This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

(CoinDesk)

Top Stories

Changpeng “CZ” Zhao on Thursday denied that he is the owner of CommEX, the mysterious company that has bought Binance’s business in Russia. Binance, of which CZ is the founder and chief executive officer, this week announced it was quitting Russia after reports of a U.S. Department of Justice investigation into sanctions violations. That led to questions around the identity of CommEX – a company with similar user look and feel to Binance, and which appears to just be a few days old. “I am not their UBO [ultimate beneficial owner], nor do I own any shares there,” CZ said of CommEx in a post on X, formerly Twitter, adding that a few former Binance staff from the region have gone to work for CommEX, or may do so in future.

Blockchain activity tied to MakerDAO’s maker (MKR) token is signaling caution to bulls following MKR’s 45% price surge in four weeks. The number of MKR held in wallets controlled by centralized exchanges has increased by 5% to 71,190 MRK ($106 million) in the past 24 hours, taking the total exchange balance to the highest since Sept. 3, according to Coinglass. MakerDAO is one of the largest crypto lending protocols and issuer of the $5 billion stablecoin DAI. MakerDAO’s sDAI represents DAI deposited in the protocol’s DAI Savings Rate (DSR) module. The notable spike in the exchange balance may breed price volatility, mainly to the downside. An increase in the so-called exchange balance is widely taken to represent investors’ intention to sell or liquidate their holdings or deploy coins as a margin in derivatives markets.

The European Commission issued an 800,000 euro ($842,000) contract on Tuesday as it seeks to mitigate what it calls “significant harm” of crypto on the environment. The study, for which bids close on Nov. 10, will develop standards that feed into potential future EU policies to curb the impact of crypto on climate change, and to new energy efficiency labels for blockchains. “There is evidence that crypto-assets can cause significant harm on the climate and environment,” potentially undermining the bloc’s goal to cut greenhouse gas emissions, the European Commission said in tender documents, which suggest that new sustainability standards may be taken up in future laws.

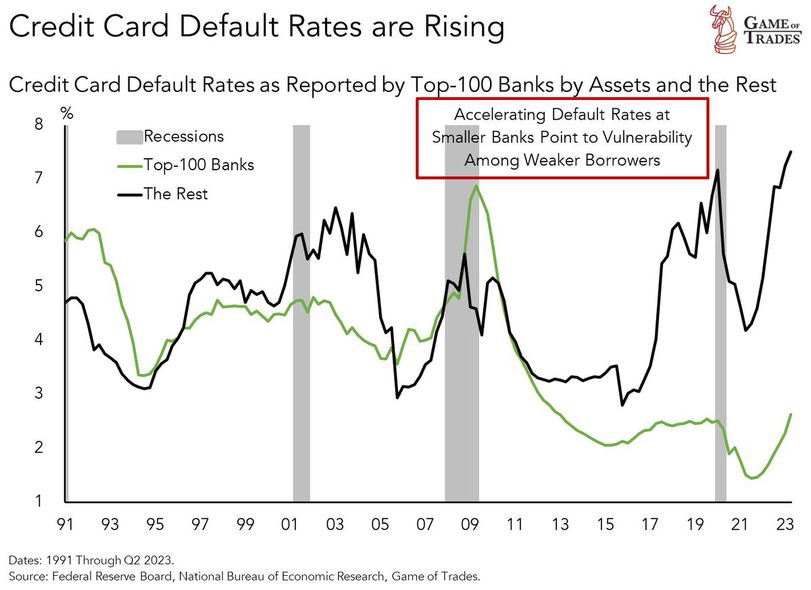

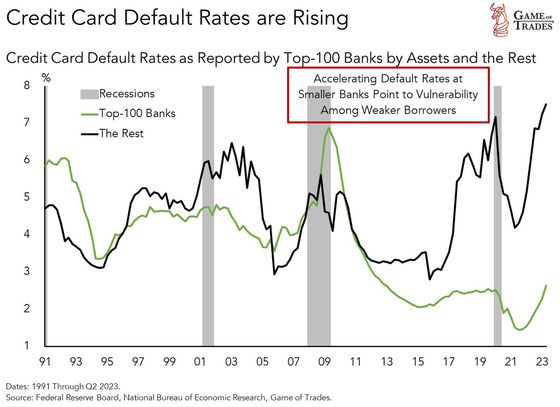

Chart of the Day

(Game of Trades, Federal Reserve Board)

– Omkar Godbole