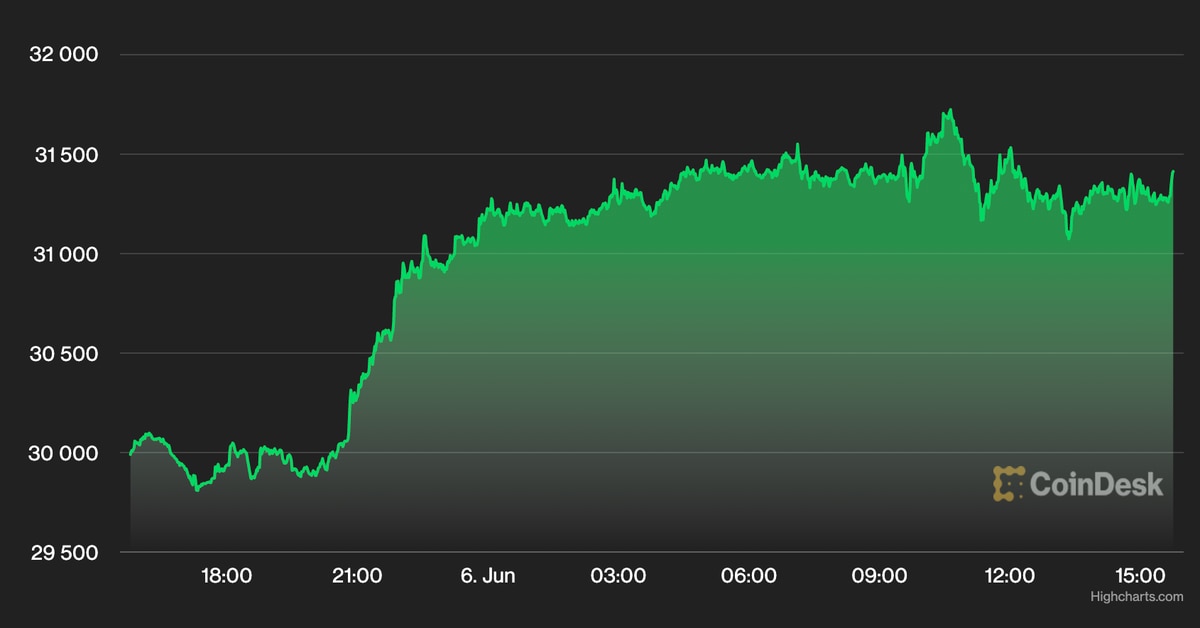

Bitcoin (BTC) was up by 4% over the past 24 hours as volatility continued to fade. The cryptocurrency has traded in a tight price range over the past month, but so far has avoided a significant dip below $30,000 since May 12.

The bitcoin dominance ratio, which compares BTC’s market cap relative to the total crypto market cap, ticked higher on Monday. That suggests a lower appetite for risk among crypto traders despite short-term price bounces.

For now, bearish sentiment among crypto traders is starting to wane. The bitcoin Fear & Greed Index has stabilized over the past month, similar to what occurred in late January, which preceded a brief rise in crypto prices.

Alternative cryptos (altcoins) were mixed on Monday. For example, Helium’s HNT token rallied by as much as 13% over the past 24 hours, compared with a 5% rise in Solana’s SOL token. Meanwhile, The Graph’s GRT token declined by 2% on Monday.

Latest prices

●Bitcoin (BTC): $31,386, +4.38%

●Ether (ETH): $1,859, +2.00%

●S&P 500 daily close: 4,121, +0.31%

●Gold: $1,844 per troy ounce, −0.08%

●Ten-year Treasury yield daily close: 3.04%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Uptick in short liquidations

