Gold prices showed their strongest performance this week since the beginning of spring. precious metal bothIt found support from open position closing and a strong safe-haven bid at both the beginning and end of the week.

Bulls gain the upper hand in gold price survey

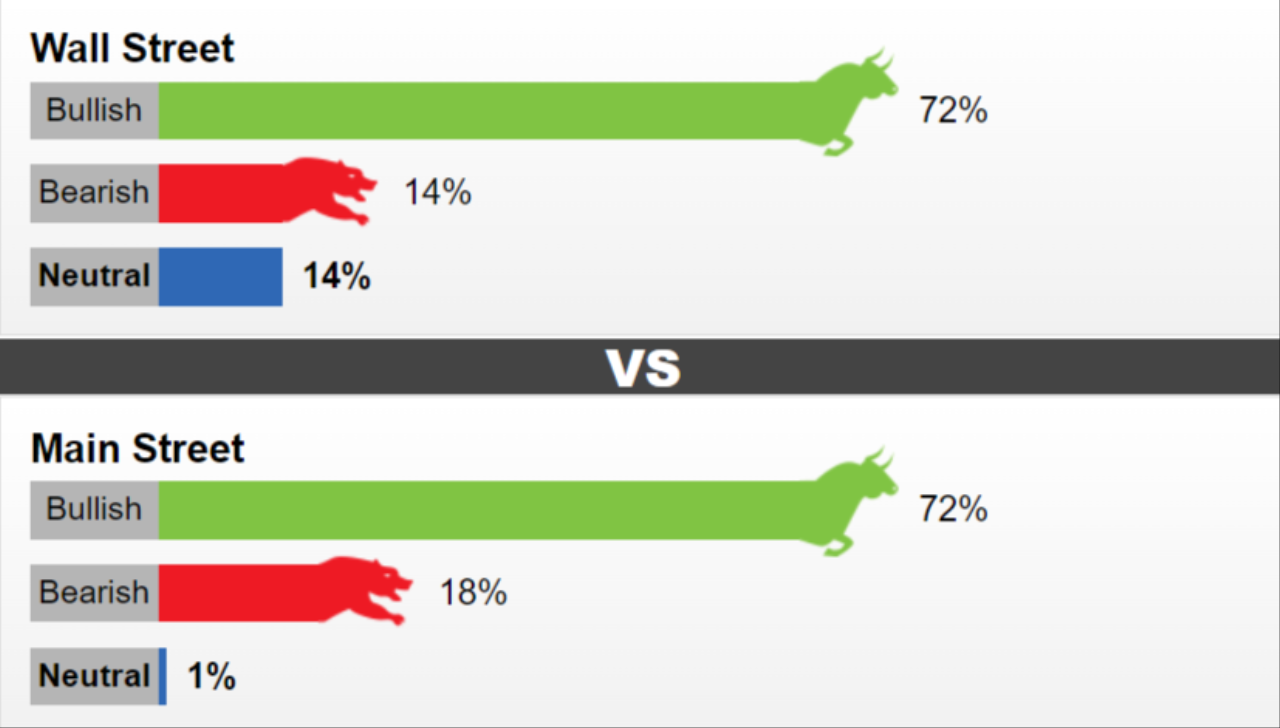

cryptokoin.com As you followed from , gold made a great debut on Friday. This situation seems to have encouraged analysts and market players. Market analysts and retail investors are almost equally bullish on the yellow metal’s prospects for the week ending October 20, according to the latest Kitco Weekly Gold Survey. 14 Wall Street analysts voted in this week’s Gold Survey. 10 experts (72%) expect an increase in gold prices next week. 2 analysts (14%) predict a decrease in prices. The other two also remained neutral on gold for the coming week.

Meanwhile, participants cast 595 votes in online surveys. Of these, 431 (72%) predict that gold will rise next week. Another 106 people (18%) expect the price to fall. Only 58 respondents (less than 1%) remained neutral on the precious metal’s near-term prospects.

John Weyer: It’ll be higher next week!

