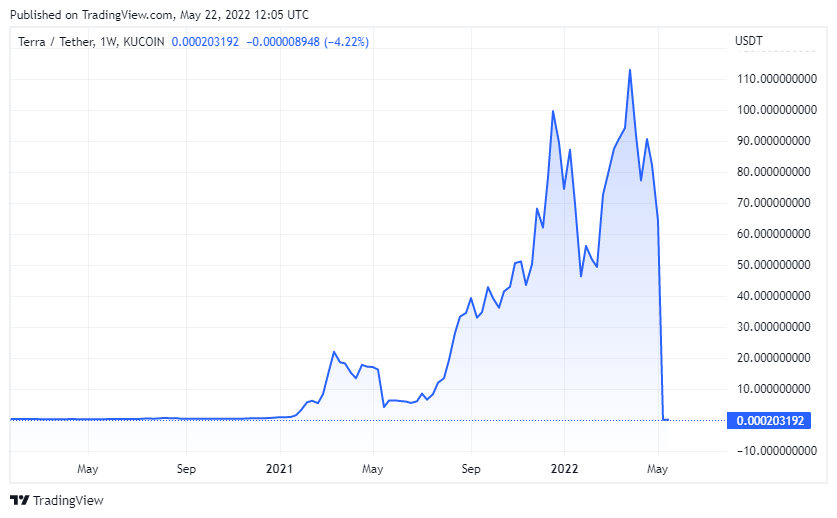

As several large Terra (LUNA) whales exited their positions, individual investors continued to accumulate in the early part of the crash, according to reports.

Whales sold as LUNA crashed, rallied individual investors

Jump Capital, a major investor in Terra, said in a recent report that some of the project’s biggest investors are ‘UST stablecoin’. He said it was selling quickly as the company began to crash in early May. In turn, smaller wallets continued to accumulate. Jump Capital noted that a series of large withdrawals and swaps in an UST liquidity pool caused the stablecoin to lose its dollar peg.

Also, a heap of whale sales has intensified around Terra’s Anchor Protocol, which saw a flurry of pullbacks as the UST began to lose price stability. In this regard, Jump Capital refers to on-chain data in the report.

Anchor Protocol played a key role in the Terra crash

Jump Capital is a recent report from on-chain analytics firm Nansen that identifies seven major wallets that trigger exits from Anchor. refers to the report. But these seven were part of a much broader trend. With over $1 million in Anchor deposits, which Jump describes as “big” depositors, the whales divested more than 40% of their assets on the platform during the initial depegging.

By contrast, small investors holding less than $10,000 wallets on Anchor have increased their holdings on the platform during this period. However, this demand was insufficient to support LUNA and UST prices, given that they constitute some of the overall liquidity.

Anchor Protocol was essentially the originating point for the Terra crash, given that 70% of UST liquidity was locked onto the platform. The platform’s imbalance between depositors and borrowers also contributed to its eventual collapse.

Crypto sentiment also played an important role

Exits from Terra worsened due to weak crypto market sentiment. The depegging came after a market crash triggered by the Fed’s rate hike. Strong US inflation figures also contributed to this decline.

Terra’s collapse wiped out over $30 billion in investor funds in a matter of days. It has drawn regulatory anger from around the world and is expected to introduce stricter laws on crypto. As Kriptokoin.com , the Japanese parliament introduced the world’s first bill on stablecoins. While Terra has now launched a new blockchain to help restore some value, the project seems to have lost much of its reputation in the market.