Let’s take a closer look at friend.tech, the most talked-about application of recent days? With this application, which started only a few weeks ago, users offer their followers the opportunity to sell “shares” of their own profiles.

What I found while doing research surprised me a lot because the project first started with an invitation spree on August 10th and tens of thousands of users flocked to it, but the app remained popular for only three days. At this point, friend tech received investment from Paradigm, one of the largest investment companies. Thus, the legitimacy of the application was ensured.

However, if you enter the website, you cannot see a proper explanation. It doesn’t even have a whitepaper and you give a lot of permissions when logging into the app with your social media account.

According to yuga.eth, a senior software engineer at Coinbase, friend tech was created by Racer, the lead developer of TweetDAO and Stealcam.

Friend Tech charges 10% for each share transaction, 5% of which goes to the profile owner, and the remaining 5% goes to treasury revenues.

Doesn’t that sound very interesting?

- Go to friend.tech in your browser and click on the share button and then “Add to Home Screen” and your application is ready.

- Enter your invite code and link your X account.

- To be active, you need to have ETH in the Base network. In other words, you should buy some ETH and transfer them to the BASE network by making a bridge.

- After the transfer to the linked wallet address, you can start using Friend.tech.

In practice, the first shares of a profile are offered at a price that can be considered free, but you have to deal with bots in this part. What really scares me is the economic model in which the application is built.

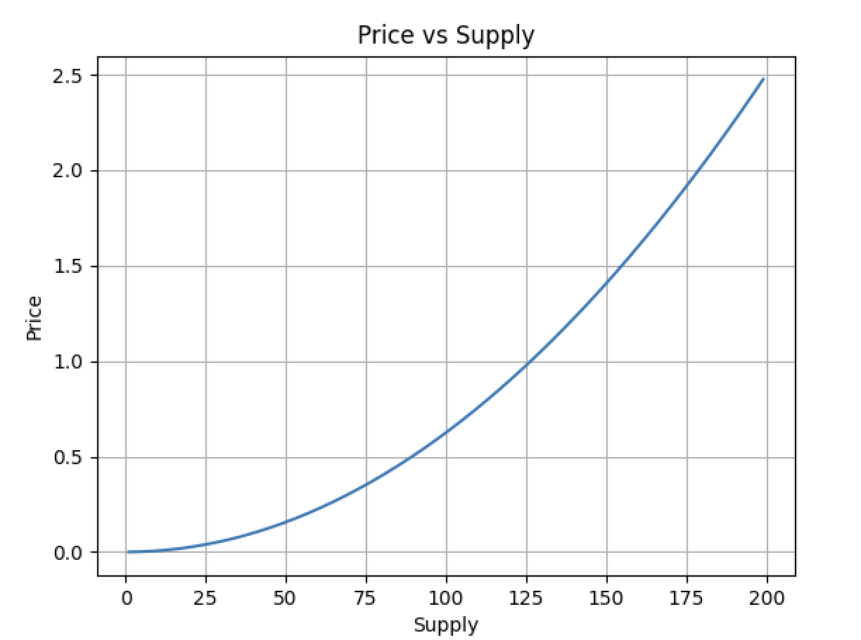

With the simple math behind it, the price goes up exponentially. As the supply increases, the price increases exponentially.

Share Price = (Share Supply)* 2 / 16000

From this point of view, is this a Ponzi scheme that we are familiar with? Questions also come to mind. Because aggressive growth in this way will lead to overvaluation of the share price and may disappoint users.

