Bitcoin is stuck in a range. However, according to crypto analyst Rakesh Upadhyay, some altcoins are showing signs of bearish in the near term. Could Bitcoin’s range-bound move increase selling pressure on altcoins including DOGE? The analyst examines the charts of the top 10 cryptocurrencies to find out.

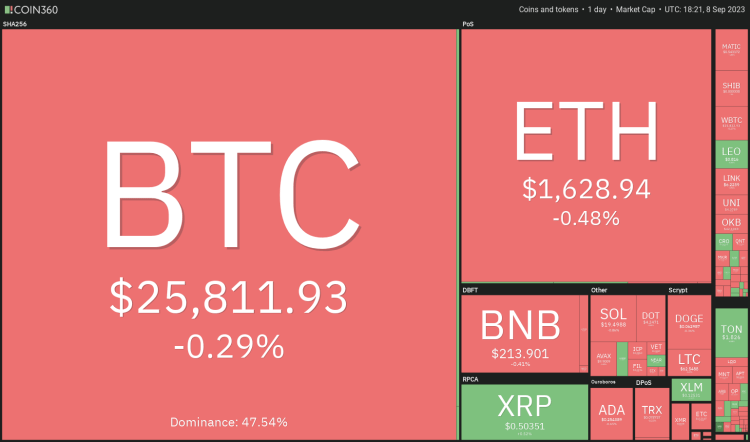

An overview of the cryptocurrency market

The bulls tried to wake Bitcoin from its slumber on September 7. However, cryptokoin.com As you can follow, the rally was short-lived. This suggests that there is no clarity between the bulls and bears about Bitcoin’s next directional move of $25,902. Analyst CryptoCon says Bitcoin could remain in a “mid-cycle lull” until the start of the next bull run in November 2024. Similarly, ARK Invest states in a report that cryptocurrencies may continue to face headwinds for the rest of 2023 due to various macroeconomic issues such as interest rates, gross domestic product forecasts, unemployment and inflation.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360In September, bulls will closely monitor the U.S. Securities and Exchange Commission’s decision on various Bitcoin spot exchange-traded fund (ETF) applications. In addition, the spot Ether ETF race officially started on September 6 with applications from VanEck and ARK Invest. Bloomberg ETF analyst James Seyffart expects more Ethereum ETF applications in the next few days.

BTC, ETH, BNB, XRP and ADA analysis

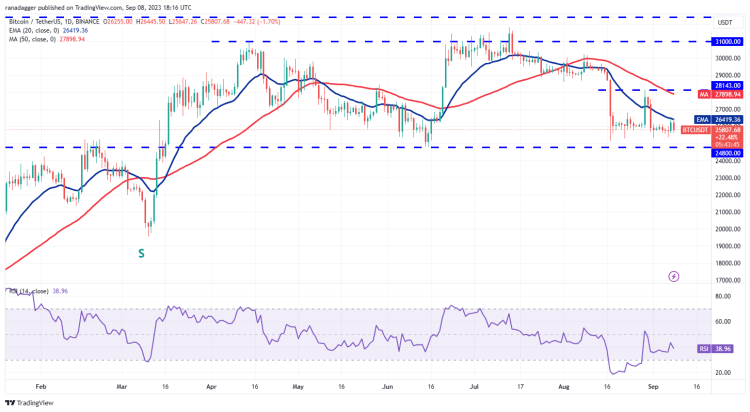

Bitcoin (BTC) price analysis

Bitcoin reached the 20-day exponential moving average (EMA) of $26,419 on September 7. However, the bulls could not overcome this obstacle. This indicates that the bears are strongly protecting the 20-day EMA. However, the failure of the bears to challenge the important support at $24,800 suggests that the selling is fading lower.

The relative strength index (RSI) is trying to form a positive divergence. This indicates that the bearish momentum is weakening. The first sign of strength will be a break and close above the 20-day EMA. This will pave the way for a sustained recovery towards $28,143. Conversely, if the $24,800 support breaks, it is possible for BTC to start a downtrend. There is a minor support at $24,000. But it may not be able to stop the decline. It is possible for BTC to eventually reach the crucial support at $20,000.