John Weyer, Director of Commercial Hedging at Walsh Trading, says Friday’s big price increase is typical when the market is open with full participation and all eyes are on gold. In this context, the analyst makes the following statement:

I wonder if all the players decided to come in and take long positions today. I think ahead of the weekend, with all the events in Gaza and Israel, it’s a bit of a risk-off safe haven play. If there is no new climb over the weekend, we can give some of it back on Monday. I expect there to be some back and forth. However, it will be higher next week.

Colin Cieszynski: Possible to attract attention as a shelter

Colin Cieszynski, chief market strategist at SIA Wealth Management, expects a rise in gold prices for the coming week. He says US treasury yields and the US Dollar appear to have stalled for now. He also predicts this will continue with the focus on corporate earnings. Based on this, the analyst makes the following comment:

Meanwhile, as the war drums beat louder, precious metals may continue to attract renewed interest in the safe-haven role as a haven.

James Stanley: Gold prices will get stronger

James Stanley, senior market strategist at Forex.com, thinks the precious metal will strengthen further next week. Stanley expresses his views on this issue as follows:

Gold has performed tremendously this week despite the USD regaining strength. The reaction to the oversold backdrop I mentioned a few weeks ago has been intense. At this point, I see no evidence that this is over.

Everett Millman expects ranged trading in gold

Everett Millman, Chief Market Analyst at Gainesville Coins, says a number of factors contributed to gold’s stunning performance this week. Part of that is due to earlier this week, when the CPI came in slightly higher than expected and the University of Michigan Consumer Sentiment Survey came in slightly below expectations, according to Millman. The analyst notes that for next week, gold will follow the range in which it was trading towards the end of last month. In this regard, Millman draws attention to the following levels:

At the end of September, gold prices were holding above $1,900. However, it failed to break above the $1,950 resistance. I think this trading band is what I’m really going to target. I expect gold to consolidate these gains and trade between $1,900 and perhaps slightly above that, up to $1,950.

Marc Chandler expects these levels for gold prices

Bannockburn Global Forex Managing Director Marc Chandler says the yellow metal has had its best week since banking tensions flared in March. He also notes that the timing of this week’s move is interesting. Chandler underlines that the biggest part of the rally came not on Monday, when markets responded to Hamas’ attack on Israel and the prospect of a possible response, but before the weekend, spurred by the decline in the dollar and US interest rates. In this regard, the analyst is looking at the following levels:

I like that gold held above $1,800 earlier this month and that the gap that opened on October 9th is still a bullish sign. The next target is around $1.929-30. Moreover, this will be followed by $1,950. I suspect a string of weak US data in the coming days could pull rates and the dollar lower and help gold rise.

Michael Moor: Additional short selling could bring these levels

Michael Moor, creator of Moor Analytics, says he is warning investors about additional short selling on Friday. In this context, the analyst points out the following levels for gold price expectations:

A good trade above the $1929.7-$31.3 level will alert for continued strength. A good trade above $1,944.1 will alert for strength for the days/weeks ($127 minimum). If we get reasonably over here and reasonably low again, look for reasonable pressure.

Anxious on the rise under Darin Newsom

Barchart.com Senior Market Analyst Darin Newsom says last week the long-term downtrend continues. The analyst notes that he is “concernedly bullish for gold” next week.

Adrian Day: Gold prices will remain flat next week because…

Adrian Day Asset Management President Adrian Day thinks that gold prices will remain flat next week after the big rise this week. Day explains his prediction on this issue as follows:

Geopolitical rallies in gold do not tend to last long. For gold prices next week, much depends on developments in the Middle East. Tensions will likely remain high and so will gold. Over the longer term, monetary factors are more important to the gold price. These perhaps point to weakness in the near term, but extremely bullish early in the year as the economy slows, inflation remains stubborn, and the Fed is unable to tighten further.

Mark Leibovit and Jim Wyckoff are also on the rise

Mark Leibovit, publisher of VR Metals/Resource Letter, continues his rise in gold as usual. “The cycle will continue until the end of the year,” says the analyst.

Kitco Senior Analyst Jim Wyckoff was also bullish on the precious metal. “It will be higher with safe haven demand,” he says.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!