$730 million worth of crypto assets in the wallets of bankrupt FTX and Alameda are strong enough to affect the market.

The issue of FTX has been on the agenda in the crypto industry lately. The process that started after FTX’s bankruptcy in November 2022 is about to result in its return to the market. However, the return process of FTX, which has turned its route back to crypto, seems to be quite painful.

Bankrupt and restructuring, FTX is on the verge of selling its holdings of crypto assets. The exchange, which transferred Solana (SOL) assets to another wallet, also mobilized Solana co-founder Anatoly Yakovenko. Yakovenko suggested distributing SOLs to customers. FTX and its sister company Alameda Research hold $730 million in crypto assets.

Danger bells are ringing for FTX and Alameda

The news that FTX could sell the crypto assets it held, mobilized the market. Many crypto actors state that FTX needs to meet customers at a common point. One of them is Anatoly Yakovenko, co-founder of Solana (SOL). FTX moves cryptocurrencies worth more than $1.5 billion on the Solana network. In particular, Bitcoin, which is held on the Solana network, attracts attention. Another recorded data was that the exchange transferred $10 million worth of assets in Solana wallet to another network. This data, which suggested that the stock market is taking action, worried crypto investors.

🚨 FTX wallets on the move🚨

Over $1.5B worth of $SOL, SPL tokens, and Wrapped #Bitcoin in FTX's Solana addresses are shifting‼️

Looks like they're gearing up for potential sell-offs.

Keep an eye on this, especially the ~$200M in #Solana Wrapped $BTC.#crypto #bitcoin … pic.twitter.com/sRDI6hvTJD

— Pump House 🍥 (@pumphouz) September 3, 2023

Struggling to re-launch, FTX’s priority is to recover the stock market before customers, so it’s possible that the exchange will sell its crypto assets.