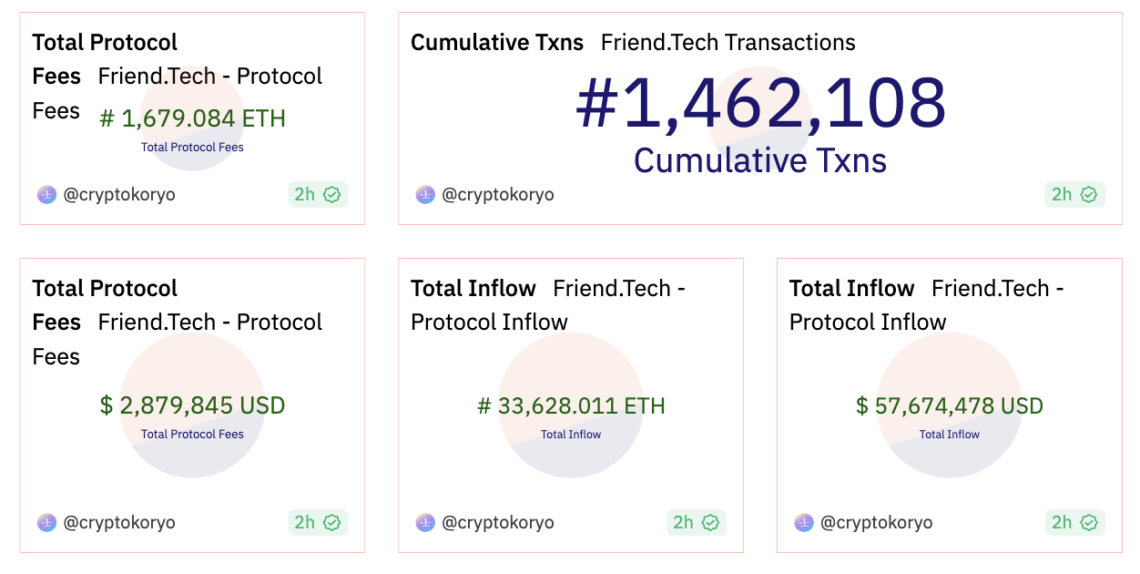

Below you can see the transaction data I received from Dune.

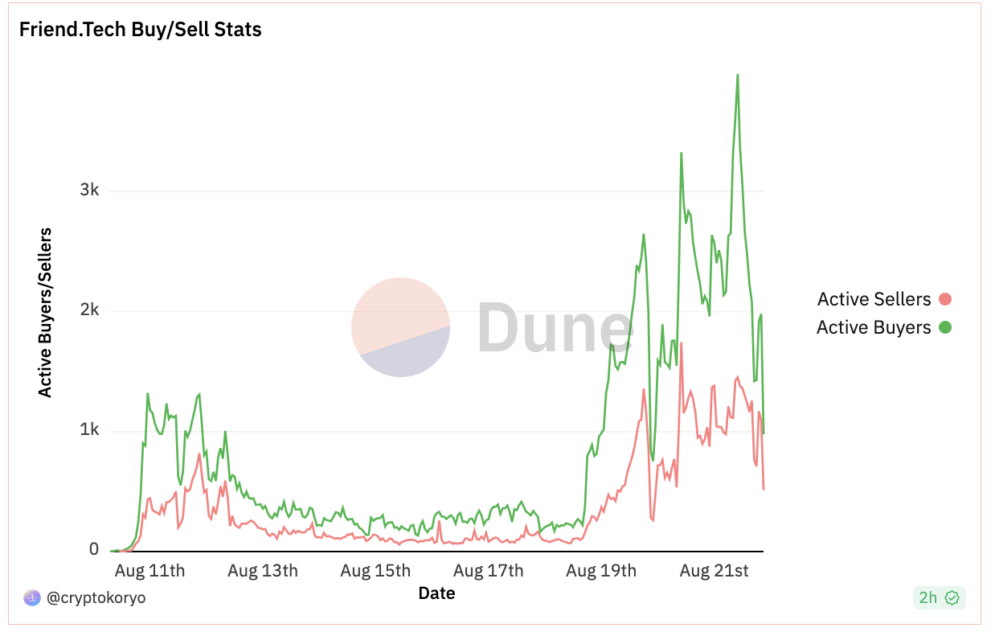

In the chart below, you can see active buyers and sellers. It’s like the hype is starting to fade a bit.

For now, I will continue to watch, and you must be sure to manage your risk.