Blockchain analytics firm Santiment is reviewing on-chain metrics to update their analysis on Cardano and 2 altcoins.

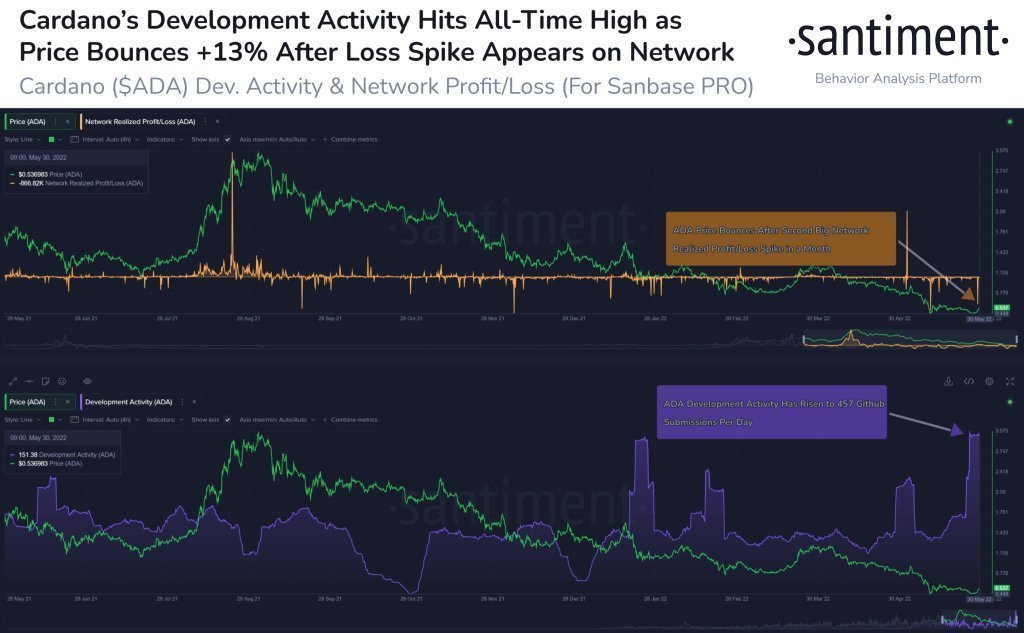

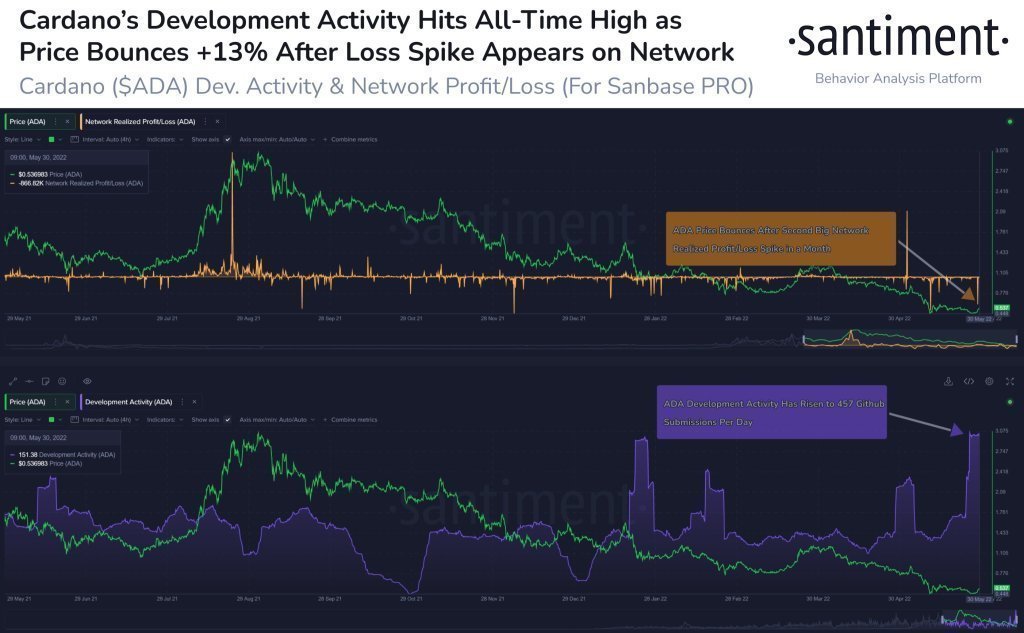

Cardano started rally as ADA development activity peaked

Santiment was initially driven by Cardano (ADA) which has seen a significant price increase recently, and development activity on GitHub has increased daily. He talks about the fact that it got over 450 submissions. Cardano is one of the few cryptocurrencies to have a strong start to the week, gaining 17% since last week. Development activity has reached all-time highs as ADA’s dev team focuses on innovations when prices are tight.

Cardano is currently trading at $0.5722 and is down 1.78% in the last 24 hours.

