K33 Research says that leading altcoin Ethereum will gain over Bitcoin in the short term. The research firm’s prediction is based on possible approval of an Ethereum futures-based ETF next month.

Research firm: Leave Bitcoin, look at Ethereum!

According to K33 Research, the SEC is likely to approve the first Ethereum futures ETF in the US. The research firm expects this approval decision on or before the mid-October deadline.

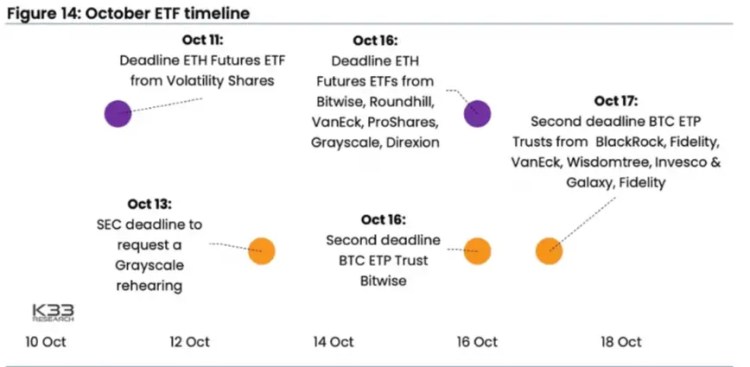

Timeline for crypto-related ETFs in October. Bloomberg/K33 Research

Timeline for crypto-related ETFs in October. Bloomberg/K33 ResearchMeanwhile, K33 says the market is underestimating the buying pressure of a spot Bitcoin ETF. However, K33 Research said in a report on Tuesday that leading altcoin Ether (ETH) is poised to outperform Bitcoin (BTC), benefiting from stronger momentum around a possible exchange-traded fund (ETF) listing in September and October. says.

“ Leading altcoin has more potential than BTC!”

The U.S. Securities and Exchange Commission (SEC) deadline to approve or reject the first Ethereum ETF is mid-October. According to experts, there is a high probability that the institution will give the green light to the product. K33 senior analyst Vetle Lunde states that this development will potentially increase the price of the leading altcoin. Meanwhile, he notes that Bitcoin gained 60% in the three weeks before the launch of its first futures-based ETF two years ago. In this context, Lunde shares the following assessment:

The odds are stacked in favor of ETH. Ethereum is a strong relative buy versus Bitcoin. ETH/BTC is trading near the lows of the 2.5-year range. There is also significant wiggle room for relative upside.

Spot Bitcoin ETF’s impact is underappreciated

cryptokoin.com As you follow from , asset management giant BlackRock applied for the spot product in June. A number of other asset managers, including Fidelity, also applied shortly after. Following these developments, Bitcoin has received its fair share of fanfare regarding ETFs. Last week, the possibility of the SEC approving a spot Bitcoin ETF seemingly increased after Grayscale’s victory against the agency in its lawsuit to convert the closed-end Grayscale Bitcoin Trust (GBTC) into an ETF.

But excitement over the court decision quickly faded. Because the SEC postponed the decision on spot product applications from BlackRock and others. This development also poured some cold water on sentiment in the later days of the week. Bitcoin, which initially rose above $28,000 with Grayscale’s court victory, soon lost all its gains and more, falling to a six-month low of just above $25,000 last Friday afternoon. Lunde comments:

The market appears to be underestimating the potential impact of a spot Bitcoin ETF. Approval of a spot ETF would have to attract massive inflows, creating significant buying pressure on BTC. Conversely, if BTC spot ETFs are rejected, nothing changes.