Altcoin Yearn.finance (YFI), a leading player in the decentralized finance (DeFi) ecosystem, unexpectedly experienced a staggering 45% drop in price in just a few hours on November 18. The crypto community is closely monitoring this significant decline and speculating on potential reasons behind the massive sell-off. Here are the details…

There was a sharp decline in the altcoin project

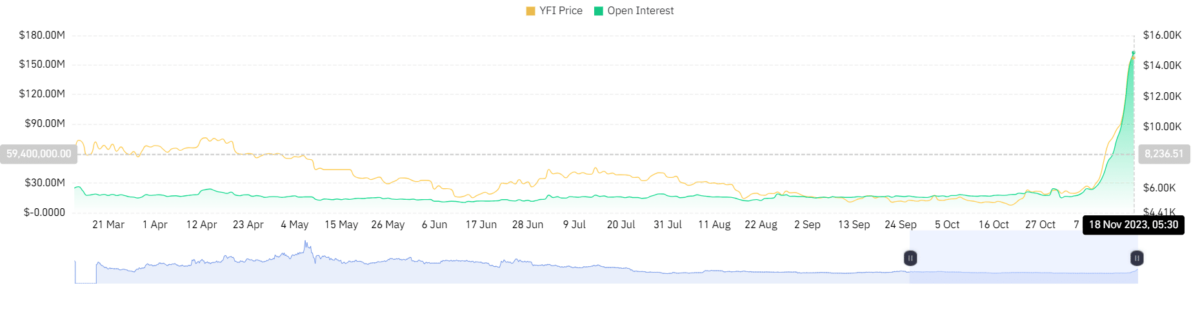

YFI, which witnessed an impressive rise of over 160% in November and reached $15,591, faced a sudden reversal as its price dropped from $15,591 to $8,421. This sudden move resulted in a loss of over $250 million in market value, falling from $525 million to $275 million. Although market capitalization showed signs of recovery, investor confidence was shaken by the rapid and significant decline.

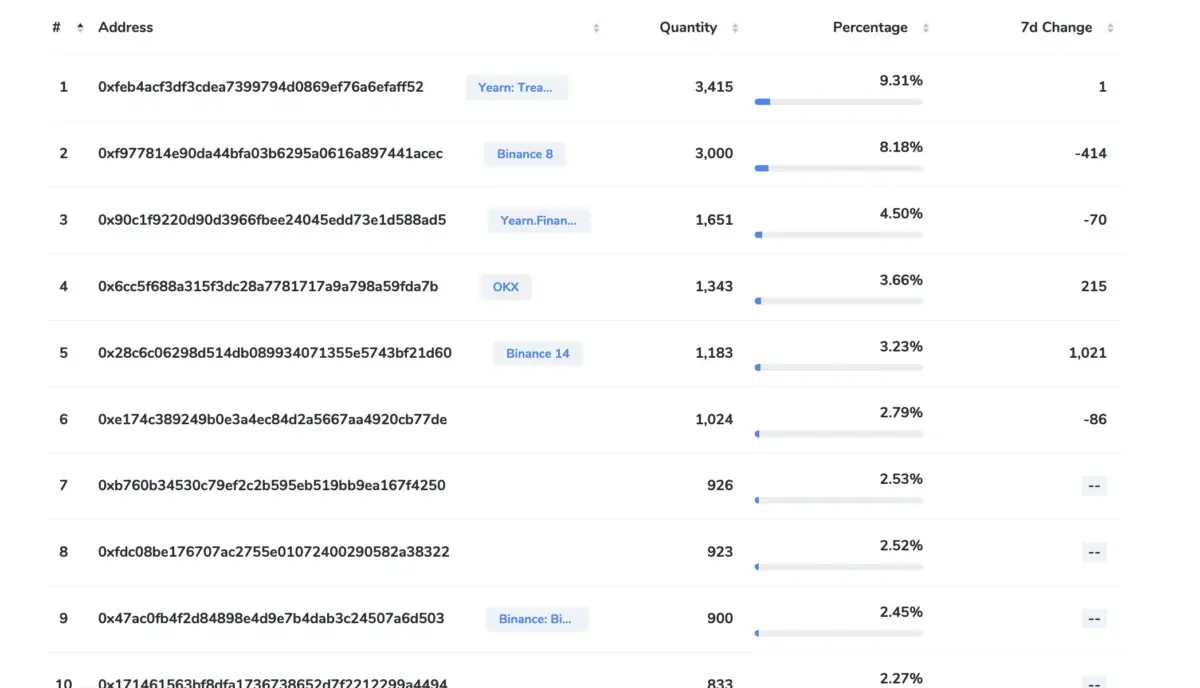

The cryptocurrency market is no stranger to volatility, but YFI’s sudden decline has raised concerns among market participants. Some speculators attribute the sell-off to a potential exit scam orchestrated by insiders. Notably, almost half of the entire YFI supply is concentrated in just 10 wallets, including those associated with various crypto exchanges.

There is a loaded liquidation

Coinglass data reveals that YFI witnessed liquidations exceeding $5 million in the last 24 hours. YFI contract positions, which previously reached up to $162 million, have decreased significantly. In parallel, YFI open positions (OI) increased, indicating an increase in short positions taken by traders on YFI. Current market conditions have also impacted major altcoins, which continue to face downward pressure amid a broader sell-off. On the other hand, Bitcoin is slowly regaining its dominance. The overall market cap has fallen significantly by almost $25 billion in the last two days.

Leading altcoins such as ETH, XRP, SOL, ADA and others witnessed a decline of around 3% in the last 24 hours. DeFi tokens, in particular, are bearing the brunt of the market correction, contributing to a further decline in global market value. Analysts expect additional pullbacks in the market before witnessing capital inflows again into altcoins. The situation surrounding Yearn.finance will undoubtedly be closely monitored in the coming days as the crypto community tries to understand the factors that caused this sudden and significant price drop.

What is YFI?

Yearn Finance is a suite of products in the DeFi space that provides loan aggregation, yield generation and insurance on the Ethereum Blockchain. The protocol is maintained by various independent developers and managed by YFI owners. It started as a passion project by Andre Cronje to automate the process of shifting capital between lending platforms in search of the best yield on offer, as the yield on lending is a variable rate rather than a fixed rate. Funds are automatically shifted between dYdX, AAVE and Compound as interest rates change between these protocols.