According to the latest Digital Asset Fund Weekly Flow Report published on CoinShares Blog, crypto asset investments continue to rise with inflows of $1.76 billion in the last 10 weeks. This increase marks the highest level since the launch of the futures-based ETF in the US in October 2021. Here are the coins such as Solana (SOL) and XRP that corporate money invested the most in the past week…

There were fund inflows in many cryptocurrencies

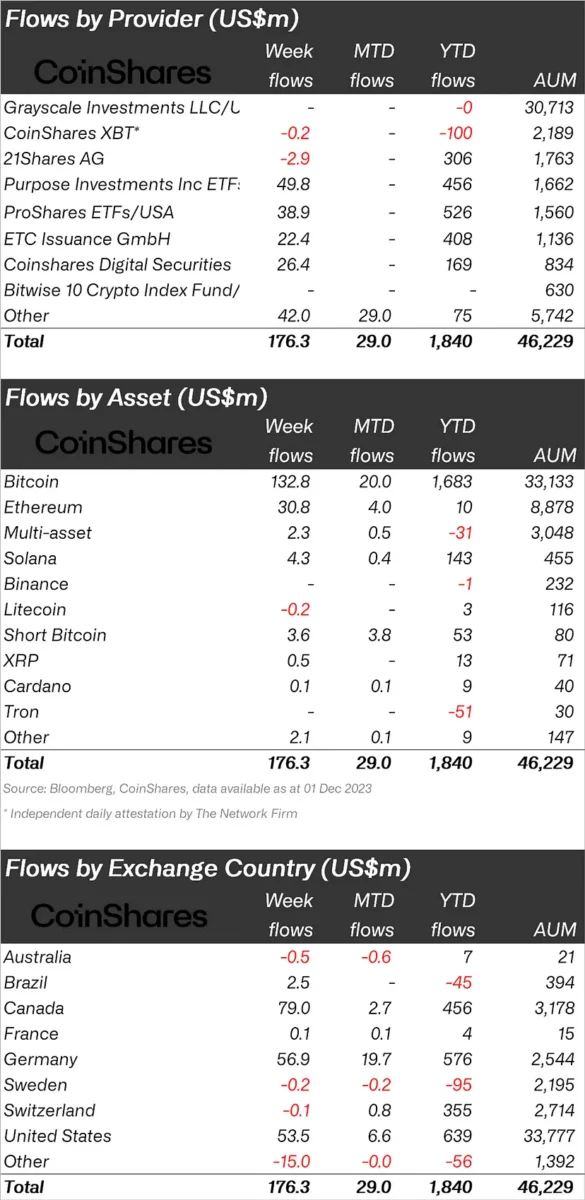

Last week alone, crypto asset inflows totaled $176 million, adding to a 10-week uninterrupted streak of inflows. These investments currently account for 4% of assets under management (AuM) and represent a significant 107% increase in total AuM for the year. However, despite this impressive growth, current AuM of $46.2 billion remains below the all-time high of $86.6 billion seen in 2021.

The increase in crypto asset investments was especially evident in Canada, Germany and the USA, with inflows of $79 million, $57 million and $54 million, respectively. Meanwhile, Hong Kong experienced smaller outflows totaling $15 million, contributing to year-to-date net outflows in the Asia region. Despite relatively low AuM and ETP figures in Asia, it stands out as one of the few regions experiencing net outflows in 2023.

Interesting data for Bitcoin, Ethereum and SOL

Bitcoin emerged as the primary beneficiary of the recent surge, with inflows of $133 million. Interestingly, short Bitcoin, which had a three-week outflow, reversed last week with a total inflow of $3.6 million. Ethereum also experienced a notable rise with an inflow of $31 million, bringing its five-week total to $134 million. For the first time this year, net flows for Ethereum turned positive at $10 million, signaling a positive shift in sentiment after a long period of negativity. Solana saw a fund inflow of $4.3 million, XRP $500 thousand, Cardano $100 thousand. Meanwhile, $200 thousand left Litecoin.

Blockchain stocks have been positive for seven weeks

Blockchain stocks continued their winning streak, recording seven consecutive weekly inflows. Last week’s inflow of $17.4 million was the largest inflow since July 2022 and underlined the continued interest of investors in this sector. In conclusion, the resilience of the digital asset market and continued investment inflows suggest that there is a strong investor appetite for cryptocurrencies and related assets. The diverse geographical distribution of these investments, combined with positive trends in leading digital assets such as Bitcoin and Ethereum, paints a promising picture for the cryptocurrency market to continue growing in the coming weeks.