The co-founders of crypto analytics firm Glassnode have prepared two scenarios for Bitcoin (BTC) following the market crash. Analysts believe a bottom can occur if one of two things happens.

Two possible scenarios for Bitcoin, according to Glassnode

Glassnode co-founders Jan Happel and Yann Allemann, using the name Negentropic, say they are working on two scenarios where Bitcoin could make a local bottom. According to Happel and Allemann, the first scenario is for Bitcoin to gradually fall into the $25,000 range. The second scenario is to witness a serious liquidation event before hitting bottom. According to the chart shared by analysts, when BTC’s Risk Signal reaches 100, Bitcoin will witness a corrective move. In this context, analysts make the following statement:

Bitcoin Risk Signal at 100. There are two possible short-term scenarios in this situation:

1. A slow drop to the $24,800-25,000 range.

2. Fast, aggressive roving to buy fast.

Either way, we’ll hit bottom shortly after one happens. We have seen these two scenarios happen in the past when the BTC Risk Signal reached 100.

Source: Negentropic

Source: Negentropic“ BTC looks weak after double top formation!”

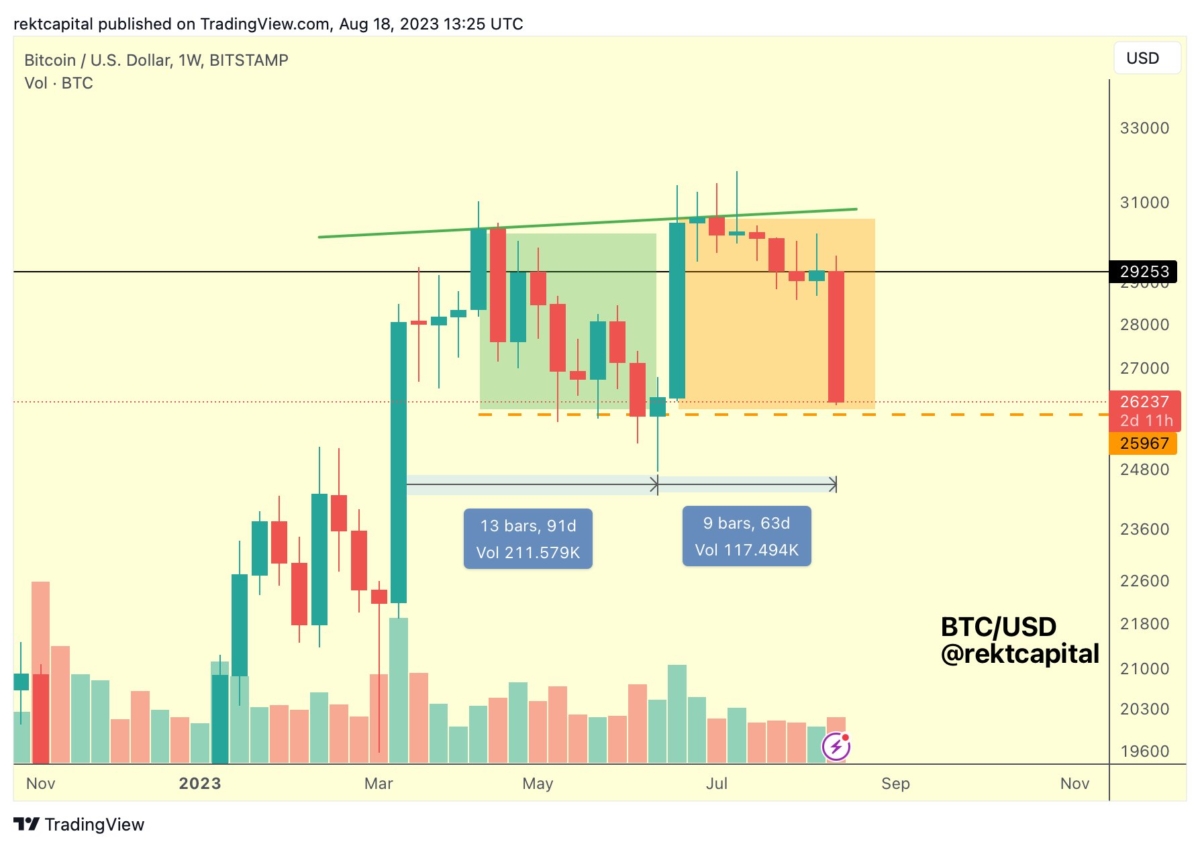

The crypto strategist alias Rekt Capital also weighs in on BTC. According to the analyst, Bitcoin is weak after the double top formation. “It took 91 days for BTC to form the first half of the double top. It took only 63 days to form the second half of the double hill. What is the conclusion to be drawn from here?” he makes the following statement:

In the first half, the price dropped step by step, respecting the support. But eventually it broke them (green box). This latest Bitcoin crash ignored any support on its way down (orange box). No reaction was given. It shows how weak the buy side pressure is around the orange boxed area. Buyers are not ready or strong enough to step in properly and change the course of price action. Current volume levels also suggest that seller pressure has yet to peak.

Source: Rekt Capital

Source: Rekt CapitalBitcoin addresses in profit: What has changed

cryptocoin.com As you can follow, the latest developments regarding spot ETF applications have raised the expectations of investors. However, the news continued only sideways movement from July 2023. Hence, there was a sentiment that needed to be shaken by macroeconomic and broader financial market moves, such as SpaceX’s sale of $373 million worth of Bitcoin holdings. As a result, the majority of traders have become less profitable or faced unrealized losses, according to Glassnode data.

Looking at the seven-day moving average, we see a significant decrease in the number of BTC addresses. The data shows that the number of addresses has decreased to 32,506,617 addresses, which is the lowest level in a month.

📉 #Bitcoin $BTC Number of Addresses in Profit (7d MA) just reached a 1-month low of 32,506,617.637

View metric:https://t.co/qLnvDYVzPt pic.twitter.com/DPTIsTnPtH

— glassnode alerts (@glassnodealerts) August 19, 2023

More drops in BTC price imminent?

It remains to be seen whether the leading cryptocurrency will remain in the correction phase. In the current range, BTC holds support levels at $25,000 followed by $21,500. According to experts, this means that traders are experiencing fear, uncertainty and doubt (FUD) about shorting. However, any positive news about spot Bitcoin ETFs in the first week of September is likely to restore the bullish mood.

Between September 1 and September 6, 2023, the U.S. Securities and Exchange Commission (SEC) is expected to present an update or decision on various spot ETF filings such as Blackrock and Wisdomtree. This probably means that the Bitcoin price will not rise before the first week of September 2023.