In a recent analysis, Jan Happel and Yan Allemann, co-founders of Glassnode, which goes by the name Negentropic, shared their perspectives on the cryptocurrency market, focusing specifically on altcoins. Analysts state that altcoins have been lagging behind Bitcoin (BTC) for some time. So, they wonder when altcoins will start gaining significant ground. Crypto expert Elmaz Sabovic looks at the top three altcoin projects that are ready to benefit from the Bitcoin narrative.

Bitcoin is leading the way, but altcoins are advancing too!

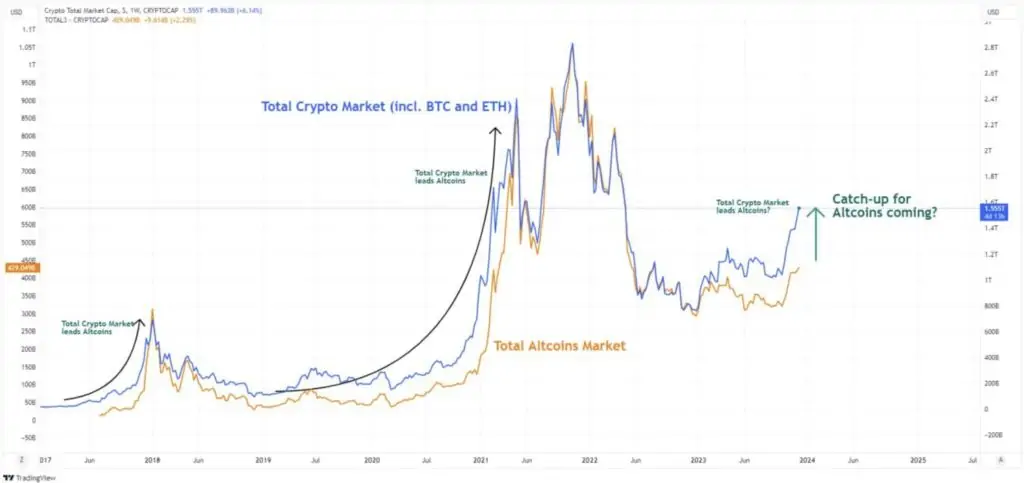

Negentropic looks at indicators that despite Bitcoin’s lead in market trends, the total market capitalization of altcoins is advancing. This trend is particularly notable, with major players such as Ethereum (ETH) closely following Bitcoin’s lead.

Altcoin market cap movement chart. Source: Negentropic

Altcoin market cap movement chart. Source: NegentropicAnalysts suggest this is a harbinger of broader volatility in the altcoin market. In response to these observations, what are the top three altcoins poised to benefit from the overall Bitcoin narrative?

Leading altcoin Ethereum (ETH) ranks first

Amid significant bullish momentum across multiple assets in the cryptocurrency space, Ethereum, the second-largest crypto by market cap, is also following suit. According to renowned crypto analyst Ali Martinez, Ethereum breaking $2,000 represents a “pivotal buying moment” for the altcoin. This perspective is based on the observation that traders purchased a significant amount of ETH around this price level.

Number of ETH holders in profit/loss. Source: Ali Martinez

Number of ETH holders in profit/loss. Source: Ali MartinezAt the time of writing, Ethereum was trading at $2,343. This indicates a 3% gain on the day. Additionally, the leading altcoin increased by 14.7% over the previous week. Moreover, it has gained over 24% on its monthly chart, according to the latest data.

ETH 30-day price chart. Source: CoinMarketCap

ETH 30-day price chart. Source: CoinMarketCapSecond on the list is Solana (SOL)

Considering the gains among the broader cryptocurrency market in previous days, Solana (SOL) is no exception, having gained nearly 50% in the past month. Solana is approaching the top of an ascending triangle visible on its 12-hour chart. This formation indicates a potential upward move for SOL. However, it is better to be careful.

A confirmed close above $68.2 will likely initiate a bullish breakout targeting $90. However, it is crucial to watch the $60 support level. Any signs of weakness around this point could lead to an increase in profit taking, potentially taking SOL to $47 according to Ali Martinez.

Solana’s potential resistance and breakout zone chart. Source: Ali Martinez

Solana’s potential resistance and breakout zone chart. Source: Ali MartinezAt the time of writing, the altcoin price was trading at $65.72, up 3.93% on a daily basis. Additionally, the token gained 10.47% in the previous 7 days. SOL made 49.42% progress on its monthly chart.

