In a highly anticipated launch, Banana Gun’s native token, BANANA, dropped from $8.70 to just $0.02 just three hours after launch, leaving investors in shock and disappointment. Crypto enthusiasts were quick to express their “rug pull” skepticism. However, the Banana Gun team pointed to a critical error in the altcoin contract as the culprit. However, despite two inspections, they could not fix this problem.

Altcoin was also audited

Even more surprising, a coder known as MisterChoc claimed to have detected the vulnerability in seconds using OpenAI’s ChatGPT, highlighting the growing role of AI in code audits. In response to the crisis, the Banana Gun team announced their plans for affected users. The first step involved selling the contents of the treasury wallet to empty the liquidity pool that would be used for a new contract. Additionally, the team promised a relaunch of the token along with an airdrop to compensate hapless BANANA investors, while providing a thorough audit of the new contract.

However, this incident sparked a debate about the use of artificial intelligence in code auditing. Although ChatGPT has been praised for quickly detecting the bug, experts warn against relying solely on AI for such critical tasks. CertiK Chief Security Officer Kang Li expressed concern, arguing that AI-powered assistants like ChatGPT could unintentionally introduce more bugs, and this risk could be disastrous for amateur coders trying to get their projects off the ground.

Banana claimed they had 2 audits. So I asked for a third one to my favorite auditor: ChatGPT

And it found the bug 😬 https://t.co/cA9ju08dHB pic.twitter.com/F1GCtmEiSs

— MisterCh0c (@Mister_Ch0c) September 11, 2023

Telegram bots continue to gain momentum

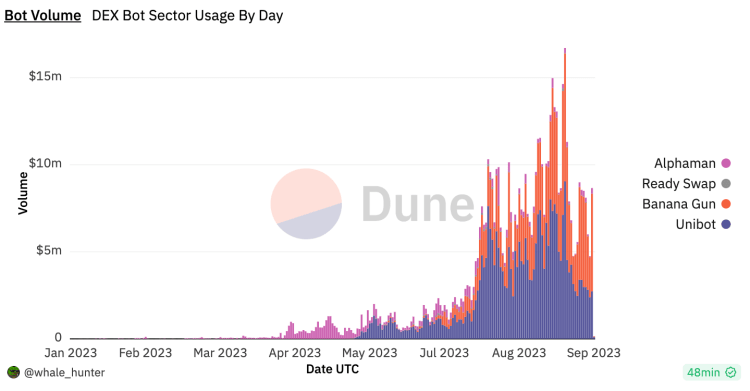

Banana Gun has emerged as one of the newest and most prominent players in the Telegram bot trading arena following the success of Unibot. Telegram bot-enabled trading has gained popularity among traders who want to access new tokens and airdrops efficiently. Data from Dune Analytics revealed that DEX trading bots reached a record daily trading volume of $16.7 million on August 29, underlining the growing influence of these trading tools in the cryptocurrency market.

As the fallout from the BANANA token launch continues, questions remain regarding the role of AI in code audits, reminding the crypto community of the need for comprehensive security measures in this rapidly evolving environment. In the wake of this incident, cryptocurrency enthusiasts continue to ponder the risks and rewards associated with projects inspired by Telegram bot-themed altcoins. BANANA’s rapid rise and fall, reaching a staggering market cap of $60 million within minutes and falling only 99%, serves as a stark reminder of the unpredictable nature of the crypto market.

When did the disaster begin?

BANANA’s ill-fated saga began around 9:30pm when the token was launched, initially creating a frenzy of excitement among investors. However, this euphoria was short-lived and just an hour later the transactions started to go wrong. A significant error was discovered during a thorough review of the token contract by a cryptocurrency analyst. According to the analyst, a flaw in the BANANA contract caused the 4% fee that was supposed to be deducted from sellers to remain in the seller’s wallet.

Announcement

We have a bug in our contract we cannot hotfix.Despite two audits there is a bug in the contract with our taxes, which allows people to sell their bags while having tax tokens remaining in their wallet.

1. First step is to sell the treasury wallet to drain the LP…

— Banana Gun 🍌🔫 (@BananaGunBot) September 11, 2023

Following the discovery of this critical error, the BANANA team issued a statement and admitted that they were unable to fix the problem in the token contract. This revelation was particularly concerning, as the team claimed to have performed two security checks on their code, further raising doubts about the effectiveness of such checks. The team’s next plan involved selling all tokens in their treasury wallets and reallocating them for a new contract. He also assured that snapshots were taken to ensure that all token holders will be compensated. They also promised to distribute a new airdrop to users immediately.