FTXComing to the fore with the developments regarding the reopening of FTX token( FTT) started to pay the price of the sharp rise.

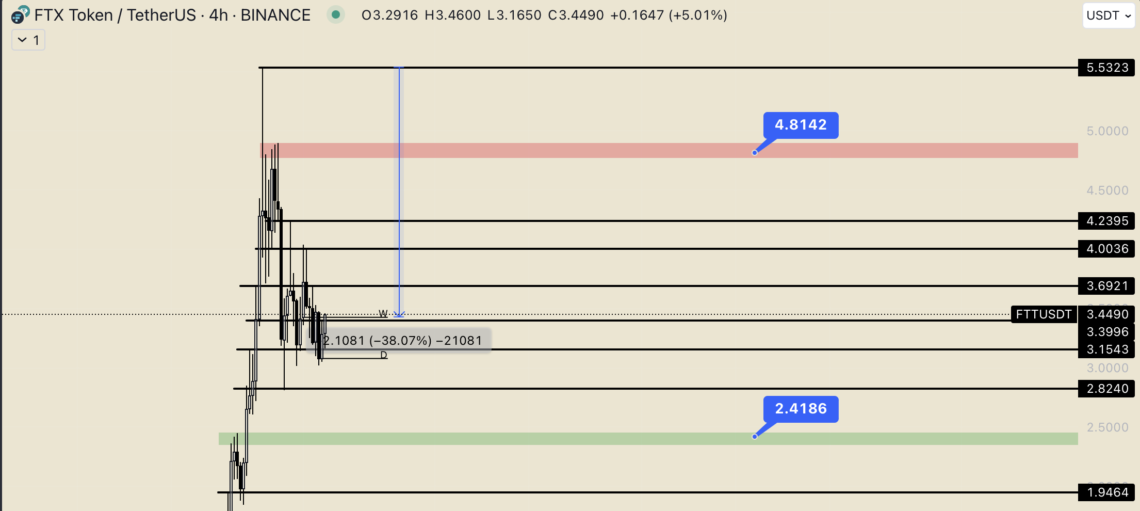

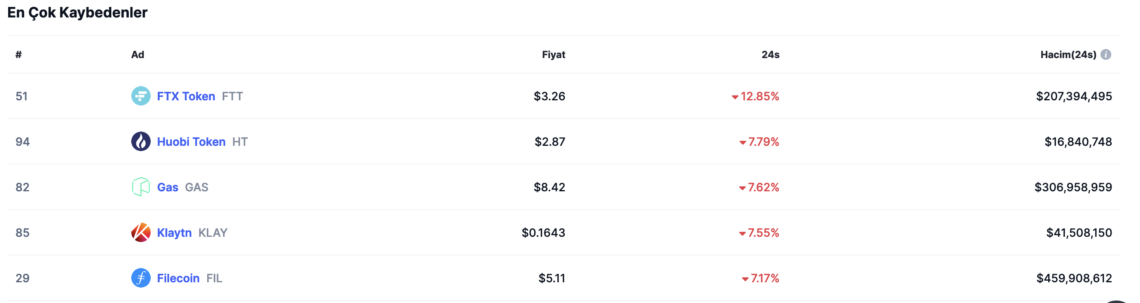

FTXIt exploded with the news about the launch of 2.0 and rose by 360 percent in the last month. FTT started to see selling pressure. The stock exchange token, which started to decline after hitting $5,528, reached $3,429 in a short time, losing a total of 38.07 percent in value. Additionally, FTT lost 12.85 percent in value in the last 24 hours. Most A lot losers” ranked first on the list.

So, can the decline continue on the FTT side? Which levels are critical to monitor?

If buyers do not step in, there will be a big problem!

Although FTT, which recorded a decline of more than 38 percent in just three days, made a move to the weekly opening price, the dangers are not over. The stock exchange token, which currently finds buyers at $ 3.4490, will want to test the lower levels as long as it cannot exceed $ 3.6921. The support levels that can be followed in such a situation are 3.3996 – 3.1543 – 2.8240 – 2.4186 and 1.9464 dollars, respectively.

Events such as the successful launch of FTX 2.0 or BTC rising to $40,000 will naturally push FTT up. In such a scenario, the levels that can be followed as sales zones are 4.0036 – 4.2395 – 4.8142 and 5.5323 dollars, respectively. In particular, settling above $4.8142 would signal a bull run.