Bitcoin (BTC) quickly erased the nearly 3 percent rise it experienced the previous day, pushing the crypto market into pessimism.

An upward scenario took place on the Bitcoin side on the night between September 7 and September 8. The upward wave, which started at 23:00 on September 7, peaked at 03:00 on September 8. BTC price reached $26,431 in a short time and made the bulls hungry. However, in a very short time, BTC fell below $ 26,000 again.

Cointelegraph cited the desire to take profits, the resistance point being firmly defended by bears, and market uncertainty as reasons for the drop.

Bitcoin (BTC) price points to ‘correction’

Bitcoin (BTC) price has been struggling to find direction since September began. BTC, which has been moving in a fixed price range for a long time, could not gain volatility. On the BTC side, the effect of lack of volume and inflow of money is quite high.

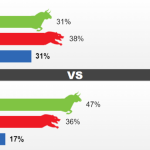

The indecision of BTC investors makes bears and bulls hesitate. Still, BTC bulls maintained a buying appetite that pushed it past $26,000. The recent rally suggested that the bulls had surpassed $26,000. But things did not go as expected and the bears managed to defend the 26,000 resistance.

BTC price revealed a lack of liquidity through minor fluctuations. BTC, which oscillates between small gains and losses, was disturbed by the drift it experienced the other day.

BTC analysts are divided, with many suggesting that BTC will experience a pullback to the $23,000 level and the crypto market is not giving any positive signals. However, the number of analysts who think that the upward scenario will come to the fore again is quite high.

The stagnant BTC price experienced a new volatility between September 7 and September 8. In this movement, which resulted in a 2.5 percent decrease, the question investors are wondering is “Why is BTC falling?” happened.

Cointelegraph attributed the process in BTC price activity to the selling of profits when the purchases made from the support point came to the resistance point. Additionally, as another reason, it has been suggested that the resistance point is not yet weak enough to break.

The decline that took place on September 8 resulted in the liquidation of those who opened upward transactions. Specifically, the decline on the spot BTC side liquidated $8.69 million in bullish transactions. Cointelegraph attributed this situation to traders selling BTC to pay off borrowed cryptocurrencies.

To find out what might happen in the next process, where the Bitcoin price will go and the activity waiting for altcoins, you can check out our news; Altcoin price analysis: A decline may occur!