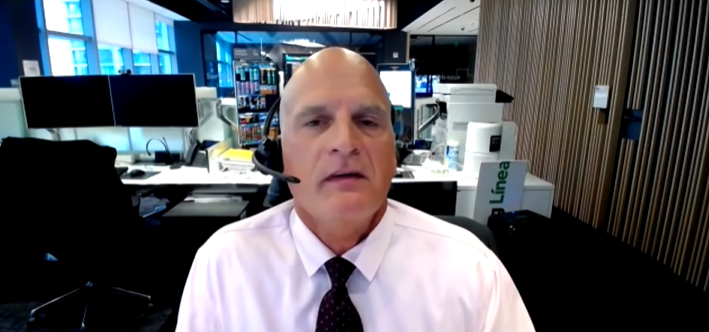

Senior Bloomberg commodities analyst Mike McGlone has predicted a much stronger bullish future for gold, US bonds and Bitcoin (BTC). Known for his accurate predictions, the analyst predicts that these beings will rise from the ashes much stronger than before.

Mike McGlone sees a big trend change in gold, bonds and Bitcoin

You can take a look at Mike McGlone’s accurate predictions in this article. In his current analysis, McGlone said in a recent interview that he expects a “big reversal” or deep correction in risky assets like real estate and the stock market. The analyst, who gave a wide explanation on the subject, thinks that Bitcoin will eventually become one of the best investment tools:

I believe the big return will happen. This is just the beginning. It may resemble post-1929, but I believe it will resemble 2008 [or] the aftermath of the 1987 disaster. It is too late and valid. To all risk assets, from Miami apartments to the stock market. It’s just getting started, and the most significant inflation in 40 years and most people’s lives is about to begin. After getting through this period, I believe Bitcoin will be recognized as one of the best investments to have in the world. This is my starting point…

The analyst, who predicts that some assets will return stronger than before, explains the reasons for this prediction as follows:

Gold, US long bonds and Bitcoin will be some of the best things to buy in my opinion. I believe we are back in deflation, and the best method of achieving deflation is to hit a big spike in prices followed by a flush. This is exactly what we do. We are just starting to wash.”

Mike McGlone says that with the rise, BTC and ETH will expand further

Expert, with the rise of crypto money markets, Ethereum ( ETH) believes it has earned a place at the table along with Bitcoin. According to McGlone, major crypto industries such as stablecoins and NFT will continue to evolve depending on the operation of the Ethereum network. In the words of Mike McGlone:

Ethereum is changing the face of fintech and tokenization. As for what is blocking tokenization, I think most NFTs are built on Ethereum tokens. Yes, there are some competitors, but this just goes to show you what’s going on in the industry. This will not go away.

Indicators show that current bearish trend may not be as brutal as past bear markets

Continued correction period, crypto market over 60% saw it fell too much, from $3.07 trillion at the time of writing to $1.23 trillion. As Kriptokoin.com analyzes, Bitcoin and Ethereum have lost nearly 60% since their highs.

Certain on-chain indicators, however, suggest that the current downtrend of the crypto market may not be as brutal as past bear markets. Lucas Outumuro, head of research at analytics firm IntoTheBlock, put forward this perspective in a June 4 blog post. Also, key indicators pointed out that from a long-term perspective, this time might be different from other bear markets.