The Ethereum team took another step in the project’s roadmap with new updates this week. In this article, you can find the latest developments and on-chain analysis from the ETH network.

How is the Ethereum price?

ETH price has taken a very long time since touching $4,000. The peak came on November 10, 2021, when ATH reached a market cap of $489.17 billion. At this point, not only Ethereum but the entire crypto market was in a bull run.

However, the tide quickly turned and 2022 brought a harsh reckoning for Ethereum. The resulting price correction, combined with the broader market pullback, plunged ETH’s value to about a third of its peak 22 months ago. This sharp decline undoubtedly tested the patience of long-term investors. It also raised doubts about the project’s future prospects.

Development activities and updates

One of the most important moments in Ethereum’s recent history was the much anticipated precursor to the merger aimed at improving scalability and energy efficiency. In terms of achieving its technological goals, Ethereum has been quite successful in this endeavor. Despite these developments, Ethereum’s struggle to exit and regain lost momentum has caused investors to slowly turn their attention elsewhere and overshadow the coin’s larger value counterparts.

As Ethereum overcomes its current challenges, the question on everyone’s mind is: What’s in store for this blockchain giant? According to Santiment, the project remains viable, as evidenced by SAND’s continued trust in Ethereum. However, the data-driven analysis offered by Santiment digs deeper into the current state of Ethereum’s metrics.

What’s next?

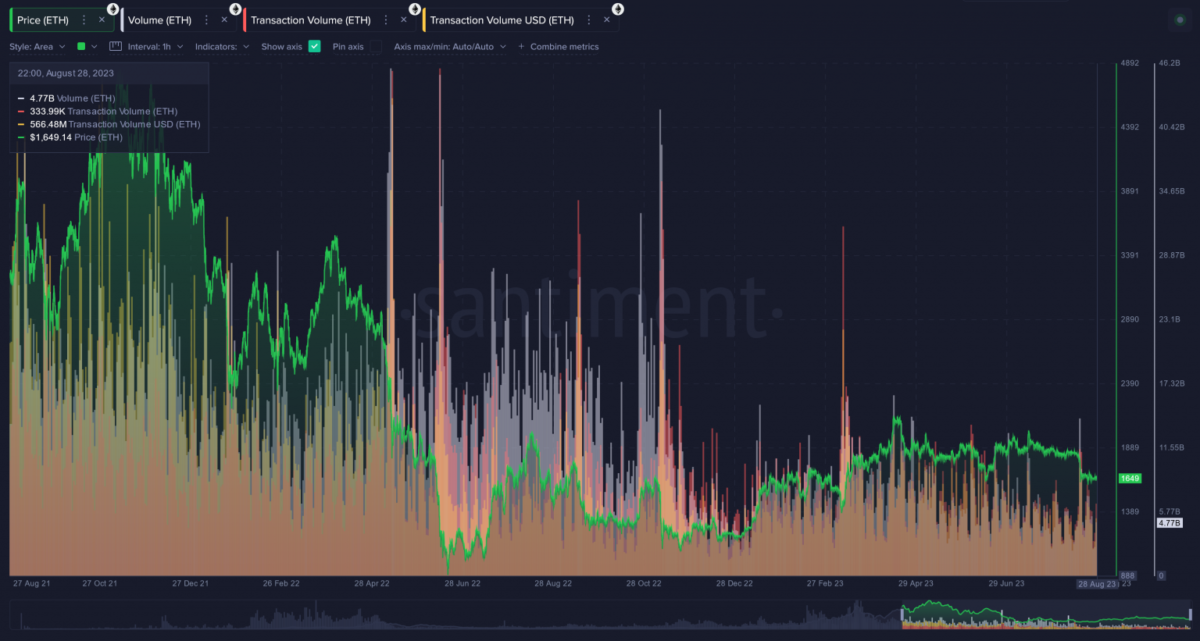

In terms of utility, Ethereum has witnessed a significant decline in on-chain transaction volume and trading activity since its peak in early November last year. Such metrics are not accurate indicators for any coin. Still, it reflects a sense of waning interest among investors grappling with uncertainty.

cryptocoin.com As we included in our analysis, a psychological support zone was formed around the $ 1,500 level. This shows that investors follow this threshold closely. If Ethereum falls to this level, it will experience a renewed increase in investor activity. This means a significant increase in transaction volume.

