We look at the buy and sell levels for Bitcoin and seven altcoins, especially SPX and DXY. The S&P 500 is trying to recover. However, Bitcoin and certain altcoins are struggling to rise above their resistance levels. According to data from CoinGlass, Bitcoin lost about 11% in August. Accordingly, it fell behind the 13.88% decline seen in the same month of 2022. The picture does not look bright for September either. History shows that every year since 2017, Bitcoin has declined in September.

pessimistic feelings

Bloomberg Intelligence senior macro strategist Mike McGlone is even more pessimistic about Bitcoin. McGlone warns that in the event of a “global economic reset,” Bitcoin could fall as low as $10,000.

Analysts give both bullish and bearish targets for the Bitcoin and altcoin world. However, it is better to wait for the price to break out of the range before making big investments. Typically, volatility increases after a period of low volatility. However, it is difficult to precisely predict the direction of the breakout.

S&P 500 Index price analysis

Before looking at altcoin projects, the S&P 500 Index (SPX) turned down from the moving averages on August 24. But the bears failed to sustain lower levels.

The bulls continued the buying pressure after the August 25 recovery. It also pushed the index back to the moving averages. Should buyers break this hurdle, the index will rise to the general resistance zone between 4.607 and 4.650. This region will likely be the scene of a tough fight between bulls and bears. If the price turns down from the moving averages once again, it will show that the bears are fiercely defending the level. The pair could then slide to the crucial support at 4.325. If this level is broken down, the index will complete a bearish head and shoulders pattern. This will initiate a correction towards the formation target of 4.043.

US Dollar Index price analysis

The bulls carried the US Dollar Index (DXY) above the downtrend line on August 22. Accordingly, they signaled that the correction may end in the near term.

The bears tried to push the price below this level on August 23. But the bulls remained in their places. This shows that the bulls have successfully turned the downtrend line to support. The bulls will try to push the price to 106 in their next attempt. The 20-day exponential moving average (EMA) rising at 103 and the relative strength index (RSI) near the overbought zone point to an advantage for buyers. If the bears want to make a comeback, they will need to quickly push the price below the downtrend line. If they do, the index could slide to the 50-day simple moving average (SMA), which is 102.

Bitcoin trading levels

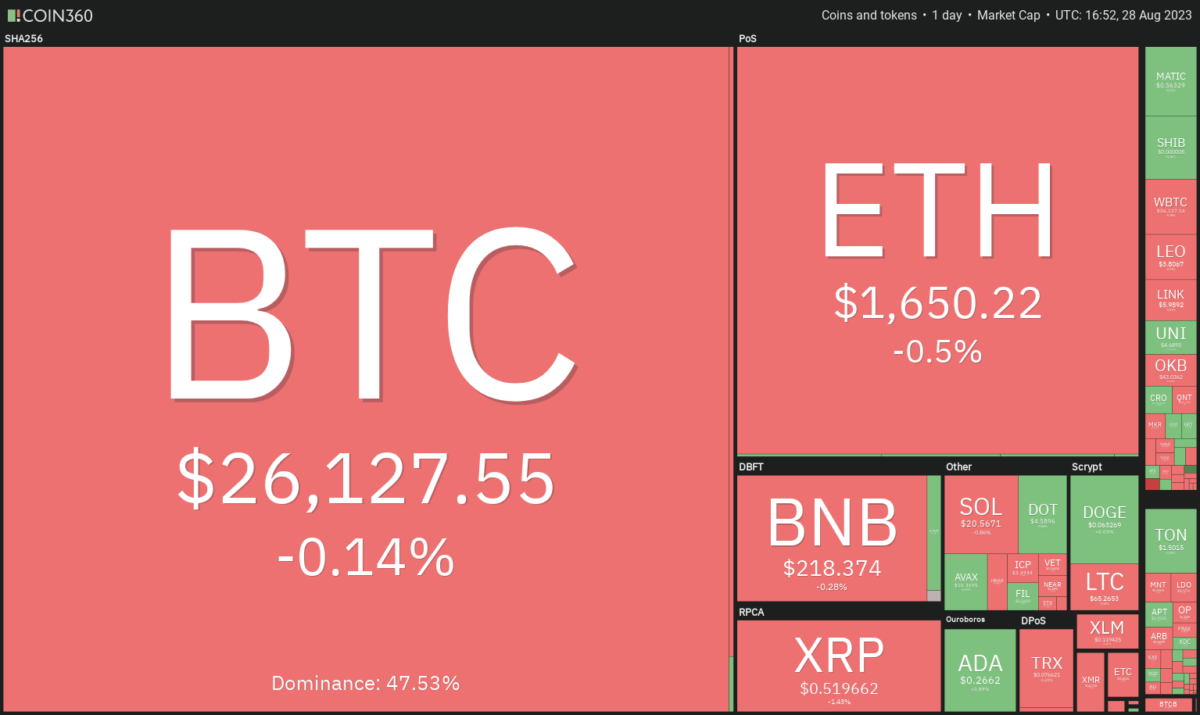

Bitcoin continues to trade in the range between $24,800 and $26,833. This is why bulls and bears don’t place big bets.

