The blockchain industry remains mired in crypto winter, with the price of bellwether bitcoin (BTC) down 11% in the past month. But there’s no slowing down in the race among technologists to position for the future. In the past week MakerDAO’s Rune Christensen, a pioneer of decentralized finance, signaled his openness to abandon the Ethereum blockchain ecosystem for rival technology from Solana or Cosmos, as the project searches for its own dedicated blockchain. Separately, a debate broke out over whether Ethereum should have its own “Supreme Court” to arbitrate disputes.

This week’s feature focuses on blockchain “sequencers” – a crucial element of the fast-growing infrastructure for “layer-2” networks atop Ethereum. Sequencers have been in the headlines recently, partly because they’re sometimes cast as single points of failure that could undermine the design principle of decentralization. Our Sam Kessler explains.

You’re reading The Protocol, CoinDesk’s weekly newsletter that explores the tech behind crypto, one block at a time. Subscribe here to get it every week.

Network news

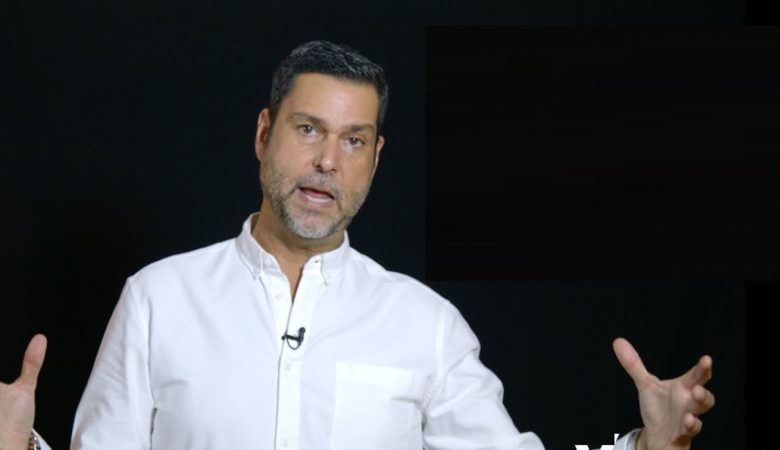

MakerDAO co-founder Rune Christensen (Original image by Trevor Jones)

SOLANA SEDUCTION: MakerDAO, one of the oldest and biggest decentralized-finance (DeFi) protocols on the Ethereum blockchain, is considering moving to its own dedicated blockchain. And rather than simply start a new layer-2 network within the dominant Ethereum ecosystem – as crypto-friendly firms like Coinbase and Consensys have chosen to do – MakerDAO might be looking to decamp altogether. Rune Christensen, MakerDAO’s founder, suggested last week that the project’s best bet might be to clone or “fork” the Solana blockchain – since it has the “most promising codebase.” In a governance forum post, he said Solana had demonstrated “technical quality” as well as “resilience by having gone through the FTX blowup.” (Solana was famously promoted by the collapsed FTX crypto exchange’s now-jailed founder, Sam Bankman-Fried.) Christensen went so far as to suggest the Cosmos blockchain’s technology as the “other main contender.” Ethereum co-founder Vitalik Buterin was apparently none too pleased, reportedly raising the question – in a post on a rival stablecoin project’s Discord channel – of whether “MakerDAO is torpedoing itself in weird directions” and then selling some 500 of the project’s MKR tokens (worth $579,000) that he had held since 2020. (Separately, in what might be a salt-in-the-wound moment, the credit-card network Visa announced Tuesday that it had expanded its stablecoin settlement capabilities to Solana, in addition to Ethereum.) On Wednesday, Solana Labs co-founder Raj Gokal told CoinDesk TV that the network was “battle-tested” and “ready for prime time.”

CODE VS. HUMANS: There’s an oft-repeated mantra in blockchain ideology that “code is law” – the idea that a network’s underlying programming should be sacrosanct, providing the ultimate authority to settle disputes even when serious emergencies or existential threats arise. Now, a top executive in the Ethereum blockchain ecosystem is explicitly embracing the idea that, in certain extreme scenarios, humans rather than hard-coding might be the superior arbiters of justice. Alex Gluchowski, CEO of Matter Labs, the developer of a top layer 2 network on Ethereum, has floated the idea of an “Ethereum Supreme Court” to arbitrate disputes that escalate to the point of threatening the main blockchain’s integrity. The system, which Gluchowski described on X (formerly Twitter) as “a hierarchical system of on-chain courts similar to the real-world judiciary,” would allow apps built atop Ethereum to appeal for a chain “fork” in the event that they are hacked or face some other sort of security crisis. “Code is law, bug = death,” Gluchowski wrote in a follow-up comment to his Sept. 2 post.