Whale activities

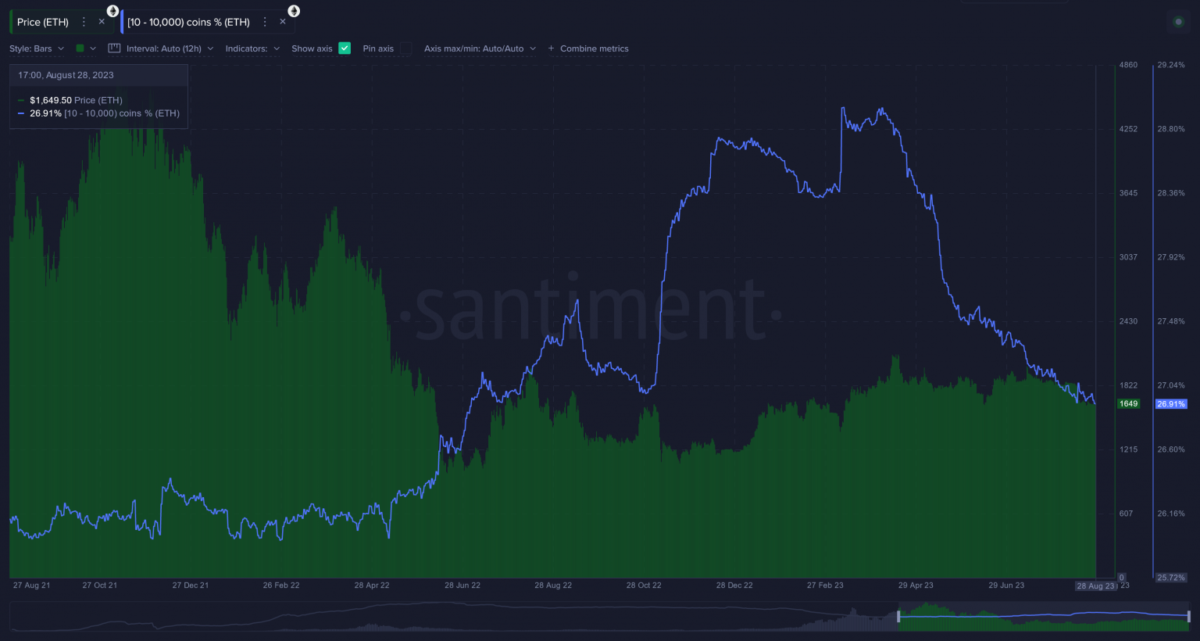

Analyzing the key players in the market, especially the whales, reveals a notable trend. Over the past four months, whales holding 10-10,000 ETH have reduced their reserves considerably. This is not an accurate predictor of market movements. But it shows that whales moved into cash just as the Ethereum price reached its 2023 peak of $2,120.

However, the continued decline in supply held by major shareholders does not necessarily rule out the possibility of a price increase. The relationship between profit-taking activities and overall market trends is complex. This becomes a complex factor to consider when predicting Ethereum’s trajectory.

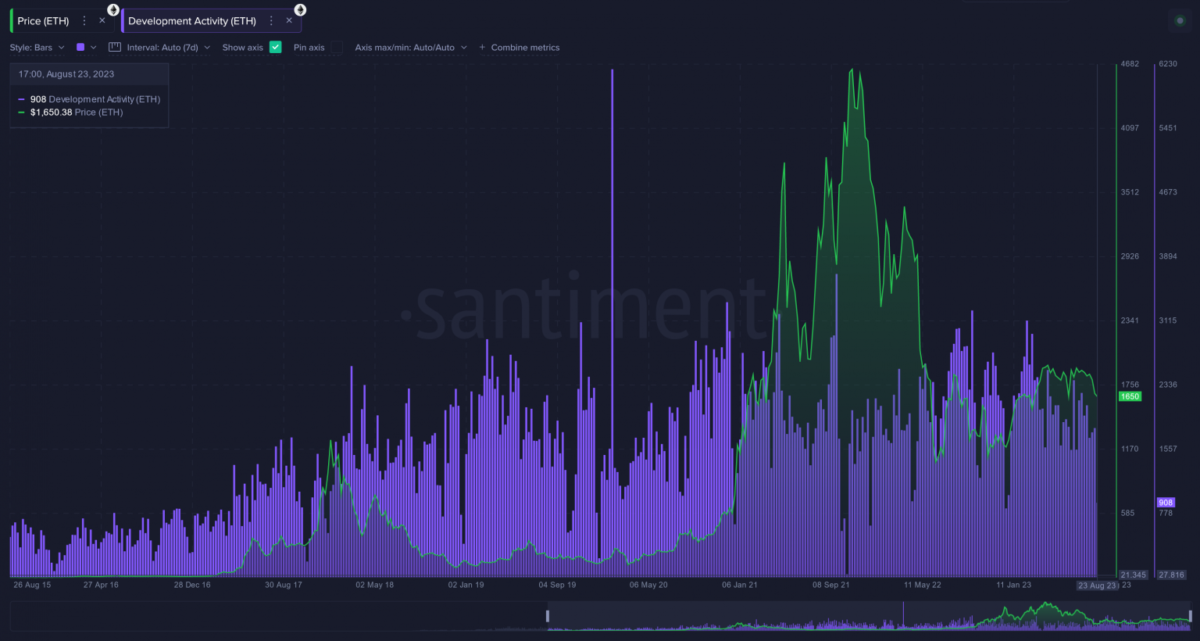

Finally, Ethereum development activity serves as a beacon of hope for those invested in its success. The project’s history of continuous improvement and innovation spans over eight years, as can be clearly seen by its growing presence on platforms like GitHub. Such a consistent commitment to development reflects the project’s commitment to progress and bodes well for its long-term sustainability.

Santiment analysts expect a recovery process for Ethereum

Ethereum continues to maintain its place as a core Blockchain platform. Its use is increasing as more projects adopt its capabilities. This underlines its importance in the broader crypto ecosystem. However, for those looking to time the market and look for optimal entry points, Santiment’s metrics suggest that more viable opportunities may exist beyond the current market scenario.