Trading volume across crypto derivatives listed on the Panama-based Deribit exchange remained brisk last month even as the global activity cooled.

Deribit’s derivatives market volume rose to $42 billion in August, a 17% increase versus July, bucking the global downtrend that saw worldwide derivatives volumes decline 12.1% to around $1.6 trillion, the exchange said in the monthly review shared with CoinDesk. Volume figures represent total activity in options, futures and perpetual futures segments.

“The resilience can be attributed to the strong performance of our options segment. Notably, ETH options recorded their highest volumes since March of this year. Meanwhile, BTC continues to show strength, initially buoyed by its use as a banking system hedge in March and now further invigorated by the upcoming ETF decision,” Luuk Strijers, chief commercial officer at Deribit, told CoinDesk.

Options are derivative contracts that give the purchaser the right to buy or sell the underlying asset at a preset price at a later date. A call option offers the right to buy and a put gives the right to sell. Deribit controls nearly 90% of the global crypto options activity.

Bitcoin (BTC), the largest crypto asset by market value, chalked out violent price moves between $25,000 and $30,000, triggering massive liquidations in futures and options on Deribit and boosting hedging demand for call and puts. Deribit’s bitcoin implied volatility index (BTC DVOL) and similar ETH-focused gauge surged to 53% and 50%, respectively from their respective historic lows in a sign of renewed demand for options.

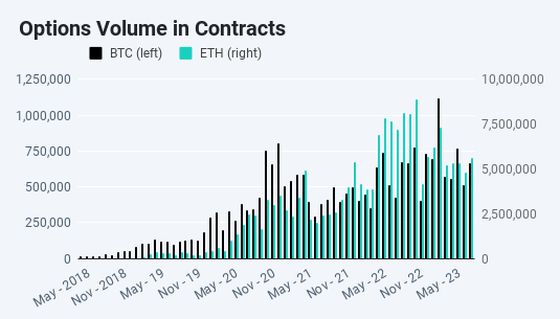

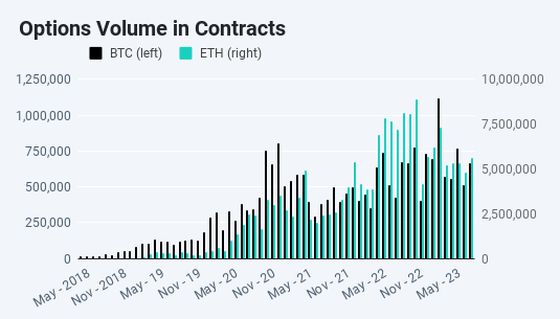

Trading volume in ether rose to the highest since March. (Deribit) (Deribit)

More than 5.6 million ether (ETH) option contracts, worth $9 billion at the ETH’s current market price of $1,624, changed hands last month. That’s the highest single-month tally since March.

Meanwhile, about 0.7 million BTC options contracts were traded. On Deribit, one options contract represents 1 ETH and 1 BTC.