The gold price is replicating Thursday’s move. Accordingly, it is attempting a moderate bounce above $1,820 on Friday. Markets are waiting for critical Non-Farm Employment (NFP) data from the USA later in the day. Amidst this wait, the market remains cautiously optimistic.

All eyes on US Nonfarm Payrolls data

The US Dollar corrected downwards for two days in a row from its 11-month high. It then entered a consolidation phase. In this environment, the gold price rises to fresh air for a short time. It is possible to attribute the subdued tone around the US Dollar to the slightly optimistic mood in the Friday Asian session. In the meantime, it is necessary to keep in mind the mixed developments in the Chinese real estate market. The decline in oil prices and the pause in the rise in US Treasury bond yields provide some relief to investors. However, investors are staying away from betting on gold ahead of US labor market data.

Economists expect the US economy to add 170 thousand jobs in September, slowing compared to the previous month. cryptokoin.com As you follow from , the US economy recorded an increase of 180 thousand jobs in August. Meanwhile, expectations are for the Unemployment Rate to fall from 3.8% to 3.7% in September. Additionally, markets expect Average Hourly Earnings to increase 4.3% year-on-year during the reporting period. This is in line with previous levels.

Gold price is looking for a breather

US private sector employment growth on the ADP side came to 89 thousand in September. This was well below expectations. Following this, downside risks remain on the headline NFP figure, which could further negatively impact the US Federal Reserve’s (Fed) interest rate hike expectations in November in the face of loosening labor market conditions.

If the US NFP report is negative, it is possible that the correction movement in the US Dollar will strengthen further along with US Treasury bond yields. This is likely to support recovery attempts in the gold price towards $1,850 and beyond. Conversely, if US labor market data, including wage inflation, indicate that the Fed may raise interest rates again by the end of the year, the US Dollar could continue its uptrend against the price of non-interest-bearing gold.

Gold price technical analysis

Market analyst Dhwani Mehta explains what he sees in the technical picture of gold as follows. Technically, the next directional move in gold price depends on the US NFP result. The daily technical setup looks mixed for the near term, as a ‘Bearish Cross’ confirmation negates any scope for a recovery in oversold Relative Strength Index (RSI) conditions. The 100 Day Moving Average (DMA) crossed above the 200 DMA on a daily closing basis on Wednesday. This confirmed the downward trend.

Gold price daily chart

Gold price daily chartOn the upside, if the recovery continues, gold buyers will turn to resistance, which turns into support at $1,850 if the strong resistance around $1,830 is broken. Further up, it is possible that the gold price could challenge bearish commitments at $1,880. This level is the highest point gold reached on September 28 and 29. Alternatively, gold needs to gain acceptance below the important support at $1,810. This level is the lowest level of March 8. It will be a difficult level for gold sellers to overcome the $1,800 threshold. This will open ground towards the psychological level of $1,750.

Consolidative atmosphere will continue for the gold price

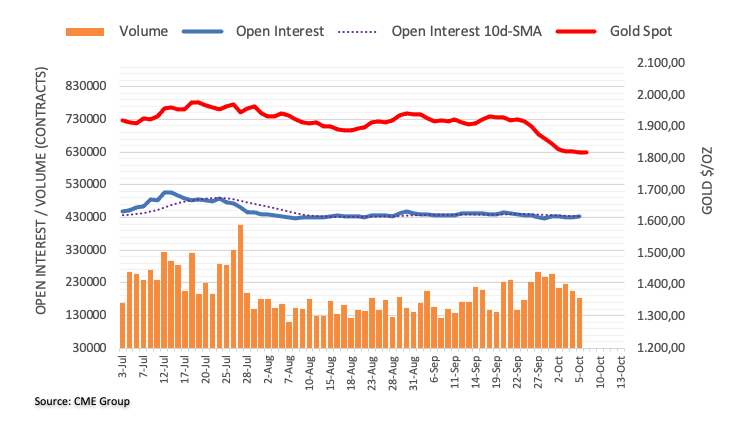

The number of open interest in gold futures markets increased by nearly 1.2 thousand contracts for the second consecutive session on Thursday, according to preliminary data from CME Group. Volume decreased by approximately 21 thousand contracts for the second session in a row.

Gold price Thursday extended its multi-session decline on increased open interest and further decline in volume. However, according to market analyst Pablo Piovano, he predicts that gold will maintain its current consolidative mood around $1820 for now.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!