SOL 30-day price chart. Source: CoinMarketCap

SOL 30-day price chart. Source: CoinMarketCapLast ranked altcoin: Ripple (XRP)

cryptokoin.com As you follow from , many assets in the crypto market have entered a positive phase. In this process, XRP (XRP) has shown a relatively lower performance recently. However, optimistic predictions for a bullish rally remain.

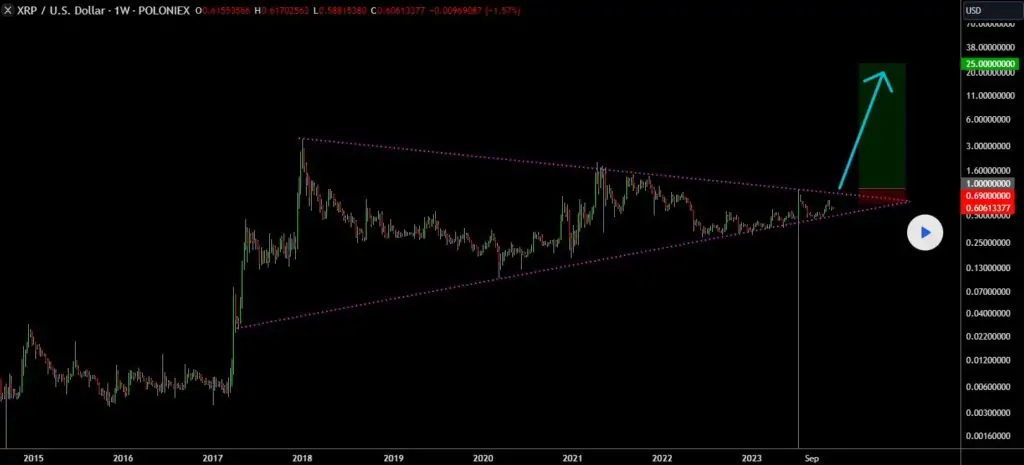

Crypto analyst with the pseudonym FieryTrading has a very optimistic stance on XRP. The analyst shows a potential target of $25 for the altcoin. The analyst says that XRP follows a consolidated pattern where it marks higher lows and lower highs. He states that he created a triangle model in this direction. The analyst defines this formation as a bull flag. He highlights that this comes on the heels of a notable 7,000X increase in 2017.

XRP multi-year price analysis chart. Source: FieryTrading

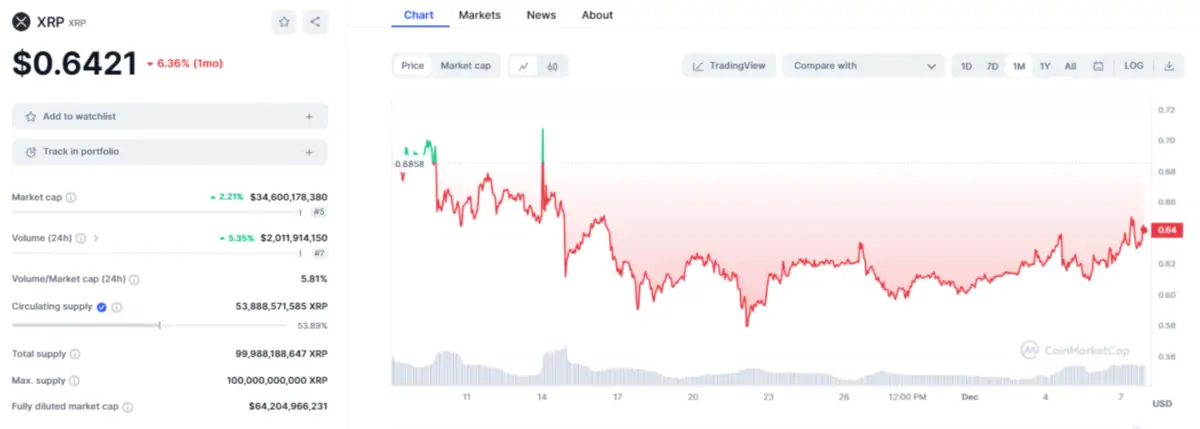

XRP multi-year price analysis chart. Source: FieryTradingMeanwhile, at the time of writing, XRP was trading at $0.6421, registering a daily gain of 2.2%. The altcoin recorded an increase of 6.45% on the 7-day chart. However, XRP lost 6.38% in value in the monthly time frame.

XRP 30 day price chart. Source: CoinMarketCap

XRP 30 day price chart. Source: CoinMarketCapThe opinions and predictions in the article belong to experts and analysts and are definitely not investment advice. We strongly recommend that you do your own research before investing.