Bitcoin (BTC) price started September on the downside and fell back below $26,000 on Friday. However, a critical on-chain indicator reveals increasing bullish pressure from US-based whale investors. Here are the details…

September 19 is important for Bitcoin

US FED will announce new Interest Rates on September 19. With just 10 days until the important monetary policy meeting, US-based corporate firms appear to be making last-minute Bitcoin (BTC) savings. Will this trigger a Bitcoin price rally in the coming days? With the next Fed meeting fast approaching, a vital on-chain indicator shows US institutional investors increasing buying pressure. CryptoQuant’s Coinbase Premium Index shows the percentage difference between Bitcoin prices on the Coinbase Pro and Binance spot markets.

While Binance dominates the individual spot market globally, Coinbase Pro is largely dominated by US-based institutional firms and high net worth traders. Therefore, positive Premium Index values indicate that US investors’ buying pressure on Coinbase has increased. The chart above shows that on September 7, the Coinbase Premium Index reached positive values for the first time this month. But interestingly, the last time the Coinbase index rose above 0.80 was around March 2023. This was followed by a price rally towards the then 2023 peak of $30,500.

BTC liquidity is rising

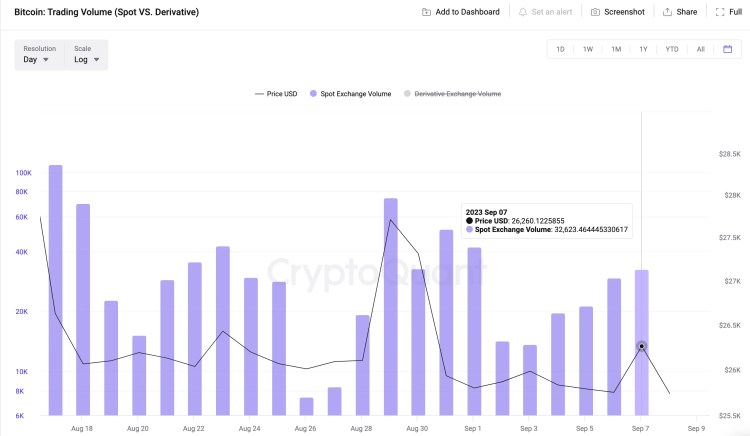

This optimistic stance has been further strengthened by liquidity flowing into Bitcoin spot markets this week. According to Cryptoquant, Bitcoin Spot Transaction Volume has increased continuously since September 2nd, almost doubling. Numerically, BTC Spot Trading Volume on September 2 stood at 14,230 BTC. At the close of September 7, a total of 32,632 BTC was traded on various crypto exchanges. This represents a 130% increase in Spot Market volumes in one week. Typically, during bear markets, Spot Trading volumes decline as beleaguered investors close out their positions.

Therefore, increasing BTC spot volumes during the current sideways price movement means that liquidity and investor interest are returning to the market. This increased liquidity could help Bitcoin traders execute orders efficiently while keeping prices stable in the coming days. Additionally, historical data trends show that there is usually an increase in BTC Spot trading volumes before recent Bitcoin price rallies. As a result, buying pressure from US-based whales and an increase in BTC Spot trading volume could combine to trigger a Bitcoin price rally.

There is an estimate of $28,000

From an on-chain perspective, US-based whales could trigger a Bitcoin price rally towards $28,000 in the coming days, This bullish stance is also confirmed by the Money In/Out data around the price showing the purchase price distribution of current Bitcoin holders. If BTC clears the $26,500 barrier, it suggests that the bulls may gain momentum to push $28,000. As shown below, 2.31 million addresses that purchased 740 BTC at the maximum price of $26,560 are currently creating major resistance. But if US whales’ optimism intensifies, the Bitcoin price rally could reach $28,000.

Conversely, the bears could gain control if BTC price falls below $24,500. However, as shown below, 654,000 addresses purchased 253,000 BTC at the minimum price of $25,000. These addresses can provide significant support by making diligent attempts to close their positions. However, if this support level collapses, BTC price could eventually decline towards $24,000.