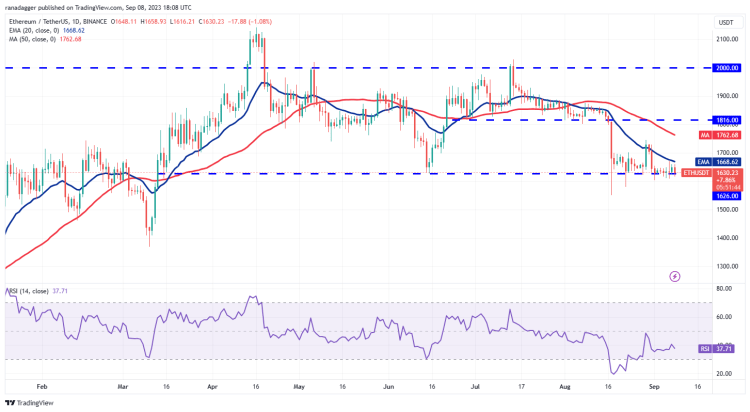

Ethereum (ETH) price analysis

Ether continues to trade in a tight range between the 20-day EMA ($1,668) and the tough support at $1,626. The failure of the bulls to overcome the overhead barrier at the 20-day EMA increases the risk of a breakout.

Below $1,626, it is possible for ETH to retest the August 17 intraday low of $1,550. Buyers are likely to buy strongly on the dip to this level. Because if it breaks the support, ETH is likely to drop to $1,368. Time is running out for the bulls. If they want to avoid a collapse, they will first need to push the price above the 20-day EMA and then try to rise above the 50-day simple moving average (SMA) at $1,762. This increases the likelihood that ETH will remain between $2,000 and $1,626 for a few more days.

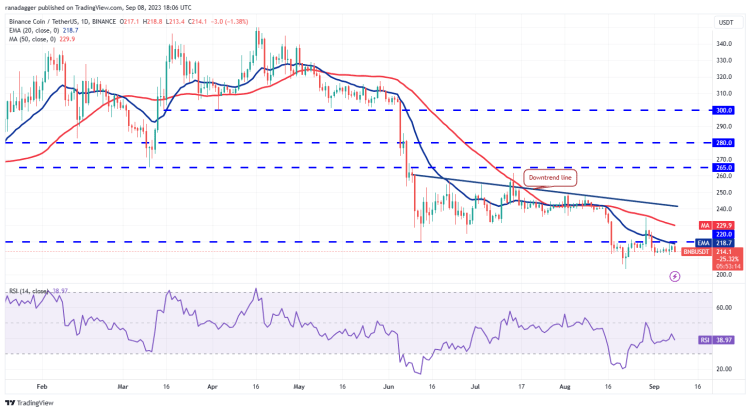

Binance Coin (BNB) price analysis

The bulls tried to push BNB above the $220 breakout level on September 6. But the bears did not agree to this. This shows that sellers are trying to turn the $220 level into resistance.

There is a minor support at $211. However, if the bears push the price below this, it is possible for BNB to reach the psychological level of $200. This level is likely to attract solid buying by the bulls. If the price recovers from this support, it will indicate that BNB will consolidate between $200 and $220 for a while. Contrary to this assumption, if the price turns up from the current level and rises above $220, it will indicate accumulation at lower levels. This is likely to initiate a recovery towards the downtrend line.

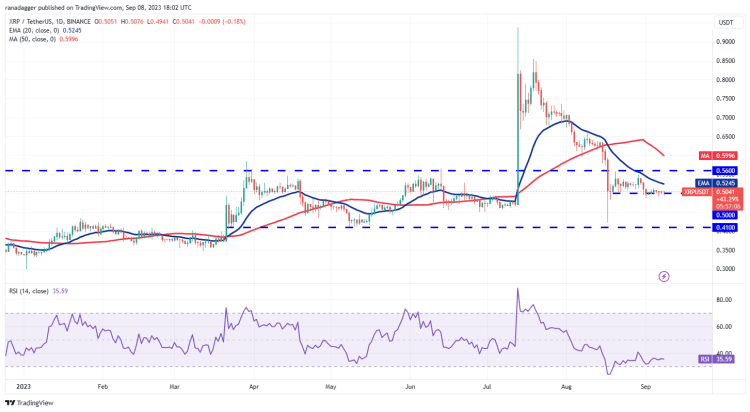

Ripple (XRP) price analysis

The bulls bought XRP for under $0.50 on September 6. However, the failure to initiate a strong recovery points to a lack of demand at higher levels.

