Market analyst Ross J Burland states that the gold price is under pressure on a spot basis, but a daily resistance break is possible this week. Meanwhile, lower time frame price imbalances could be eased to start the week.

“Money managers are aggressively liquidating their long positions”

Spot gold was trading at $1,853, up 0.12% at the time of writing, according to TradingView data. Gold futures, on the other hand, were priced at $1,854, up 0.24% at the latest. Before delving into spot gold price techniques, TD Securities analysts announced that money managers are aggressively liquidating their long gold positions as a hawkish Fed continues to reduce interest in the yellow metal, as you follow Kriptokoin.com news. Analysts make the following assessment:

After all, position squeezes continue to drive price action in the yellow metal as the world chases the same hawkish Fed narrative.

However, analysts point out that proprietary traders are the group that has increased their risk of additional liquidation, after creating a large and indifferent position since the pandemic. Analysts remind that the group’s long position holders have not yet surrendered, while the war bears in Ukraine are sending them to the goods stores for packaging. Finally, analysts underline the following:

This week, prop traders liquidated their positions only marginally, while traders’ position remained unchanged for a long time. This indicates that a liquidation event is still approaching.

“Gold bulls wait for critical daily resistance to break”

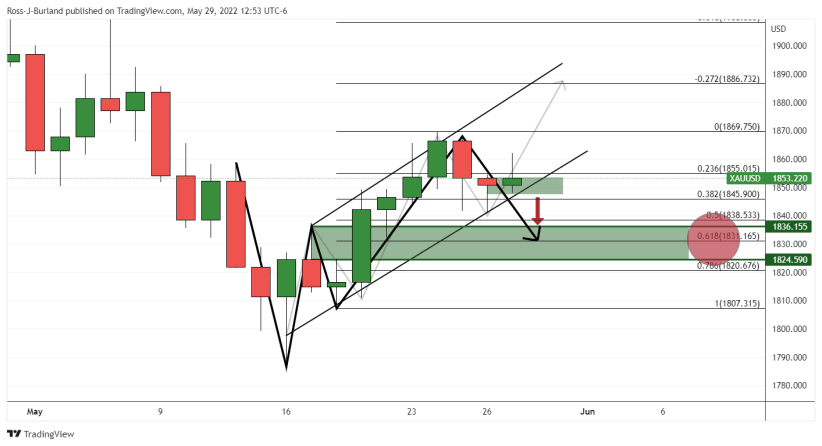

For the technical outlook, last week’s previous opening, according to market analyst Ross J Burland According to the pre-analysis gold bulls need to hold $1,850 or else the bears will have the next 61.8% gold ratio on their menu.

In addition, the analyst notes that the W formation neckline, which is close to the 61.8% golden ratio of the daily chart, has not yet been fully tested.

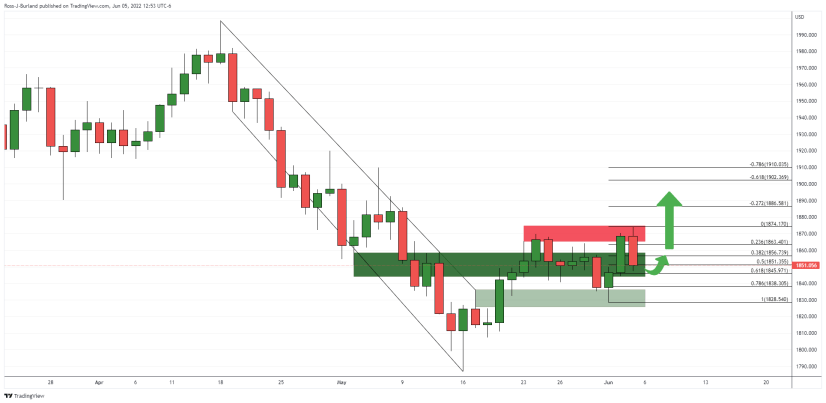

Daily chart, live market

Daily chart, live market According to the analyst, price has moved into the zone and has completed a retest of the neckline, as the chart shows. The analyst states that this situation presents a higher movement expectation after the exit from the downward channel. But it also reminds you that the resistor will need to allow it.

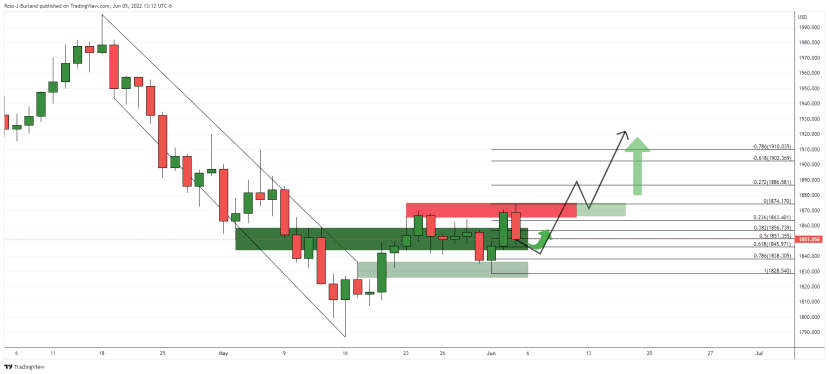

Daily chart, live market

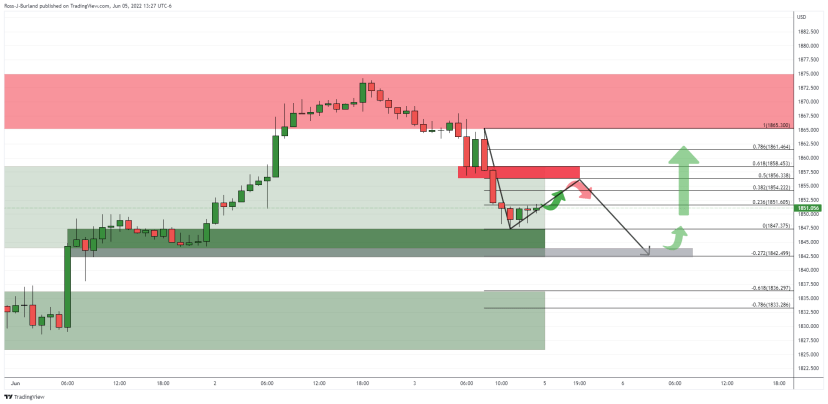

Daily chart, live market For the open, the hourly chart may see some initial bids coming in to dampen some of the latest bearish impulses. The analyst notes that the 50% average reversal area aligns with previous support as a target, however, if resistance holds, it could be a downside move to fully test the demand area at the 1.840s.

Gold, H1 chart

Gold, H1 chart