Last week, all eyes were focused on the interest rate decisions of the Federal Reserve (Fed). The market was assuming that the Fed would keep the interest rate constant and priced it positively. Actually, what was expected happened, but we saw that the markets moved into sales positions. So why did the markets react harshly to this development?

Following a 25 basis point increase in July, the Fed kept the federal funds rate target range at 5.25%-5.5%, the highest level in 22 years, in line with market expectations, at its September 20 meeting and signaled that another interest rate increase may be possible.

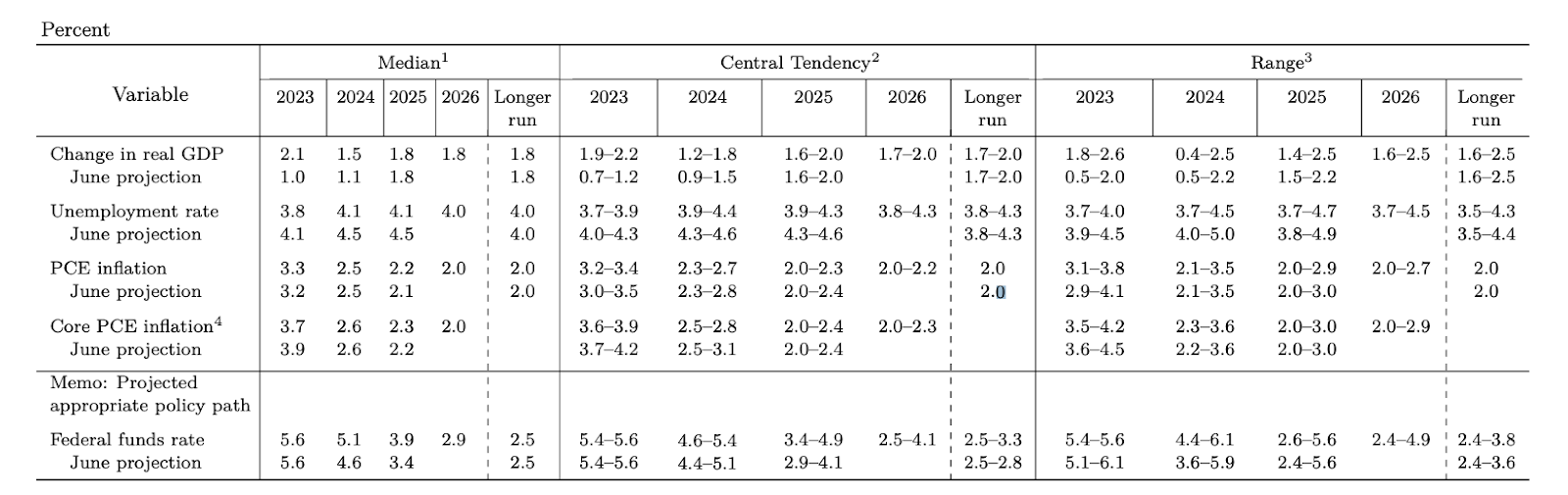

Every 3 months, Fed officials announce their expectations for the next 3 years and the long term regarding unemployment, inflation, economic growth and interest rates in the USA with the “Economic Projection Report”. It was precisely this part that made yesterday important because it contained clues about how much the Fed would increase the interest rate and how much higher it would keep it.

Key Points

-12 Fed officials expect another interest rate increase.

-7 Fed officials do not foresee further interest rate increases.

-The Fed plans to keep interest rates high for a long time.

-The expectation of interest rate reduction in 2024 has been postponed.

The growth expectation was reduced from 1% to 2.1% in the new projection. While the 2024 growth expectation increased from 1.1% to 1.5%, the 2025 growth expectation was maintained at 1.8%.

The core PCE data forecast, the Fed’s favorite indicator, was reduced from 3.9 to 3.7 percent this year. While it maintained its 2024 expectation as 2.6%, it increased its 2025 expectation from 2.2% to 2.3%.

At one point, we encountered a somewhat mixed picture because continuing high interest rates for a long time could cause serious contraction on the banks’ side.

If the interest rate continues to be this high, liquidity will continue to flow to the dollar, and especially if we know that they will keep the interest rate like this for a long time, everyone with exchange rate risk will turn to the swap market. Frankly, there is an uncertain environment right now. Funds and banks will begin to clarify their positions.

While this is the case, we also saw outflows from risky assets. While Bitcoin reached the level of $ 27,200, it fell to $ 26,500 after the decision and Powell’s speech. For the price to gain new strength, spot BTC ETF applications in October must be accepted. The price will trend downwards unless the $28,200 level is broken.

The most accurate comment to make is that we will see the market’s response to decisions and opinions most clearly in the medium term, and it should not be forgotten that market players always have the last word.