Altcoin Chainlink (LINK) suffered an 11% price drop after breaking the $7 support level. However, there is involvement of bull whales, primarily Coinbase institutional investors. Accordingly, this indicates the potential for a recovery in prices. The integration of Chainlink’s price streams into Coinbase’s Layer-2 Network Base has produced an important result. It has resulted in increased network activity and investor interest.

Coinbase whales support altcoin Chainlink’s price recovery

It comes as a shock that the price of Altcoin Chainlink (LINK) has dropped by 11% since August 10. Also, the break of the $7 support raises questions about its potential trajectory. There is another noteworthy development. That’s where bull whales step in, taking the opportunity to hoard LINK at a lower price point. The presence of these influential players sets the stage for a potential price rally.

Altcoin Chainlink’s recent integration of price streams into Coinbase’s Layer-2 Network Base has caught the attention of institutional investors associated with the exchange. The Coinbase platform is famous for catering to institutional players in the US crypto market. Therefore, the integration brought altcoin LINK back into the limelight.

Impact on whales and processes

The impact of integration is evident in the surge in trading activity among altcoin LINK whales. Whale transactions increased from 40 to 117 between August 12 and August 16. Accordingly, it has increased almost three times. This increase, tracked through the Number of Whale Transactions, is significant. Because it indicates that the interest in LINK among institutional investors has increased again.

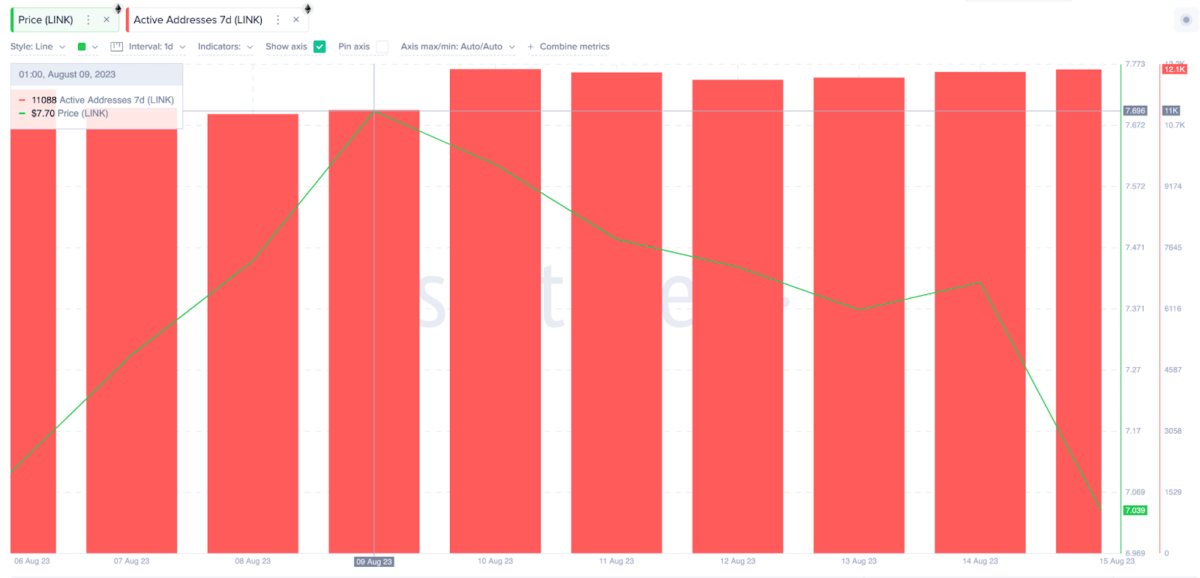

The renewed interest from institutional investors is in line with Chainlink’s continued healthy network activity. Despite the recent price correction, LINK has been experiencing consistent growth in active addresses since August 9. This growth, which marks a 9% increase, supports a positive divergence between price and network participation. On the other hand, it signals a potential uptrend.

Potential price targets

Considering these dynamics, the possibility of a rebound in LINK prices is gaining strength. Although the $7.50 level creates an important sell wall, the buying pressure from Coinbase whales could push altcoin LINK towards the $8 price target. However, falling below the vital $6 support will weaken this forecast. It will also create potential difficulties in the recovery of altcoin LINK.

cryptocoin.com Looking at it as a whole, altcoin Chainlink (LINK) is facing a price correction. On the other hand, the involvement of influential Coinbase whales offers a promising narrative for price recovery. Integration with Coinbase’s Layer-2 Network and increased network activity point to a positive outlook for LINK’s future trajectory. However, careful observation of key support and resistance levels remains essential for a comprehensive assessment of LINK’s journey ahead.