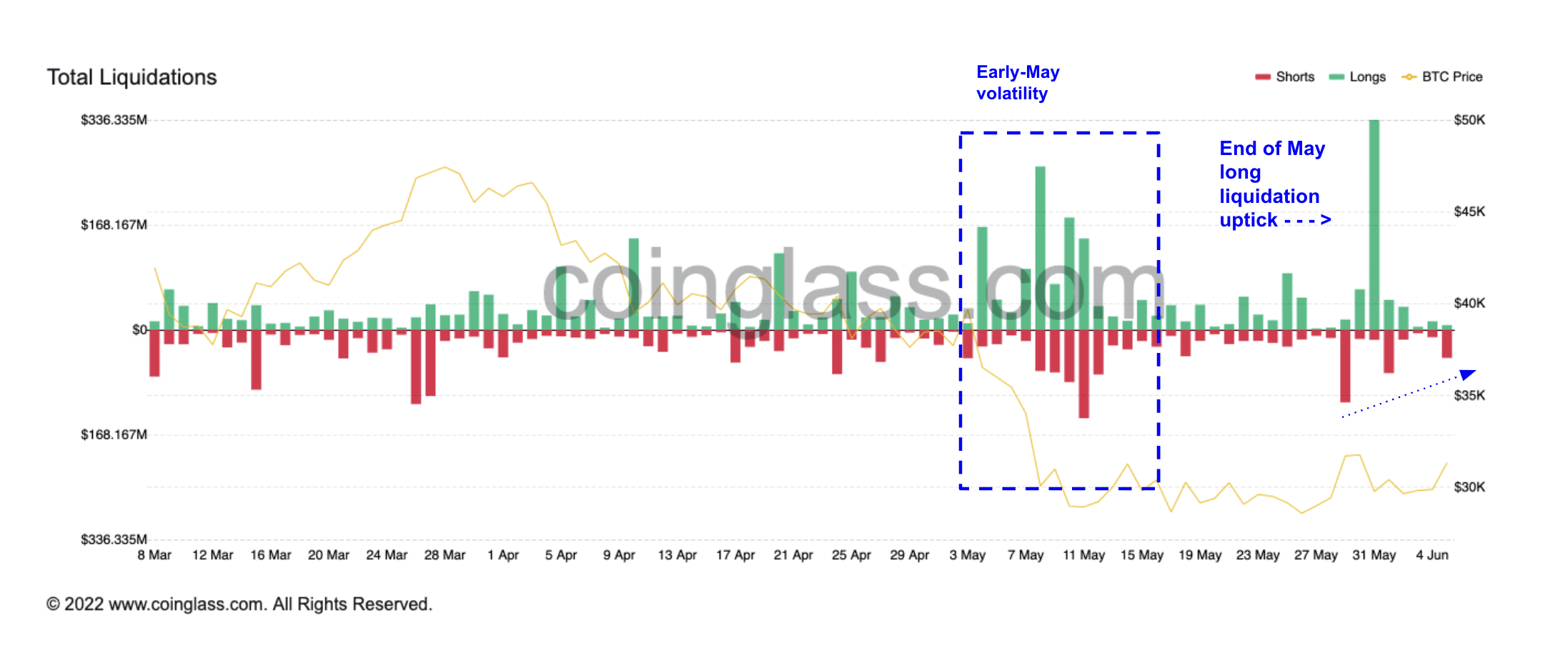

Bitcoin’s current price jump is similar to what occurred last weekend. This time, however, the rise in short liquidations is less extreme.

The chart below shows a lower amount of short liquidations over the past two weeks. That suggests a majority of sellers have not capitulated, which typically occurs at an extreme price low. Instead, long liquidations have been more severe, reflecting an unwind of bullish positions on each successive price drop over the past few weeks.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position as a safety mechanism due to a partial or total loss of the trader’s initial margin. That happens primarily in futures trading.

Bitcoin total liquidations (CoinDesk, Coinglass)

