According to the co-founders of crypto analysis platform Glassnode, Bitcoin is at an important turning point at current levels. Experts say that the BTC accumulation phase will begin with a big move on the horizon.

Can Bitcoin be purchased today?

Bitcoin, which gained upward momentum the previous day, managed to rise above $ 26,400 at one point. This move coincides significantly with the levels noted by Glassnode co-founders Jan Happel and Yann Allemann. Analysts say that current levels are paving the way for a rally, but the outcome could also be downside:

BTC’s price resurgence finds balance at $25,824, creating a potential launch pad. Multiple rejections at the $25,000 level reveal continued conscious accumulation.

But neither bulls nor bears show dominance; There is a war in the game. So why? Bullish momentum may be losing steam. Be ready for a decisive move.

cryptokoin.com As you follow from , Bitcoin is currently trading in the $25,850 region. Happel and Allemann had previously outlined two levels that could determine whether Bitcoin will follow a bullish or bearish trend moving forward.

Medium-term outlook: Favorable risk/reward ratio, but uncertainty in the short term ($25,800 – $26,800).

Possible levels due to downtrend: $23,800 – $24,800.

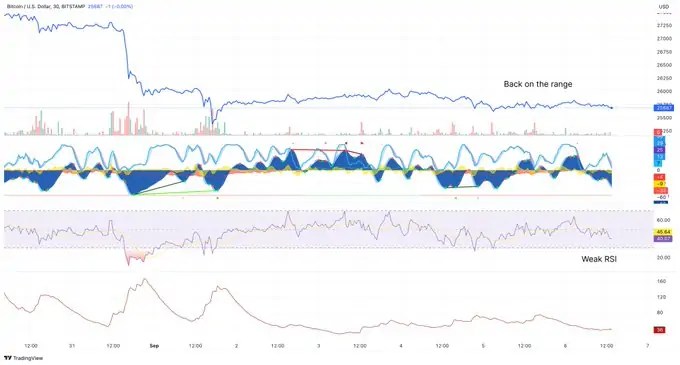

Bottom signs: RSI uptrend, volatility decreasing. Consider buying post-dip or holding firm at $26,800 to break the downtrend.

Mid-term outlook: Favorable risk/reward, but short-term, uncertain ($25.8k – $26.8k).

⁃ Possible downside ($23.8k – $24.8k) due to bearish trend.

⁃ Signs of bottoming: RSI bullish divergence, fading volatility.Consider buying after dip or solid $26.8k hold to break the… pic.twitter.com/uZ55CyOU9u

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) September 5, 2023

Bitcoin offers a round trip to $24,400

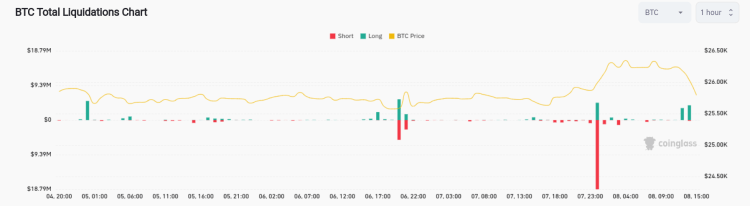

While Glassnode’s co-founders expect the leading crypto to make a decision in the short term, other analysts warn of potential bottom tests. This correction movement was revealed by the rally that the Bitcoin price started last night. Following the rally, short liquidations totaled $23.5 million for Sept. 7, according to data from CoinGlass. The long calculation for September 8 is still uncertain.

“Shorts were as expected,” wrote popular trader Skew in a segment of his overnight market news on X.

$BTC Binance & Bybit Open Interest

Shorts got hunted as expectednote the OI added here with small price reaction and decreasing perp bid delta, this implies more shorts scaling into price on this second drive higher https://t.co/OULNlQrQof pic.twitter.com/X1hNlvjbdc

— Skew Δ (@52kskew) September 7, 2023

Fellow trader Daan Crypto Trades emphasized the importance of regaining ground lost in August. X told his subscribers, “Bitcoin has finally managed to rise above the September open level after testing it many times. Now testing again. The question is: Will it provide support as well as resistance? “It’s up to the bulls to try to maintain a ‘green’ September.”

Analysts say $26,000 is critical

Continuing, Bitcoin analyst Tony said that $26,600 is the line to cross, ignoring the strength of the overnight move. “Nice rally from the $25,600 lows, but no follow-through to the highs,” it said, along with an explanatory chart. So we’re stuck in the middle range again,” he explained. He also added:

No entry into Bitcoin for me unless we clear $26,600.

“Stay away from the altcoin market”

On the altcoin side, investors need to be more careful for a while, according to Glassnode’s co-founders. Analysts warned traders and investors with the following words in their current analysis:

Minimize your investors in altcoins. Small and mid-caps are showing slightly negative momentum and selling pressure. BTC, ETH [Ethereum] and majors are in uncertain territory. A flat momentum does not guarantee a strong upward move. Safe entry for altcoins: Wait for BTC bullish momentum and stability, confirm trend reversal.