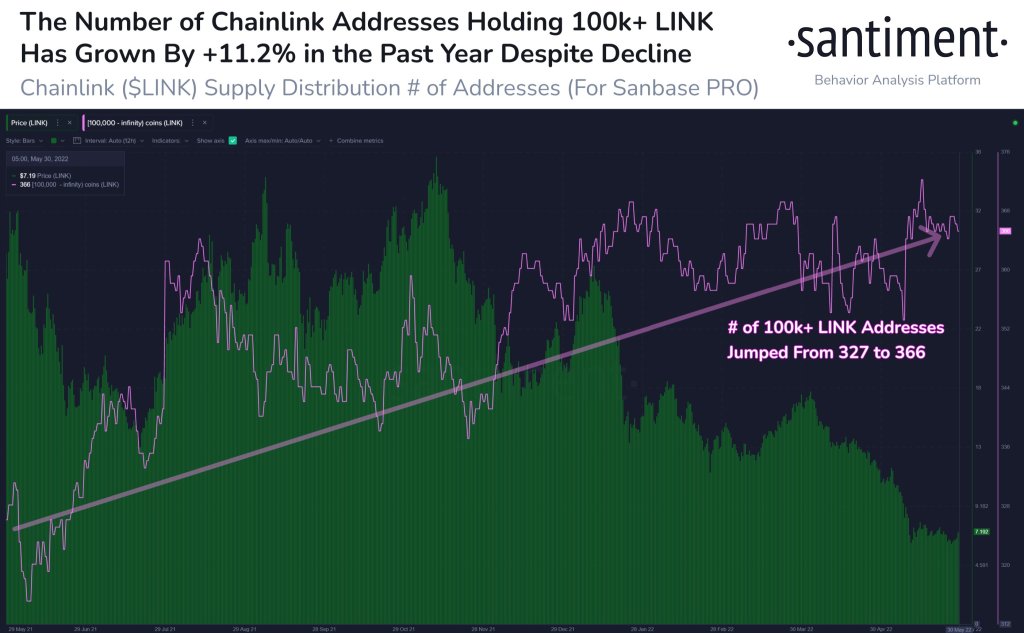

Whales save on this altcoin project

Santiment then moves to the decentralized oracle network Chainlink (LINK). He notes that despite the weak price action of the altcoin project, the number of whales holding more than 100,000 LINK in the crypto market is increasing. According to Santiment’s statements:

Chainlink appears to be in the middle of the pack on a major altcoin recovery day, up 8.5% today. In particular, we saw the amount of whale addresses holding 100,000 or more LINKs increase significantly, up +11.2% despite falling prices.

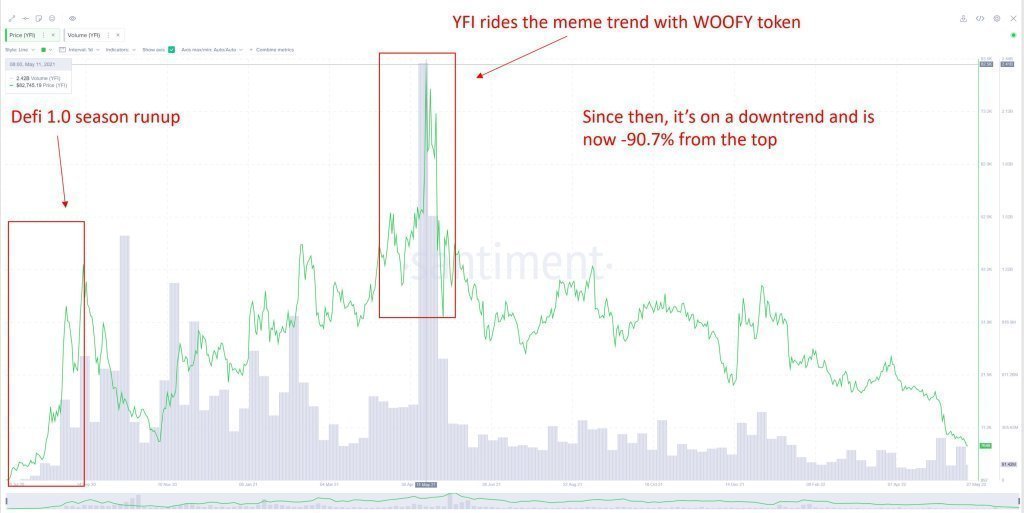

Yearn.Finance (YFI), a yield optimizer in decentralized finance (DeFi), is last on the analytics firm’s list. According to Santiment, Kriptokoin.com development on the project continues, despite developer Andre Cronje’s departure from DeFi and a massive drop in YFI’s May 2021 ATH price. Analysts say:

YFI was once the heart of the DeFi market. Now it’s down -91% over the past year after glorious days of [Andre Cronje] shipments raising Yearn.Finance. Cryptocurrency is not as abandoned by developers as you might think.

Yearn.Finance, like many other cryptocurrencies, lost significantly in the second week of May amid the loss in volume from the collapse of the Terra ecosystem. It fell 55.9% from its monthly high of $18,346 on May 4. At the time of writing, it is trading at $7,410.15, down slightly over the past 24 hours.