The bears will try to further strengthen their position by pushing the price below $0.50. If they do, it is possible for XRP to drop as low as the next major support at $0.41. This decline is likely to be rapid. Because there is no major support between $0.50 and $0.41. Conversely, if the price turns up from the current level once again, it will indicate that the bulls are trying to turn $0.50 into support. If there is a break above the 20-day EMA, XRP will oscillate between $0.50 and $0.56 for a while.

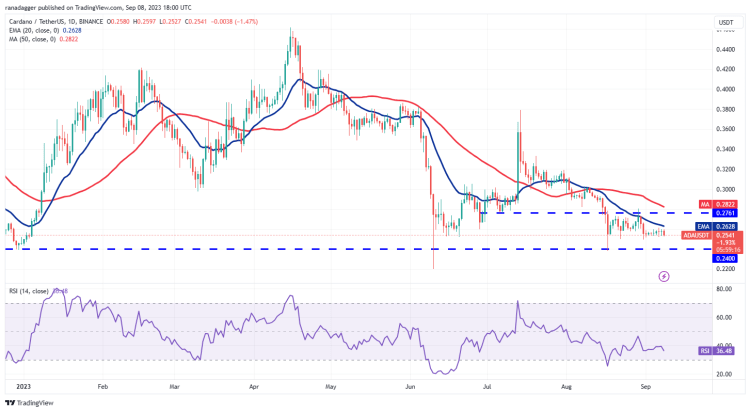

Cardano (ADA) price analysis

Cardano formed a Doji candlestick pattern on September 6 and September 7, showing indecision between the bulls and bears.

The downward-sloping 20-day EMA ($0.26) and the RSI in the negative zone increase the likelihood of a breakout to the downside. If the price dips below $0.25, a drop to the critical support of $0.24 is possible for ADA. On the upside, the bears have repeatedly halted progress near the 20-day EMA. So, this becomes an important level to pay attention to. If the bulls push the price above the 20-day EMA, ADA is likely to reach the overhead resistance of $0.28.

DOGE, SOL, TON, DOT and MATIC analysis

Dogecoin (DOGE) price analysis

The bulls tried to push the DOGE price above the 20-day EMA ($0.06) on September 6. But the bears held their ground.

DOGE price is stuck between the 20-day EMA and the horizontal support at $0.06. When the price is trading in a range, it is difficult to predict the direction of the breakout. However, the downward sloping 20-day EMA and RSI near 40 are giving an edge signal to the bears. Below $0.06, DOGE price is likely to drop to $0.055. This downside view will be invalidated in the near term if the bulls push DOGE price above the 20-day EMA and sustain it. Such a move would indicate the beginning of a stronger recovery to $0.07 and eventually $0.08.

Solana (SOL) price analysis

Solana is gradually correcting in the wide range between $14 and $27.12. The bears are selling relief rallies up to the 20-day EMA ($20.53). This suggests that sentiment remains negative.

The repeated failure of the bulls to push the price above the 20-day EMA suggests that the path of least resistance is to the downside. If the bears pull the price below the immediate support at $19, a drop to $18 and then $16 is possible for the SOL. Meanwhile, the bulls are likely to have other plans. They will try to push the price above the 20-day EMA. If successful, SOL is likely to reach the overhead resistance of $22.30. This is an important level for the bears’ defense. Because a break above this could open the way for a potential rally to $26.

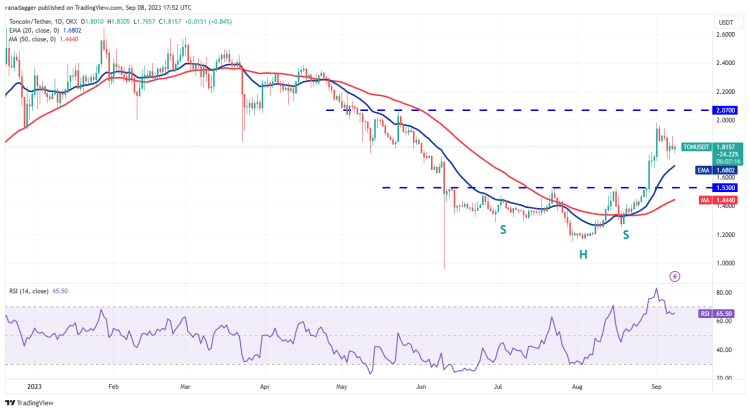

Toncoin (TON) price analysis

Toncoin (TON) attempted a recovery on September 6. However, the long wick on the September 7 candlestick shows that the bears continue to sell in the rallies.