The downward sloping moving averages and the RSI in the oversold zone show that the bears are in command. However, the bulls are likely to defend the $24,800 level strongly. Therefore, sellers will find it difficult to sustain the downward movement. If the price bounces back from support, it will show that the BTC/USDT pair may continue its consolidation for a while. On the upside, a rally above $26,833 will be the first sign of strength. This will push the price to the 50-day SMA ($28,806) and then to $30,000. Conversely, a break and close below the $24,800 support will start the next leg of the downtrend towards $20,000.

Trading levels for altcoin Ethereum

Ethereum, the leading altcoin in the crypto world, is trading near the key support at $1,626, which shows bears continuing selling pressure.

The failure of the bulls to start a strong recovery increases the risk of a dip below $1,626. In such a case, the altcoin ETH/USDT rate will drop to $1,550. This level will attract solid buys by the bulls. If the price turns up from this level but returns below $1,626, it will signal that the bears have turned the level into resistance. This will also start a bearish phase towards $1,368. The bulls will need to push the price above the 20-day EMA ($1,716) to signal a reversal.

Trade levels for altcoin BNB

The fact that a pullback in altcoin BNB meets selling at $220 indicates that the bears are trying to turn the level into resistance.

A small positive point in favor of the bulls is that they have not given up too much at $220. This shows that buyers are continuing the pressure. The bulls will need to overcome the barrier at the 20-day EMA ($223) to start a relief rally towards the resistance line. This level will again witness strong selling of bears. An initial support on the downside is the $213 level. If this level is broken down, the altcoin BNB/USDT rate will regress to the psychological support at $200. A break below this level will extend the decline to the next major support at $183.

Trade levels for altcoin XRP

There is the failure of the bulls to move altcoin XRP above $0.56. Accordingly, this indicates a lack of demand at higher levels.

The weak bounce of $0.50 may attract the aggressive selling of the bears. If the $0.50 support is cleared, the altcoin XRP/USDT pair will drop to the key $0.41 support. This level will witness strong buying by the bulls. If the price rebounds from this support, it will show that the pair could oscillate between $0.41 and $0.56 for a few more days. Conversely, if the price rises and rises above $0.56, it will indicate the start of a sustained recovery. The pair will then climb to the 50-day SMA ($0.64).

Cardano trading levels

Altcoin Cardano has been oscillating in the narrow gap between $0.24 and $0.28 for the past few days. This indicates that the bulls are buying near the support and the bears are selling at the resistance level.

If buyers push the price above the overhead resistance of $0.28, the altcoin ADA/USDT will start a rally towards the 50-day SMA ($0.29). This level may act as a hurdle, but if it is exceeded, the pair will rise to as high as $0.34. The bears are likely to have other plans. They will try to defend the general resistance. They will also pull the price towards the support of the $0.24 range. If this level is broken, the pair will drop to $0.22 and eventually $0.20.

Altcoin Dogecoin trading levels

Altcoin Dogecoin has been trading between the strong support at $0.06 and the 20-day EMA ($0.07) for the past few days.

The 20-day EMA is sloping down and the RSI is in the negative territory. This shows that bears have an advantage. Sellers will try to push the price below $0.06 and further strengthen their positions. For the bulls, time is in the process of decreasing. If they want to start a recovery, they will need to quickly push the price above the 20-day EMA. If they do, the altcoin DOGE/USDT will rise to the 50-day SMA ($0.07). Then it will jump to $0.08.

Altcoin Solana trading levels

Altcoin Solana is gradually falling. Which suggests the bears are jumping into every little rally of relief.

The altcoin SOL/USDT pair will drop to its intraday low of $19.35 on August 22. If it goes down to this level, sales will intensify. Also, the pair will drop to $18 and eventually the next major support at $15.60. Contrary to this assumption, if the price rises and rises above $22.30, it will indicate a solid buy lower. The pair will rise to the 50-day SMA ($23.61) and then the strong resistance at $26.

Polkadot trading levels

The bulls are trying to push around the altcoin Polkadot. The altcoin DOT is holding above the overhead resistance at the 20-day EMA ($4.64). However, they are likely to face stiff resistance from the bears.

If the price turns down from the 20-day EMA, it will indicate that sentiment remains negative and traders are selling on rallies. This will increase the likelihood of a retest of the important support at $4.22. If this support is broken, the altcoin DOT/USDT will drop to $4 and then to $3.88. On the other hand, if buyers push the price above the 20-day EMA, it will indicate the start of a stronger relief rally to the $5 breakout level. When we look at Kriptokoin.com, this level will attract sales by the bears.