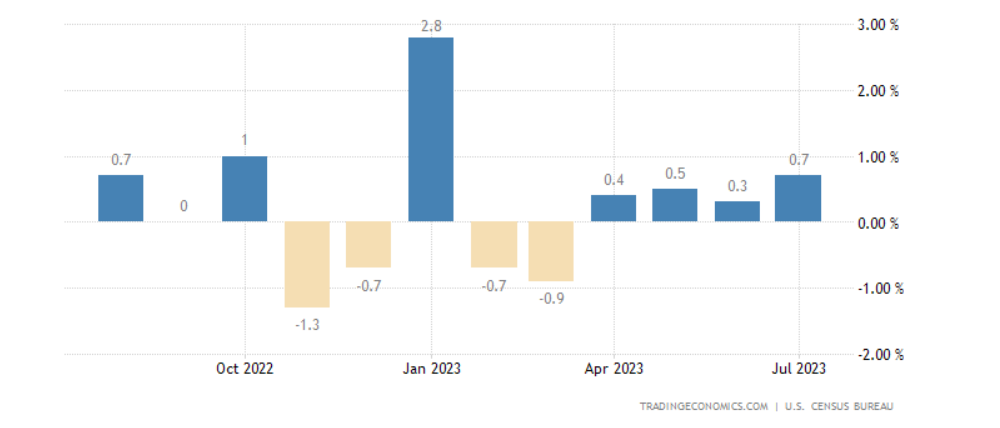

US monthly retail sales data, which is followed closely by investors and markets, has been announced as of now. Monthly retail sales, which increased by 0.3% in the previous period, exceeded the expectations for July, despite the expectation of 0.4%. Retail sales for the period of July increased by 0.7%.

In addition to the monthly figures, annual sales also increased more than expected. The annual retail sales data, which increased by 1.59% in the previous period, was announced as 3.17%, against the expectations of 1.50%.

Monthly core retail sales, on the other hand, were announced in the opposite direction, surprising everyone. Official data emerged as a 1% increase, while markets expected core sales to drop by -0.3%.

How is the Fed’s Interest Rate Decision Affected?

Following the pandemic, the FED, which implemented a tight monetary policy to stop inflation, increased interest rates for a long time. Consumer inflation, which exceeded 8% in the USA, decreased to 3.2% thanks to this.

While the retail sales data is above expectations, it reduces the possibility of a recession in the economy and may herald a possible upward pressure on inflation. However, economists expect the FED to start lowering rates towards the middle of 2024.