A crypto analyst with a large following in the cryptocurrency market says that an important metric can help to accurately look for market bottoms for Bitcoin (BTC).

“The upcoming BMB for Bitcoin will take place in January 2023”

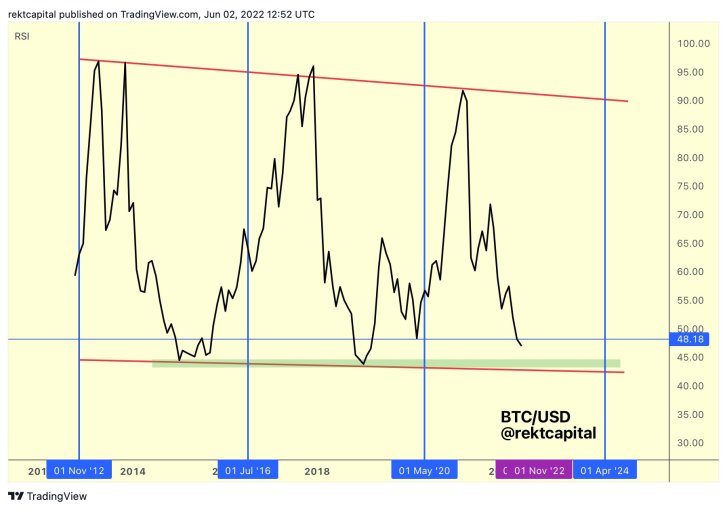

cryptocurrency analyst alias Rekt Capital, leading crypto Bitcoin (BTC) Relative to 311k Twitter followers He says that the Strength Index (RSI) reflects levels reached in January 2015, December 2018 and March 2020, indicating a jump on the horizon for the largest crypto asset by market cap:

Bitcoin (BTC) ), the RSI is approaching the Bearish Lower Zone once again. When can it take place in this cycle? After the 2015 BMB, it took 1,461 days to form the 2018 Bear Market Bottom. If the same symmetry repeats, the upcoming BMB will happen in January 2023.

Source: Rekt Capital / Twitter

Source: Rekt Capital / Twitter An asset’s RSI is a momentum indicator that measures recent prices to determine whether it has been oversold or overbought over a given time frame.

The analyst then offers a scenario where the bottom of the bear market comes two months earlier in November, citing the Bitcoin halving that happens every four years as the reason:

BTC There is a possibility that the RSI Bear Market Bottom will occur a little earlier than January 2023. And this could be due to the Bitcoin halving (next in 2024).

Source: Rekt Capital / Twitter

Source: Rekt Capital / Twitter “Long-term BTC investors will benefit from high ROI”

Cryptocoin. Rekt Capital, whose analysis and forecasts we have included in the com news, presents a “beginning in the past” scenario in which the BMB took place this fall:

BTC hit the bottom about 547 days before the 2nd half in 2015. Bitcoin bottomed about 486 days before the 3rd halving in 2018. If BTC bottoms 487 or 548 days before the 4th halving in April 2024, then that bottom will happen in October or November 2022.

The popular analyst concludes by saying that the RSI data shows that Bitcoin is oversold, that is, those who buy in the bear market that has lasted for months will be rewarded in the next cycle:

BTC’ It is clear that the coin has entered the oversold RSI conditions. Historically, long-term BTC investors piling up in these conditions have enjoyed a high return on investment (ROI) in the months that followed.

At press time, the leading crypto Bitcoin was trading at $29,657, down nearly 2% in the last 24 hours, according to CoinMarketCap data. BTC is about 57% off from its all-time high of $69k, which it saw about 7 months ago.