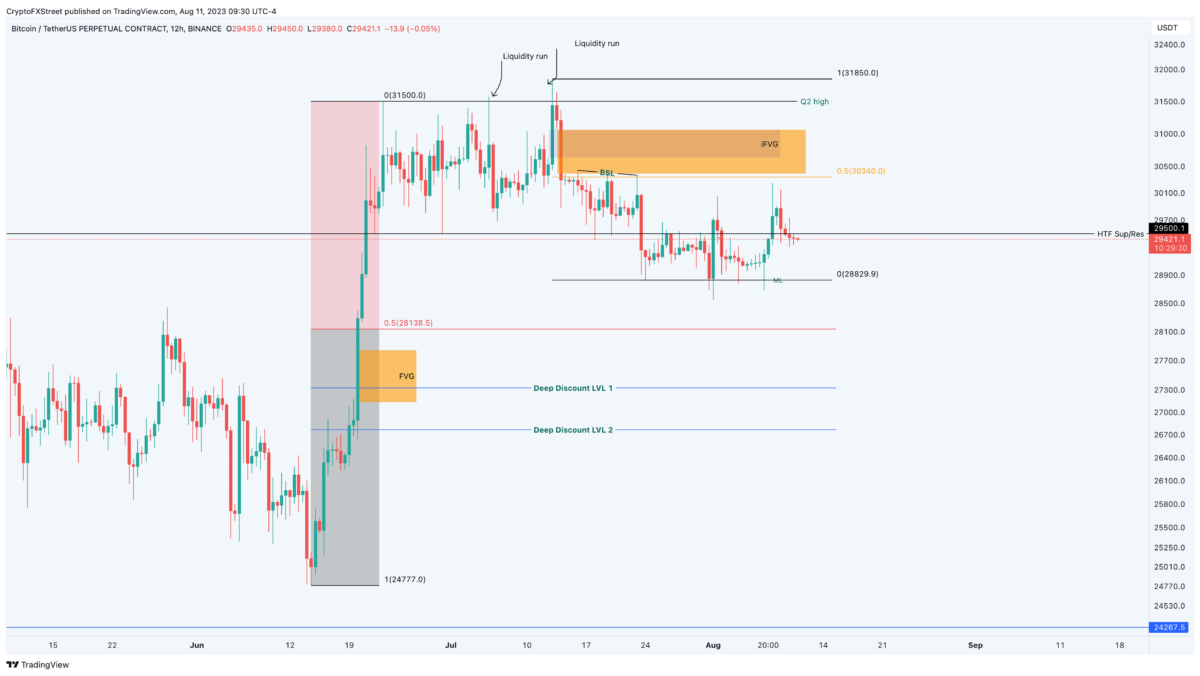

Bitcoin (BTC) moves sideways: rise or fall?

Finally, all eyes are on BTC. According to analyst Akash Girimath, Bitcoin’s long period of sideways movement, which lasted for about 50 days, has caused investors to look for trading opportunities in crypto beyond traditional volatility. This lack of price action is causing frustration among traders. However, it has also led to further examination of other potential profit avenues. This period of recession has prompted some analysts to consider the possibility of retesting key hurdles as a precursor to shorts, in anticipation of an average reversal.

The deadline for the SEC’s decision on the ARK 21Shares Bitcoin ETF is approaching. Meanwhile, speculation is growing among investors and market watchers. Despite expectations, many experts are biased towards the expectation of rejection. This sentiment is based on the regulatory authority’s historical stance on cryptocurrency-related issues. However, some degree of uncertainty remains. Some market participants are cautiously assessing the potential for a surprise confirmation. Such confirmation could ignite a new rally in BTC price and potentially push it towards the key $35,000 and $40,000 resistance levels. Conversely, if the SEC truly rejects the ETF offer, the low volatility dry period could continue and bring the price of Bitcoin down as it navigates the complex dynamics of the market.