Bitcoin is starting the week on a weak spot and the 2023 BTC movement is starting to look like a “double top”. After a disappointing weekly close below $26,000, BTC/USD is struggling to capture a bid amid a return to lower volatility. Analysts who are already betting downside continue to predict new local lows, increasingly supporting liquidity conditions arguments. Here are the details…

Weekly close makes double top of Bitcoin price a reality

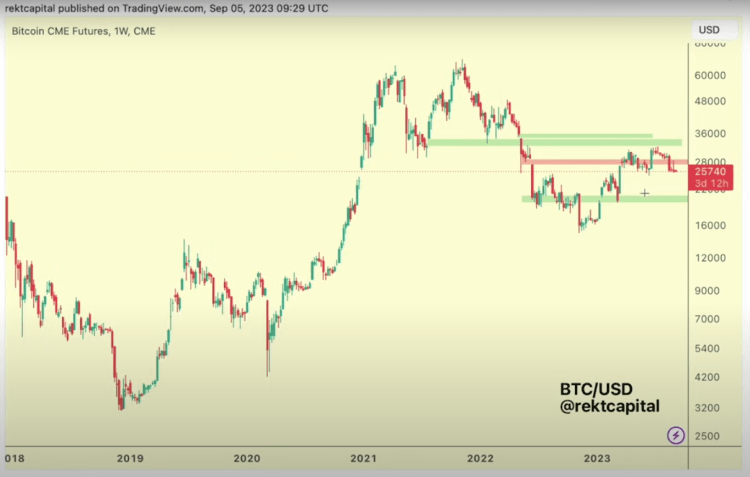

Bitcoin was already expected to close the week below key trend lines, but the reality may be worse than many want to admit. Rekt Capital warned that a close below $26,000 would “likely” confirm the double-top structure on the BTC weekly chart. According to the data, this structure currently takes the form of two 2023 local tops for Bitcoin, both above $31,000, with a pullback to $26,000 in between. A recovery to “fair value” could also come thanks to Bitcoin’s relative strength index (RSI), which has almost completely pared back its year-to-date gains to hit its lowest levels since the first week of January. Bitcoin (BTC) started an important week in a dangerous position with a price of $ 25,647.

The 2023 BTC movement is starting to resemble a “double top” formation, raising concerns among analysts. After a disappointing weekly close below $26,000, BTC/USD is struggling to gain momentum as volatility remains low. Analysts who had previously made bearish predictions continue to predict new local lows, and liquidity conditions also support their views. However, an on-chain metric shows that Bitcoin has undergone a significant shakeup similar to March 2020.

In addition, Bitcoin’s relative strength index (RSI) has almost completely pared back its year-to-date gains, reaching its lowest levels since the first week of January. These topics and more are examined in our weekly summary of important BTC price triggers. The weekly close below $26,000 confirmed the double-top structure on the BTC weekly chart, consisting of two local tops above $31,000 and a pullback to $26,000. This development has raised concerns about the potential for further price weakness.

$20,000 futures gap next?

Some analysts see optimism in the form of the 200-week exponential moving average (EMA) near $25,600, suggesting market indecision. However, the general consensus is that the price of BTC is facing downward pressure. Another controversial issue is the concept of “filling the gap” in the CME futures markets. There is currently a significant gap at the $20,000 level. While some believe that these gaps will be filled sooner or later, others point out that it is not guaranteed that all gaps will be filled.

“This is the only real CME gap we have in terms of downside movement from current price levels,” Rekt Capital said in its latest YouTube update on September 6. He continued by stating that a gap that has been filled since June 2022 is now acting as resistance after acting as support and resistance at various points since its creation. Under these conditions, a potential BTC price range will form and the $20,000 gap and the previously filled gap will act as support and resistance respectively.

What does liquidity indicate for Bitcoin?

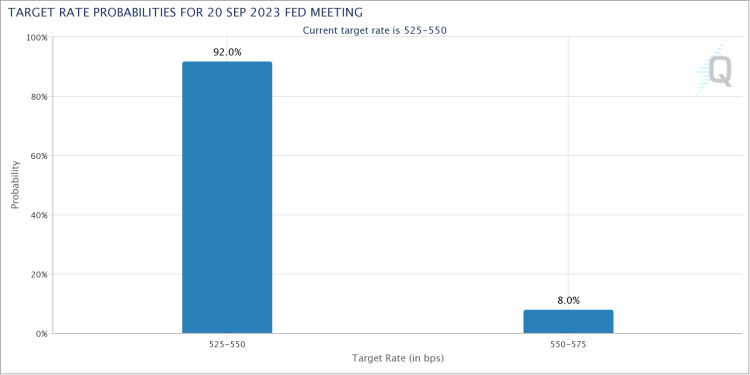

Liquidity in the BTC/USD markets is another contributing factor to bearish forecasts, with bid liquidity concentrated around $24,000, the lowest since March. The August edition of the United States Consumer Price Index (CPI) is expected to impact BTC price action, which is scheduled to be released on September 14. CPI figures may affect the market expectations of the Fed’s benchmark interest rates, and the Fed’s next decision is set for September 20. Confidence is high that rates will remain unchanged, which could benefit risk assets including crypto. Meanwhile, Material Indicators continued to mark $24,750 as the key level for the bulls to hold in its latest heatmap release for the largest volume global exchange Binance.

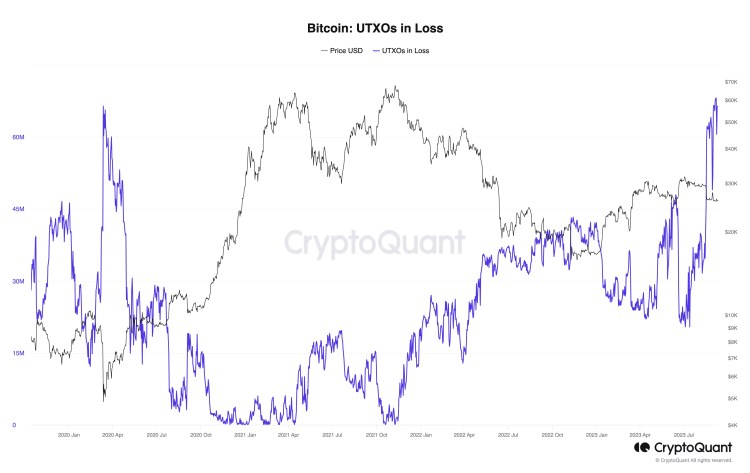

Warning about black swan incident

UTXOs in Loss, an on-chain metric, shows that BTC’s current price action may be more important than traders realize. This metric, which measures unspent transaction outputs worth less than their purchase value, is at its highest level since March 2020, raising concerns about a potential “black swan” event like the one that occurred in 2020. “Given that the current level of the ‘UTXOs in loss’ indicator reflects the Black Swan event between March and April 2020 (due to the Coronavirus), those expecting another Black Swan event may want to consider whether we are in the middle of what they’ve been waiting for,” CryptoQuant author Woominkyu wrote.