Volatility fades, for now

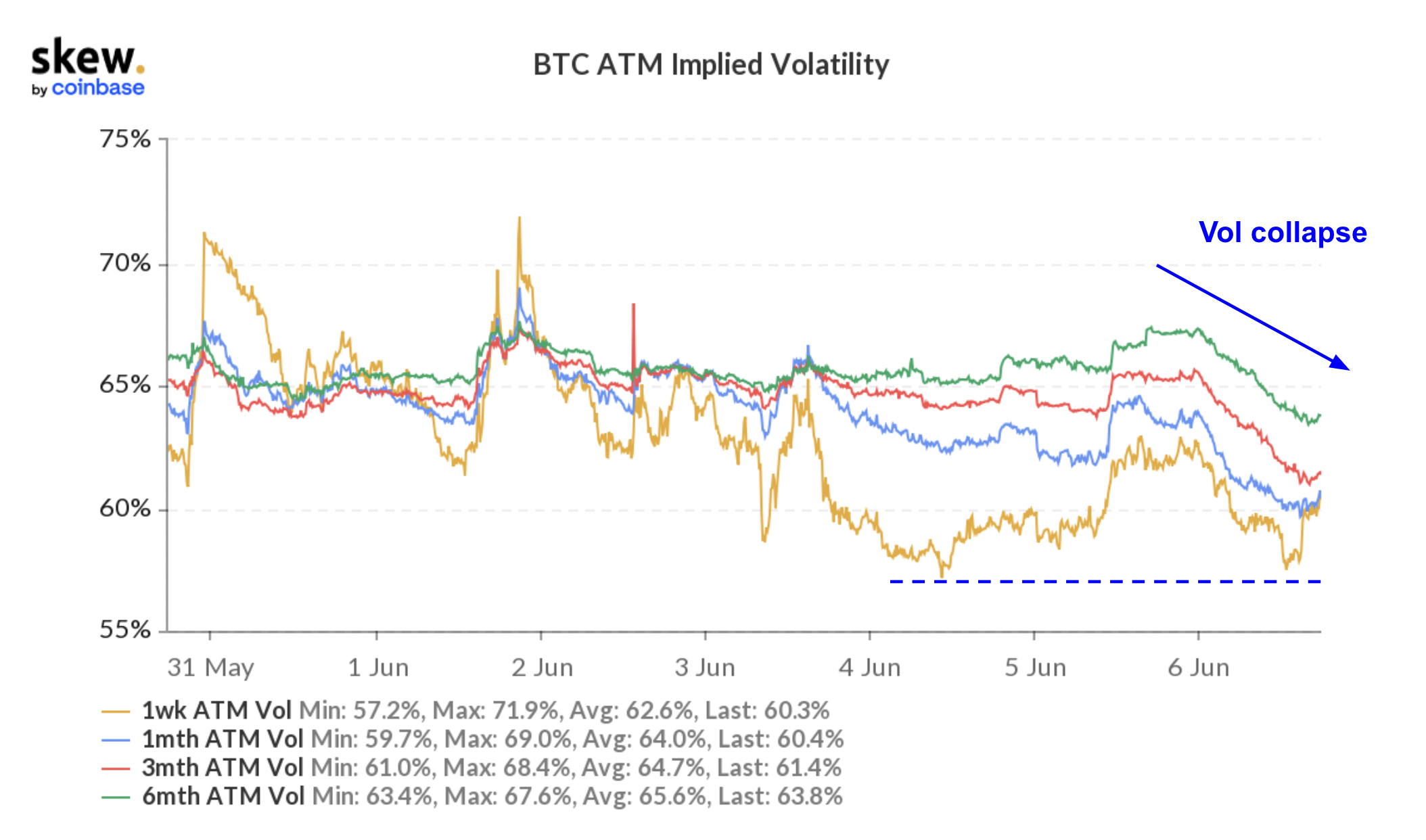

The chart below shows the recent decline in bitcoin’s implied volatility. Option traders have been expecting fewer price swings as bitcoin’s price stabilizes between $27,000 and $33,000.

Still, short-term volatility has ticked higher over the past few days, which could point to a rise in trading activity this week.

“We have a market unwilling to move higher, establishing well-defined boundaries to the upside and downside,” Greg Magadini, co-founder of Genesis Volatility, wrote in a blog post.

