We’ve had a turbulent week for Bitcoin. The flagship of cryptocurrencies fell 10% against the dollar. Also, this drop led to speculation about SpaceX’s potential Bitcoin sale. Despite this, BTC has shown impressive growth year-to-date, with an increase of around 50%. On the other hand, BTC mining shares are up over 200% this year. Also, Cipher Mining (CIFR) leads the way with a notable 389% gain.

Bitcoin-focused stocks

2023 has seen crypto-related stocks outperform traditional stock market benchmarks by a significant margin. The S&P 500, made up of the top 500 companies in the US, has posted a healthy 14% gain so far this year. The tech-focused NASDAQ Composite is up a staggering 28%. The Dow Jones Industrial Average, on the other hand, gained a more modest 4%. Notable individual performers include Nvidia (219%), Meta (164%) and Tesla (117%).

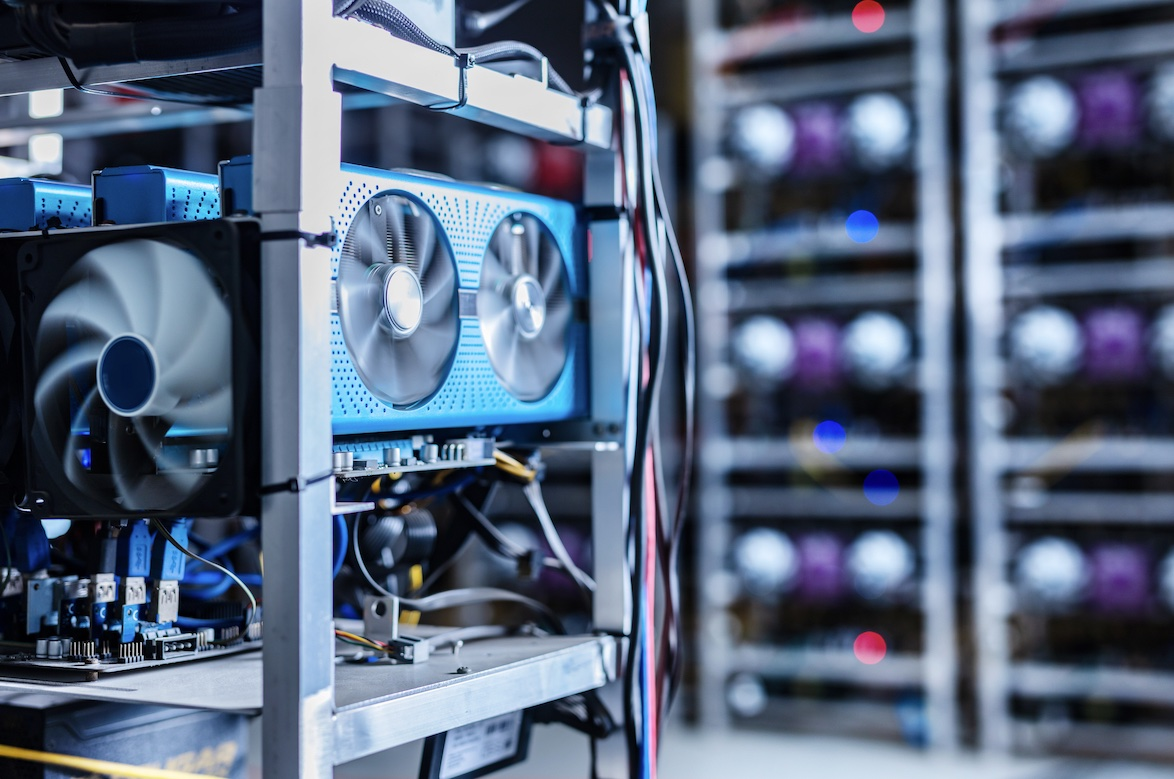

But Bitcoin mining shares are benefiting from increased blockchain activity in 2023. Accordingly, it surpassed even the best performers we gave above. Two leading Bitcoin mining stocks, Riot Blockchain Inc. (RIOT) and Marathon Digital Holdings Inc. (MARA) has increased by over 200% since January. Also, both posted gains of impressive 228%. Still, Cipher Mining has eclipsed them all, with a staggering 389% this year.

Driving force behind BTC mining stock surge

The correlation between Bitcoin and stock prices allows investors to jointly navigate market volatility, albeit with more leverage, while holding long Bitcoin positions on-chain. What makes BTC mining stocks particularly attractive is that they have more leverage potential than traditional stocks. They also serve as a useful proxy for institutional investors who cannot buy BTC directly.

However, given the cyclical nature of the Bitcoin mining industry, investors need to be careful. As Bitcoin prices fluctuate, mining operations become unprofitable. Nasdaq advises potential investors in BTC mining stocks to thoroughly understand these unique dynamics. While these mining stocks have delivered outstanding returns this year, they also carry Bitcoin-specific risks that require careful consideration.

A harbinger of a rally in bitcoin price?

The outstanding performance of Bitcoin mining stocks could herald significant price movements in the future of Bitcoin. Institutional investors cryptocoin.com Looking at it as a whole, it is increasingly adopting the SHA-256 hash currency. Accordingly, mining stocks provide valuable insight into the evolving landscape of Bitcoin adoption.