The 20-day EMA ($1.68) remains a key level to keep an eye on in the short term. If the price rebounds from the 20-day EMA, the bulls will attempt to push the TON back above the overhead resistance of $2.07. On the contrary, if the price drops below the 20-day EMA, it will indicate that traders are aggressively booking profits. The first stop on the downside is at the breakout level of $1.53. After that, the second stop is at the 50-day SMA ($1.44).

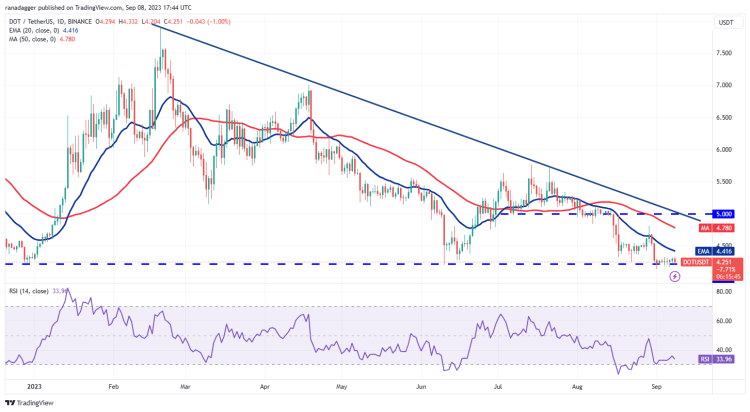

Polkadot (DOT) price analysis

The bears pulled Polkadot below the strong support at $4.22 on Sept. 6. However, they failed to hold the lower levels as seen by the long tail on the candlestick. This indicates buying at lower levels.

However, the bulls failed to maintain the momentum and push the price to the 20-day EMA ($4.41). This means that every little rally has been sold out. The bears pulled the price back to the key support at $4.22. If it breaks this support, DOT is likely to fall to the $4 psychological support. If the bulls want to make a comeback, they will have to push the price above the 20-day EMA. If they do this, DOT is likely to rise to the downtrend line. This is the key level to consider. Because a break above this indicates the end of the downtrend.

Polygon (MATIC) price analysis

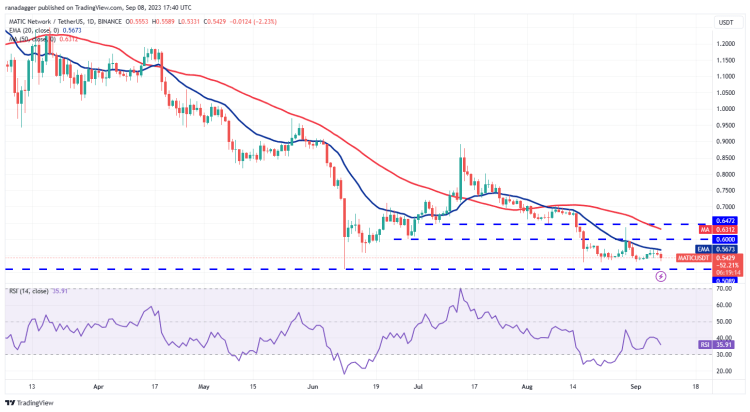

Buyers have attempted to push Polygon above the 20-day EMA ($0.56) over the past three days. But the bears held their ground. This shows that traders are selling in small rallies.

The bears will try to sink the price below the immediate support at $0.53. If they manage to do this, it is possible for MATIC to drop to the vital support at $0.50. The bulls are expected to maintain this level strongly. Because a break below this could open the doors for a further decline to $0.45. The bulls will need to push the price above the 20-day EMA and sustain it to show that bearish pressure is easing. This could initiate a rally towards $0.64, where the bears can again make a strong defense.