Cryptocurrency giant Binance is navigating dangerous waters as it grapples with a regulatory maelstrom. With the resignation of Changpeng Zhao and the announcement of the new CEO, fund outflows in the stock market became more frequent. Here are the latest data and events…

Outflows on the Binance exchange intensified

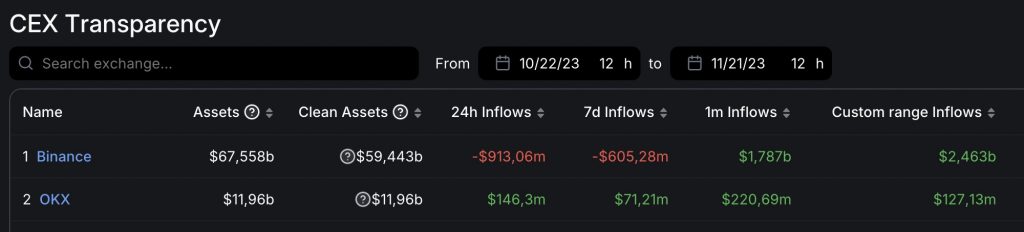

Latest data from DeFiLlama reveals a significant net outflow from Binance of approximately $913.06 million in the last 24 hours, in stark contrast to OKX’s net inflow of $146.3 million. Despite this outflow, Binance maintains its dominant position with assets exceeding $67.558 billion.

This development took place when former Binance CEO Changpeng Zhao accepted the statements of the US Department of Justice (DOJ). As Kriptokoin.com reported, the DOJ claimed that Binance violated the US Bank Secrecy Act. He also pleaded guilty to serving American customers without the required money transmitter licenses. The exchange publicly announced Binance’s acceptance of this.

What are the details of the agreement?

The repercussions have been enormous, with Binance settling for a staggering $4.3 billion and CEO Changpeng Zhao (CZ) facing a hefty $50 million fine and severe restrictions on his involvement in any cryptocurrency entity in the future. CZ was granted bail by the US court for a staggering $175 million. This legal development underlines the seriousness of the situation.

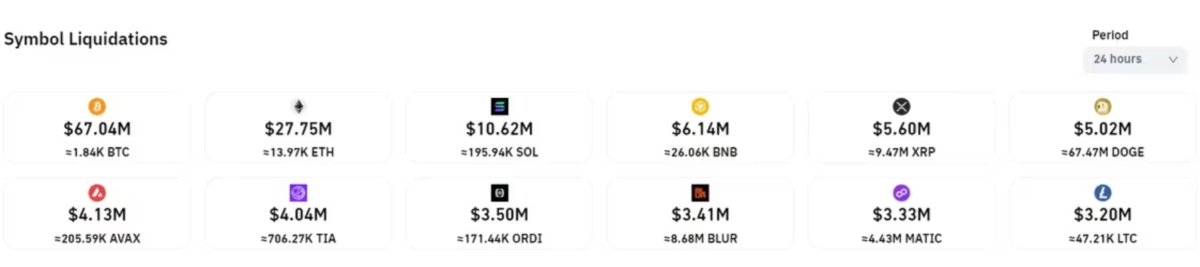

The impact of Binance’s agreement with the US Securities and Exchange Commission (SEC) resonated in the market. It particularly affects futures traders. CoinGlass data reveals that $227 million worth of crypto perpetual futures positions were liquidated in the last 24 hours, with bullish long positions accounting for nearly 80% of the total. This event is among the highest liquidation events in 2023.

There was a big liquidation in BNB

Traders on Binance faced the brunt of the liquidations, with losses of up to $100 million among counterparties, while OKX lost $62 million. Bitcoin, Ethereum, Solana and BNB, the token of the BNB ecosystem, have witnessed significant liquidations, indicating potential changes in market dynamics. Once hailed as a pioneer in the crypto world, Binance now stands at a crossroads. The plea agreement and massive settlement represent the exchange’s attempt to overcome regulatory challenges, albeit at significant cost.

Large liquidations can mark a local top or bottom of a steep price movement. This may allow investors to position themselves accordingly. Such data is useful to traders as it serves as a signal that leverage has been effectively cleared from popular futures products. Because it acts as a short-term indicator of a decrease in price volatility. The latest developments in the Binance ecosystem cryptokoin.comYou can find it in this article we prepared.