According to Coinshares’ institutional fund flow report based on last week, the SEC’s ETF decisions have had a negative impact on the market. Institutional investors selling BTC, ETH and LTC are pouring funds into a single altcoin project.

Fund outflows from BTC and ETH continue

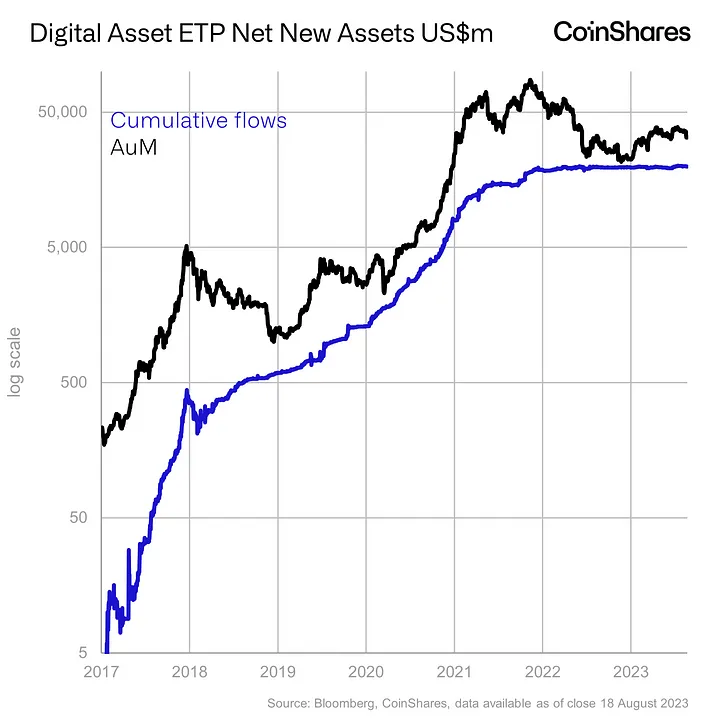

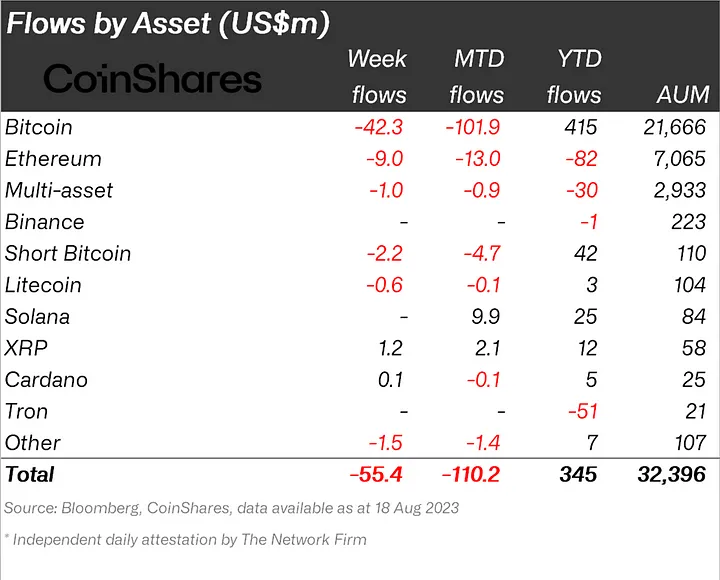

Coinshares reported in its latest weekly fund flow report that its cryptocurrency investment products lost $55 million. Analysts suggest the loss is largely due to the SEC’s delayed ETF decisions. Notably, Bitcoin saw a total of $42 million in outflows, reversing the entries seen in the previous week. Short Bitcoin products also saw debuts for almost 17 weeks in a row.

According to the report, market volumes are well below the average, mainly due to seasonal effects. This leaves prices vulnerable to large trades. Last week’s panic led to a 10% drop in total assets managed (AuM). AuM hit 32.3 billion at the end of last week.

