Data flow is heavy this week. Markets will focus on future employment data from the US and Core Personal Consumer Expenses (PCE) data, which the Fed bases its inflation measurement on.

Good week everyone.

On Tuesday we will receive the Job Opportunities and Staff Change Rate JOLTS data based on the employer survey. We will focus on the Consumer Price Index (CPI) data coming from Germany on Wednesday and the Gross Domestic Product (GDP) data on the US side. It is an important issue that we should pay attention to, as the growth data will provide us with an idea against the risk of recession.

On Thursday, we will receive the Eurozone CPI and the US side PCE data. On Friday, we will get unemployment rate, average hourly earnings, non-farm payroll data.

Fed Chairman Powell emphasized that they are determined to reduce the inflation target to 2% at the Jackson Hole meeting and that additional rate hikes will be needed if necessary. On the other hand, he stated that they are paying attention to the signs that the labor market is not cooling as expected and that they will follow the data closely. More than expected data may pave the way for escaping from risky markets and have a positive impact on DXY.

In the cryptocurrency markets, we observe that the volumes are quite low. We didn’t get any signal of an upward reversal at the Bitcoin weekly close.

The U.S. Treasury Department has released its highly anticipated regulatory recommendations for cryptocurrency brokers. It specifically chose to exempt individual validators and miners. If the rules are passed, they will go into effect in 2026 for the 2025 tax year. The community did not welcome this.

If the SEC delays Blacrock’s spot Bitcoin ETF filing on September 2, we may have to wait more time for the blood we’re looking for.

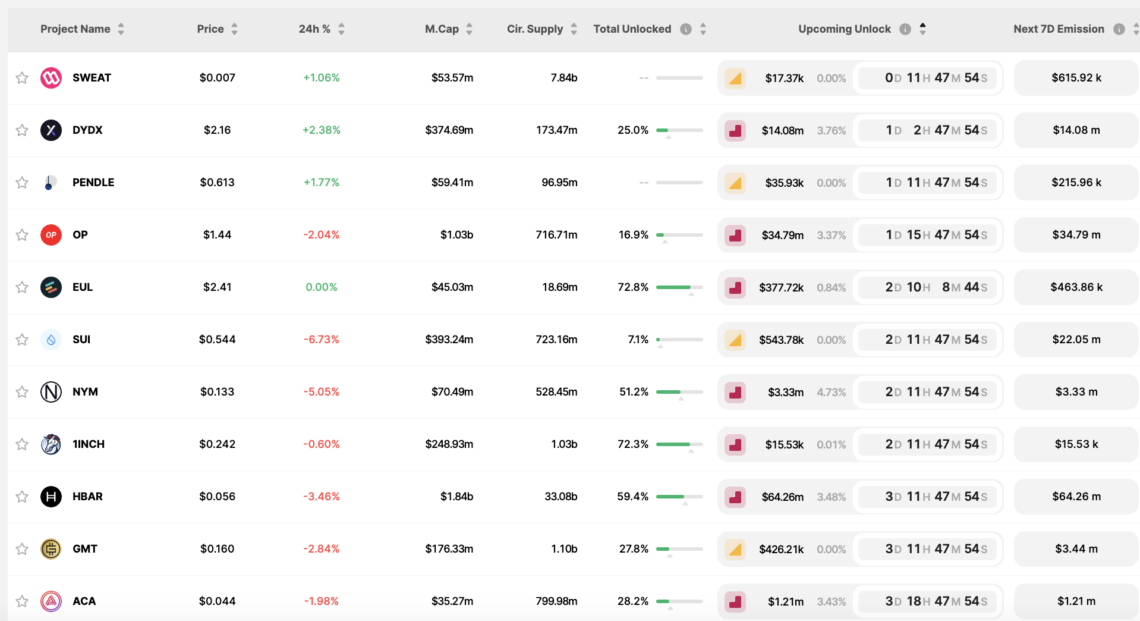

Let’s take a look at the unlocks:

Economic Calendar

Tuesday, August 29

USA – Job Opportunities and Staff Change Rate (JOLTS) Expectation: 9.793M – 17.00

Wednesday, August 30day at 15:30

USA – Gross Domestic Product (GDP) (Quarterly) Expected: 2.4% Previous: 2.0%

USA – ADP Non-Farm Employment Change Expected: 195k Previous: 324k – 15.15

ADP National Employment Report; It is a measure of monthly employment change in non-farm, private employment based on payroll data of approximately 400,000 U.S. employees. It is released two days before government data and can qualify as a good indicator before the government’s non-farm payroll report.

Thursday, August 31

Euro Zone – Consumer Price Index (CPI) (Annual) Expectation: 5.1% Previous: 5.3% – 12.00

USA – Applications for Unemployment Benefit Expectation: 235k Previous: 230k – 15.30

USA – Core Personal Consumption Price Index (YoY) Expected: 4.2% Previous: 4.1% 15.30

Friday, September 1

USA – Unemployment Rate Expected: 3.5% Previous: 3.5% – 15.30

USA – Non-Farm Employment Expected: 170k Previous: 187k – 15.30

USA – Average Hourly Earnings (Monthly) Expected: 0.3% Previous: 0.4% – 15.30

Bitcoin Technical AnalysisI

In a week when the volumes fell considerably, Bitcoin continues to move sideways between the $ 25,800 – $ 26,800 levels. Unless the candle closes above the 26.800 levels indicated by the blue line on the daily chart, it will not be possible to proceed to its next stop, $28,300. For a possible downward move, it should not lose the $25,560 – $25,720 levels indicated by the green box. If the region is lost, it could move towards the lower levels of $21,900 – $23,550.