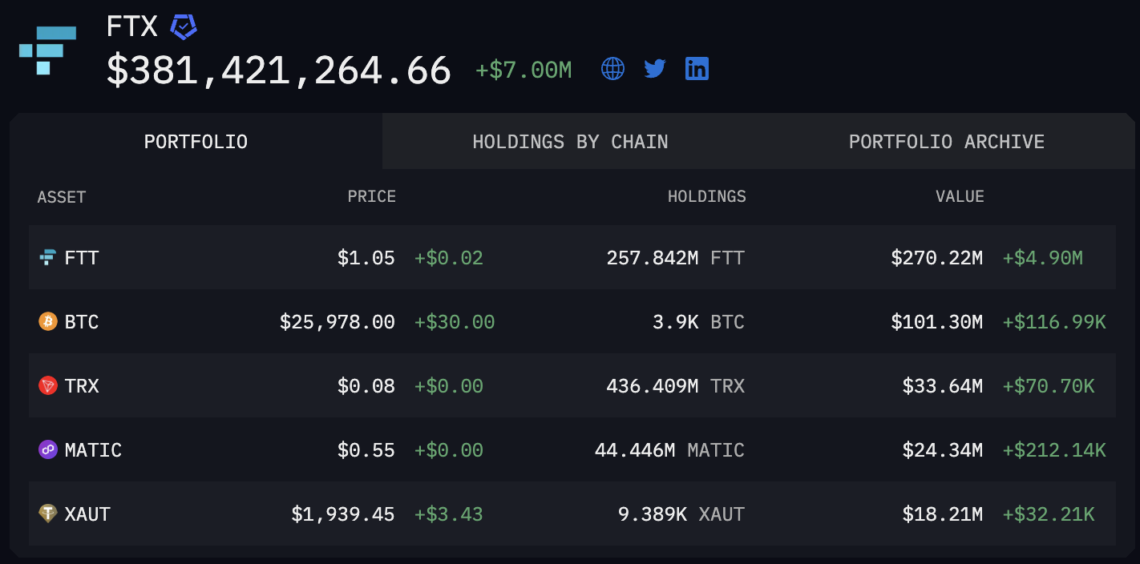

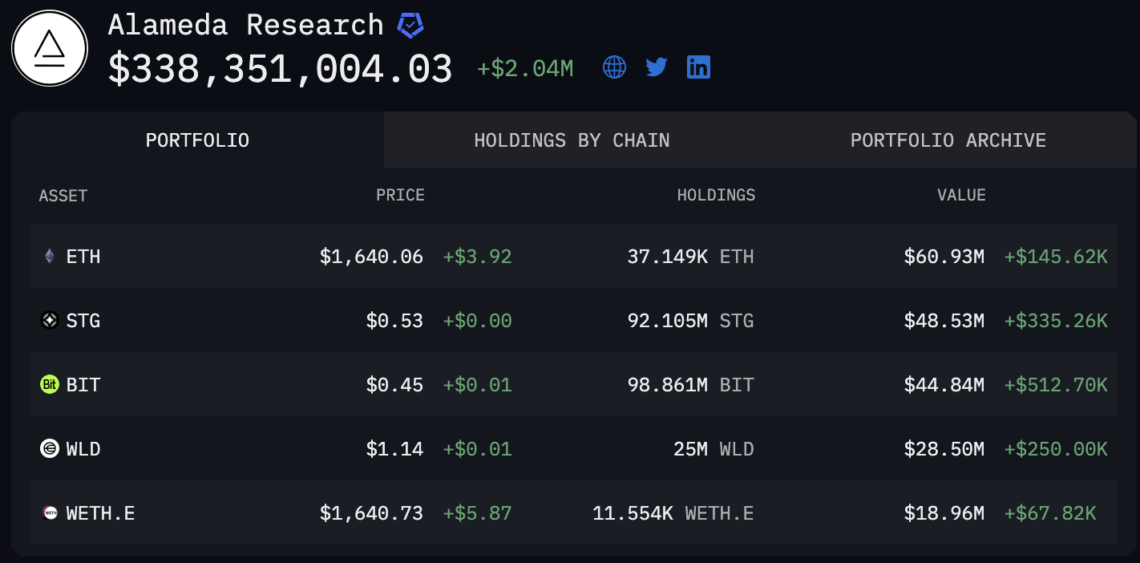

FTX’s sister company, Alameda Research, is also dangerous. FTX has $381 million in crypto assets, while Alameda has $338 million in crypto assets. The crypto market is focused on the potential impact of these assets on the market.

FTX focused on crypto assets

FTX borrowers proposed a plan where token sales would be driven by a financial advisor. It will only be allowed to sell $100 million per week for these tokens. However, this limit can be increased up to $ 200 million in some cryptocurrencies. It was stated that the plan was made to both provide hot cash inflows to FTX and not negatively affect the crypto market.

One of the details in the plan is staking. FTX is considering using its holdings on the stake side to pay off debts to its customers. Another thought in the mind of the stock market is to create a balanced portfolio with Bitcoin and Ethereum.

Looking at the current plan, the idea on FTX’s mind is to sell. Even if the exchange sells its assets on the plan, it is determined to sell it.

The FTX conundrum has become annoying

FTX and Alameda apparently have $730 million in crypto assets. However, in The Block’s report, it is said that FTX borrowers can sell $3.4 billion in crypto. Both amounts are not small in sight. Because FTX creditors still do not have access to their assets.

Looking at Arkham Intelligence data, it seems that assets are scattered in crypto wallets of FTX and Alameda. The biggest asset is the $270 million FTT in FTX’s wallet. Another asset is BTC, which is close to $ 100 million.

Assets held by FTX are apparently not in a position to create volatility. However, if there is an asset of $ 3.4 billion, as reported by The Block, this can put the market in a bad situation. In short, tough days are waiting for crypto investors again.

It is among the rumors that Sam Bankman-Fried, whose case continues with allegations of fraud and market manipulation, will not receive a high amount of punishment in the USA. On the other hand, it is on the agenda for FTX to reopen the exchange by selling its crypto assets. Those who have been hurt by this business are those who invested long-term in crypto in the past year.

Another wallet belongs to Alameda. Interestingly, this wallet also contains newly shining altcoins. The largest asset in Alameda’s wallet is Ethereum with $60 million.

Alameda holds $48 million in STG, $44 million in BIT and $28 million in WLD. From these apparent assets, the company already has 1 million dollars in its pocket. So, which investors are predominantly holding these coins? Of course, small investors.

Looking at the wallets, it seems that the cryptocurrencies FTX and Alameda can sell are TRX, MATIC, WLD, STG and BIT. Apart from this, organizations can also sell their Bitcoin and Ethereum assets. However, the focus of institutions is to use these two big cryptocurrencies as collateral in their activities. So organizations can spend altcoins more easily.

Possible impact of FTX and Alameda sales

Possible crypto sales of FTX and Alameda may cause uneasiness in the market. Although crypto investors are prepared for the worst-case scenario, the market does not allow it. Regardless of the size of the bad news, it affects the market in a short time. Therefore, the survival effort of FTX and Alameda could endanger crypto investors.