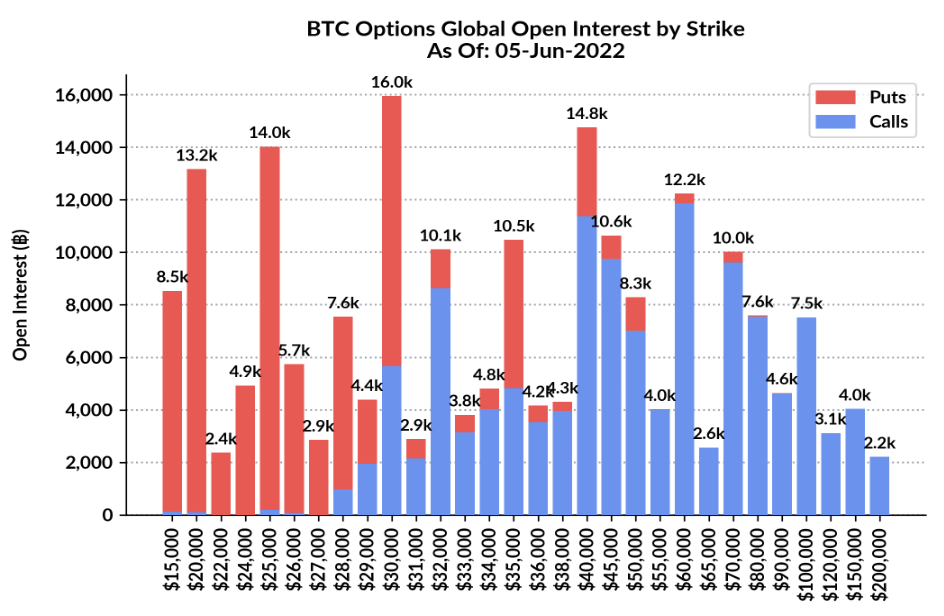

Currently, the options market places a 63% probability that BTC will trade above $28,000 next month. The most active strike price is at $30,000, where puts outnumber calls. That means traders have been seeking protection against additional price drops.

Bitcoin implied volatility (Skew)

Bitcoin open interest by strike price (Skew)

Altcoin roundup

-

Epic Games adds Gala’s Web 3 Wild West: Gala Games’s Grit – a Wild West battle royal – is now available for gamers on the Epic Games Store, according to a statement Monday. “Easy access to Web 3 games is a turning point for those players who have not yet seen how digital ownership can enrich the gaming experience,” John Osvald, Gala’s president of games, said. Gala’s GALA token was up by 4% over the past 24 hours and is down by 7% over the past week. Read more here.

-

Stepn cyber attack: Stepn, a “move-to-earn” application on the Solana blockchain that gives users cryptocurrency rewards from walking or jogging, suffered multiple distributed denial of service (DDOS) attacks following a recent upgrade. Users were recommended to “get some rest” while Stepn worked to secure its servers and recover from the various attacks. Read more here.

-

Binance Labs invests in PancakeSwap: Binance Labs, the venture capital arm of Binance, the world’s largest crypto exchange by trading volume, has made an investment in PancakeSwap, a decentralized exchange (DEX) built on the BNB Chain. CAKE, the native token of the exchange, was up by as much as 10% on Monday following the announcement. Read more here.

Relevant insight

-

Crypto Miner Hut 8 Bucks Trend by ‘Hodling’ Its Mined Bitcoins:The miner also concluded its crypto lending program, bringing all of company bitcoin back into custody.

-

Animoca Brands’ Investment Portfolio Now Worth Over $1.5B: The gaming investment firm also reported $573 million in bookings and other income for the first four months of 2022.

-

Antsy Lithuania Latest to Anticipate EU Crypto Law With One of Its Own:Ministers don’t want a crypto disaster to happen while they’re waiting for Brussels lawmakers to dot the i’s on landmark MiCA legislation, but some warn their plans could wreck the sector.

-

Yuga Labs Confirms Discord Server Hack; 200 ETH Worth of NFTs Stolen: The company behind the Bored Apes NFTs made the disclosure 11 hours after word of the exploit surfaced on Twitter.

-

Crypto SPACs Brace for Cruel Summer With Lower Valuations, SEC Scrutiny:Deals may need to get repriced, an industry investment banker told CoinDesk.

-

CoinDesk Confidential: Bradley Miles: The CEO of social token startup Roll is a New Yorker through and through.

-

Previewing the Regulatory Panels at Consensus 2022:Welcome to our annual shindig, now back in person after two years of virtual events.

-

Consensus Festival Guide: Creator Summit, NFTs and Music: ???? What not to miss this week at Consensus if you’re into crypto-related creativity. We have you covered!

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | +5.5% | Smart Contract Platform |

| Bitcoin | BTC | +4.4% | Currency |

| Cardano | ADA | +4.1% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Stellar | XLM | −0.7% | Smart Contract Platform |

| Dogecoin | DOGE | −0.1% | Currency |

| XRP | XRP | −0.1% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Read more about

Save a Seat Now

BTC$31,405.83

BTC$31,405.83

4.46%

ETH$1,859.35

ETH$1,859.35

1.96%

BNB$292.44

BNB$292.44

3.02%

XRP$0.398933

XRP$0.398933

0.02%

SOL$41.62

SOL$41.62

4.35%

View All Prices

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why.