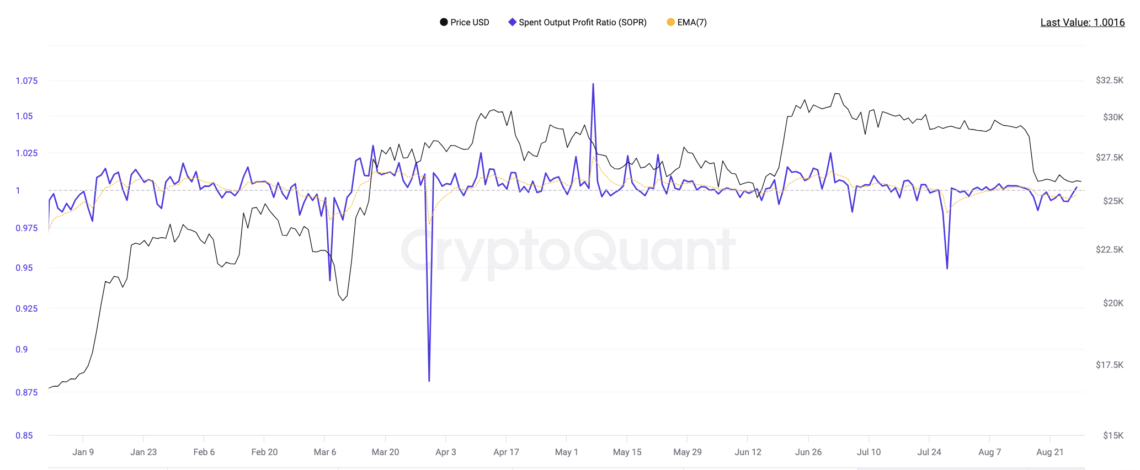

Bitcoin: Spent Output Profit Ratio (SOPR)

In macro market sentiment, it provides information about profits and losses realized in a given time period. It reflects the degree of profit realized for all cryptocurrencies carried on-chain.

The SOPR indicator can be evaluated in the following framework:

SOPR value greater than 1means that sales are realized with profit on average (price sold is higher than price paid).

SOPR value less than 1means that sales occurred at an average loss (price sold is less than price paid).

SOPR value of exactly 1,profit and loss are equal.

Last Week’s Top Rising Cryptocurrencies

- Rollbit Coin (RLB) 31.7%

- dYdX (DYDX) 15.6%

- Toncoin (TON) 9.2%

- Bitcoin Cash (BCH) 3.6%

- Mantle (MNT) 2.7%

Featured Cryptocurrency News of the Last Week

Pepecoin team members stole $16 million

On August 24, the price of PEPE dropped nearly 15 percent on fear of potential fraud after the community found that $16 million worth of PEPE had been withdrawn from the project’s multisig wallet and sent to several exchanges.

The last remaining team member of the project said, “Then they removed themselves from multisig in an attempt to end their relationship with PEPE. They also deleted all their social media accounts and left me with nothing but a message saying ‘multisig has been updated, you are now in full control’. he concluded his speech.

Fed Chairman Powell spoke at Jackson Hole: We are ready for more rate hikes

Fed Chairman Powell said, “Our job is to reduce inflation. We intend to keep interest rates at a restrictive level until inflation moves to the sustainable 2 percent target. “The Fed may need additional rate hikes to further slow inflation,” he said.

Stating that they will be careful about the interest rate hike again, Powell said, “A softer labor market may be necessary to reduce inflation. The Fed is wary of signs that the economy is not cooling as expected. “The next rate decision will depend on the data,” he said.

Crypto regulation move from US Treasury Department

Under the proposed rules, crypto brokers will be treated the same as for traditional investments. This means that taxpayers can deduct losses as well as owed taxes on their earnings. Under the new rules, brokers will need to provide a new Form 1099-DA to help taxpayers understand whether they are owed taxes in accordance with the proposed rules.

Curious transfer from Ripple (XRP) whale!

Whale Alert reported that on August 24, a large whale transferred 29.3 million XRP worth $15.13 million to the Bitstamp exchange. The whale’s move of 14 million XRP to Bitso a few hours ago also brought with it the possibility of a sales move.

Bitcoin’s supply on exchanges is at its lowest level in the last six years!

On-chain analytics company centiment has detected a noticeable decrease in the amount of Bitcoin available on cryptocurrency exchanges. According to the analysis company, currently the supply of Bitcoin on exchanges has dropped to just 5.8 percent of the total circulating BTC supply.

If this level bitcoinIt is stated that it is the lowest stock market liquidity recorded since December 17, 2017, the big bull run that brought its price to about $ 20,000.