BASE’S NEW FANBASE: Just as the Friend.tech fad faded, sapping some of the post-launch adoration of Coinbase’s new Base layer-2 blockchain (as chronicled in last week’s The Protocol), there’s a new kid in town: Aerodrome Finance. The platform, which markets itself as the Base ecosystem’s “premiere liquidity engine and hub,” has quickly attracted more than $170 million of TVL or “total value locked,” helping to push the overall TVL of protocols on Base to more than $400 million. The secret? According to the newsletter Wu Blockchain, the project’s “native token, $AERO, offers liquidity mining rewards with an annualized yield close to 1,000% without compounding.” That’s a lot, even in crypto. Aerodrome’s TVL has now exceeded – “flippened” in crypto jargon – the $158 million on Velodrome, Aerodome’s predecessor project, which sits on the older layer-2 chain Optimism. Is it sustainable? “Money doesn’t materialize out of thin air,” Wu Blockchain noted dryly, so “it’s worth considering when this spiral might come to an end.” (A Base zit: On Tuesday, the network suffered a “major outage” that lasted a little over three hours, its biggest glitch since the launch last month.)

Also:

FIRST ON COINDESK: Coinbase has quietly created a crypto lending service geared toward large investors, helping to fill the void left by last year’s blowups of firms like Genesis and BlockFi.

X, the Elon Musk-owned social media platform formerly called Twitter, has obtained payments licenses from several U.S. states in recent months – including a currency transmitter license in Rhode Island last week.

MetaMask, the popular crypto wallet, unveiled a new “Sell” feature that “allows you to cash out your crypto for fiat currency easily,” in a post on X. The feature is available in the U.S., UK and parts of Europe, “initially supporting ETH on Ethereum mainnet, with plans to expand to native gas tokens on layer 2 networks soon,” according to the company. Funds can be sent to a bank account or PayPal balance.

Protocol Village

Highlighting blockchain tech upgrades and developments.

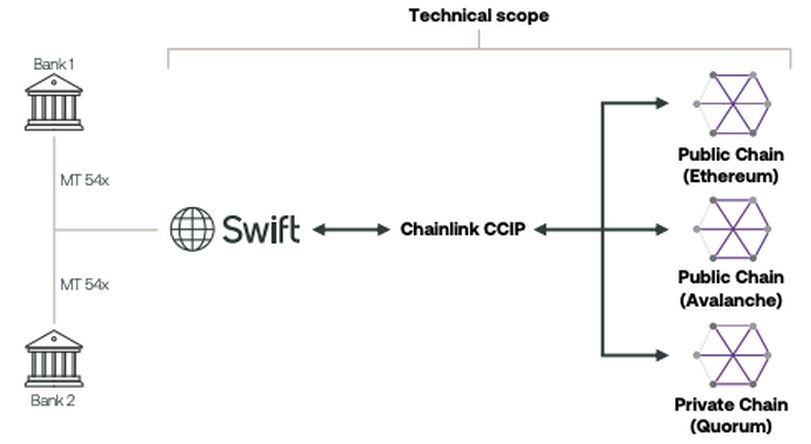

Diagram of Swift’s setup to connect banks and blockchains using Chainlink’s Cross-Chain Interoperability Protocol (CCIP). (Swift)

Money Center

Socket co-founders, Rishabh Khurana and Vaibhav Chellani (Socket)

