The gold market remained neutral at around $1,850 an ounce as the uptrend among Wall Street analysts began to cool as the Federal Reserve continued to aggressively raise interest rates for the remainder of the year. Meanwhile, a weekly gold survey also shows that the precious metal continues to rise significantly as individual investors seek assets to protect their wealth and purchasing power amid rising inflation. Here are the details…

Which developments were important for the gold price this week?

Gold prices end the week above $1,850 per ounce, a critical psychological level, but are struggling to find steady upward momentum. The precious metal managed to keep its head above the waterline after stronger-than-expected employment data. As we reported on Cryptokoin.com , on Friday, the US Bureau of Labor Statistics said 390,000 jobs were added in May, beating economists’ expectations of about 325,000.

Blue Line Futures Chief Market Strategist Phillip Streible said that the technical outlook for gold remains constructive; however, he pointed out that the basic point of view was blurred. He added that economic data supports more aggressive monetary policy actions and used the following statements:

FED will continue to be firmly hawked and we may see more than two 50bp moves. However, inflation remains a problem and is still very high. Market volatility is also increasing. For now, gold is in the middle.

Saxo Bank strategist: I’m neutral this week

Saxo Bank’s head of commodities strategy, Ole Hansen, said any drop in precious metal prices can be seen as a long-term buying opportunity, however, he said he was neutral on gold next week as prices remained below $1,870 an ounce, using the following statements:

With stronger-than-expected US jobs report, the Fed’s 50 basis points in the next few meetings nothing has happened to change the view that it will increase rates in points increments. Before the announcement, gold took a quick glance at the key resistance near $1,870. This was the minimum level to be penetrated to force a change in mood among lower gold seekers as yields increased.

According to the gold survey, what are the expectations of 15 analysts?

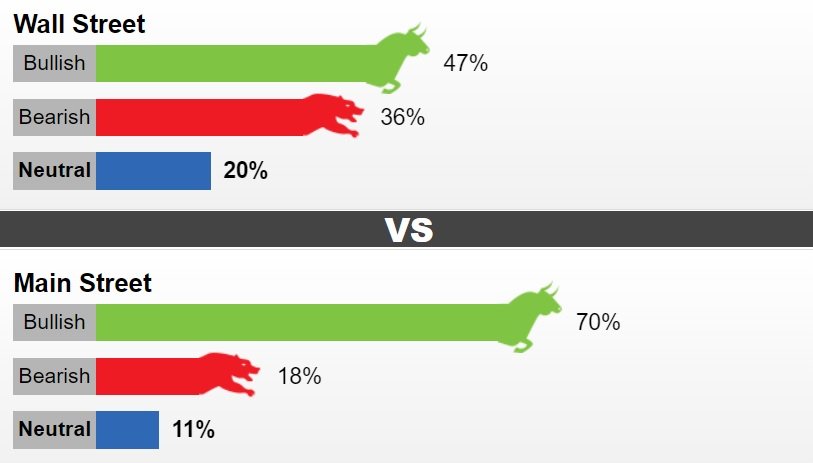

This week, 15 Wall Street analysts took part in Kitco’s gold survey. Among the participants, seven analysts, or 47 percent, called for gold prices to rise next week. At the same time, five analysts, or 36 percent of respondents, were bearish for gold in the short term. Finally, three analysts, 20 percent of respondents, were neutral on prices.

Meanwhile, 637 votes were cast in online Main Street polls of individual investors. Of these, 448, or 70 percent, think that gold will rise next week. While 117 people, or 18 percent of voters, said they expected lower levels, 72 people, or 11 percent, remained neutral in the near term.

USD remains a critical factor

The gold market is stuck in the middle between rising inflation and the FED’s hawkish stance. However, Adrian Day, head of Asset Management, said that gold continues to trend upwards. “Today’s US jobs report will only give the Federal Reserve reason to continue tightening, but the economy is not strong enough to sustain meaningful tightening without causing economic damage. We have a period of stagflation ahead and this is positive for gold,” he said.

While some analysts remain long-term gold bulls, they noted that the US dollar remains a critical factor, especially as the Fed raises interest rates. SIA Wealth Management Chief Market Strategist Colin Cieszynski said:

As nonfarm payrolls beat expectations, there seems to be no reason for the Fed to slow tightening. According to this news, US Treasury yields have started to rise again, supporting the USD against other currencies, including gold.