This altcoin continues to raise institutional funds

Streams this week didn’t just focus on Bitcoin, with a wide range of altcoins seeing the exits. Ethereum, Polygon, Litecoin, and Polkadot were among the altcoin projects that registered. Remarkably, only XRP managed to attract a positive flow of funds last week. According to the report, fund inflows to XRP in the past week have seen $ 1.2 million. Cardano (ADA) followed with $0.1 million.

Fund flow by region

Exits focused on Canada and Germany, which saw $36 million and $11 million in regional exits, respectively. Despite this, the list of product providers was extensive. Switzerland opposed this trend, seeing small entries totaling $3.5 million.

Meanwhile, Blockchain stocks did not escape the negative sentiment, seeing $6 million exit last week.

Fundraising XRP attracts altcoin whales

According to CoinMarketCap data, XRP started the new week above $0.55. However, prices fell due to the liquidation of short-term bulls. XRP is currently hovering in the $0.51 region.

However, the temporary increase was enough to boost the social buzz around the payments-focused cryptocurrency. According to social analytics firm LunarCrush, XRP’s social interactions have increased significantly in the last 24 hours.

$XRP has leading combined social + market activity.#XRP has hit the #1 LunarCrush AltRank™.

24-hour activity

Price +4.412% to $0.5410

Social engagements 140,152,191https://t.co/NzkiB1zmlx pic.twitter.com/CXm9aj8iPn— LunarCrush (@LunarCrush) August 20, 2023

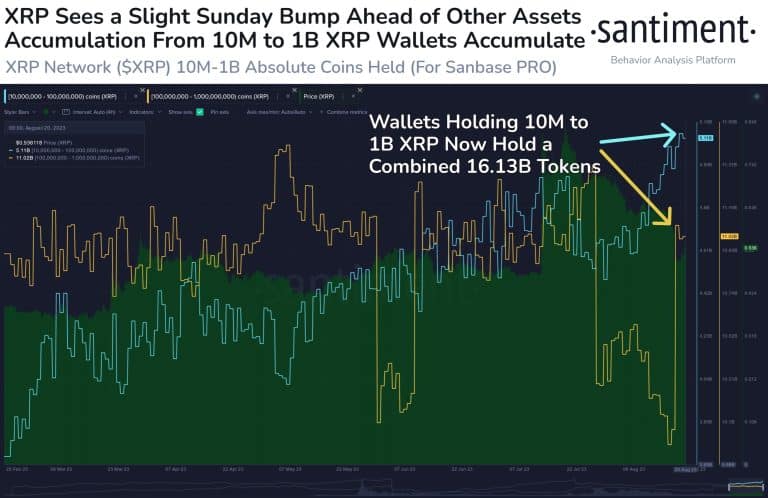

The price recovery from last week’s market crash was driven by the accumulation activity of large XRP whales. Data from blockchain analytics firm Santiment shows that the group, which has amassed between 10 million and 1 billion altcoins, has been aggressively added to its positions in the past 24 hours.

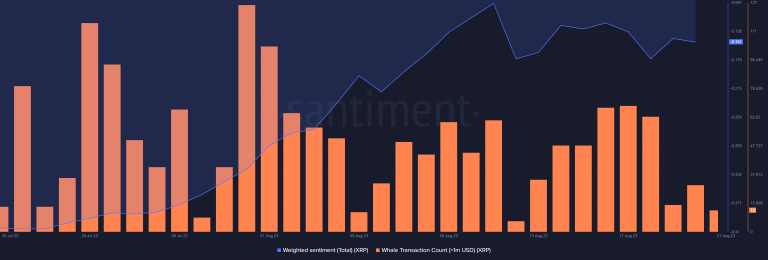

These large altcoin whales currently hold a total of over 16 billion XRP. This is worth $8.32 billion at current market price. The flurry of whaling activity on Sunday was reflected in the significant increase in the total number of whale transactions exceeding $1 million.

However, despite the interest shown by whales, the short-term sentiment surrounding the altcoin project remained firm as the weighted sentiment indicator remained in negative territory. cryptocoin.comAs we reported, XRP completed an important 8% rally yesterday despite the negative effects.