Fundraisings

Deals and grants

Data and tokens

Regulatory, Policy and Legal

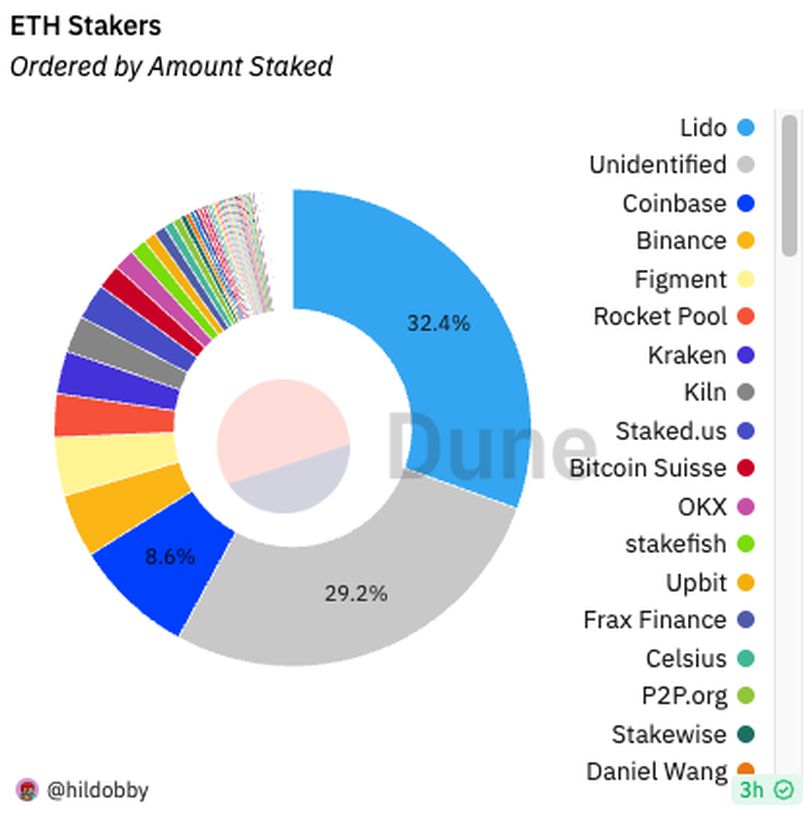

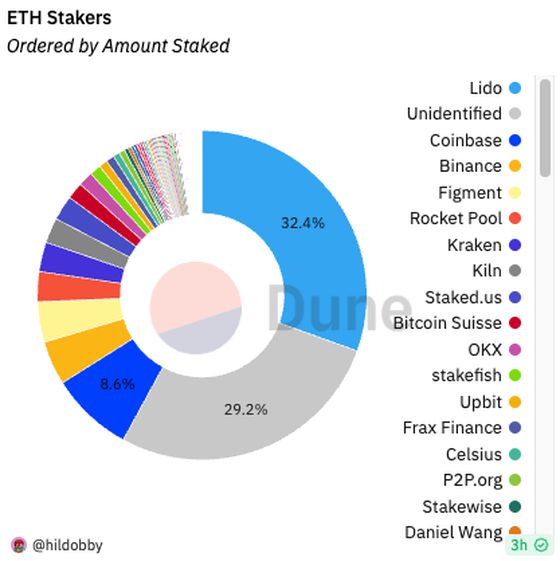

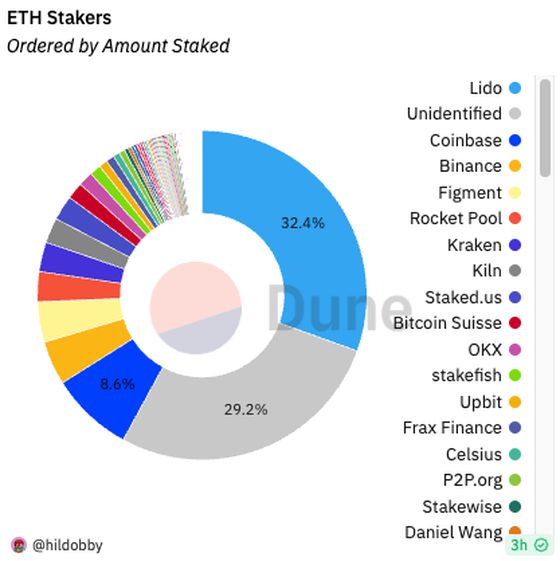

Lido Dominates Ethereum Liquid Staking Market – and Isn’t Sharing

At least four Ethereum liquid staking providers have agreed to a self-imposed limit where they would never own more than 22% of the Ethereum staking market, Cointelegraph reported, citing the X account superphiz.eth. Notably absent from the list is the biggest among them, Lido Finance, which has staked 32% of the total ETH staked.

Market share of stakers on Ethereum. (Dune Analytics)

Calendar