According to CoinShares data, crypto asset investment products based on assets such as BTC and ETH continued their momentum, recording inflows for the 11th consecutive week, although total inflows of $43 million represent a significant decrease compared to previous weeks. This trend is accompanied by an increase in short position entries due to the recent price increase and increasing concerns about potential downside risks. Here are the details…

Cryptocurrency products in Europe are ahead

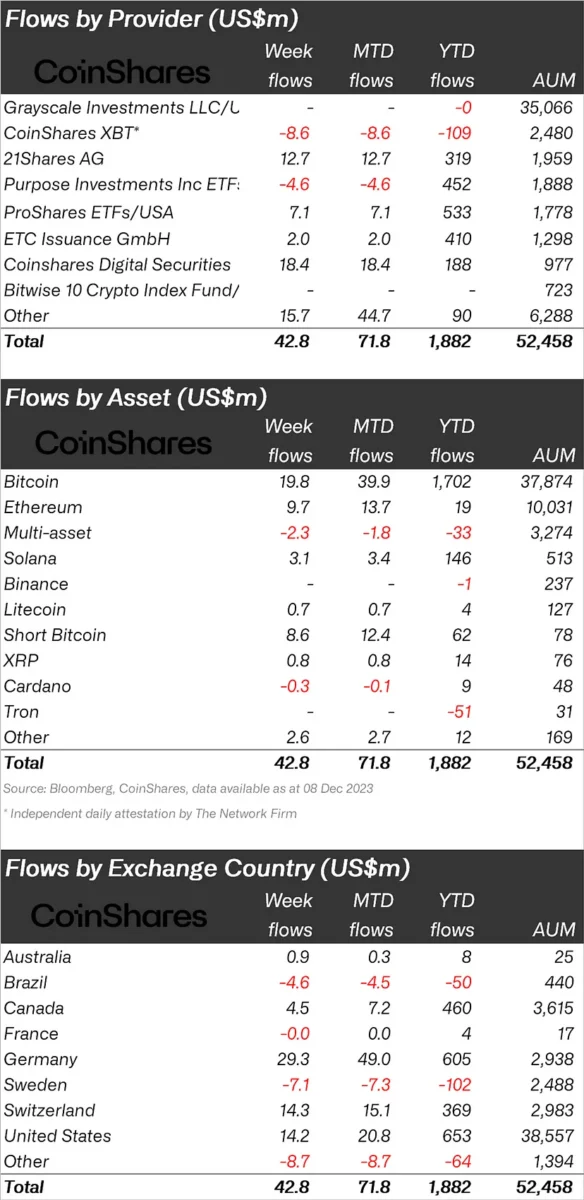

CoinShares shared its latest weekly digital asset inflow report. According to the report, Europe stands out as the leader in digital asset investment with strong inflows of $43 million. Despite the overall decline in total inflows, Europe’s continued dominance reflects continued confidence in the region’s crypto market. The United States followed with $14 million in inflows, with half of that attributed to investments in short positions, indicating a cautious approach among investors.

Hong Kong and Brazil, in particular, witnessed outflows of $8 million and $4.6 million respectively, deviating from the global trend. These regional differences point to different sentiments and strategies among investors. The global market environment continues to evolve as investors navigate the complex dynamics of the cryptocurrency space.

Bitcoin and ETH remain in focus

Bitcoin remains the primary focus of investors with an inflow of $20 million. This brought the year-to-date inflows for Bitcoin to an impressive figure of 1.7 billion dollars. However, it is worth noting that short Bitcoin positions saw inflows of $8.6 million; This indicates that some investors are expressing concerns about the sustainability of the current price increase.

The cryptocurrency world is dynamic and Ethereum has experienced a remarkable comeback. Recording $10 million inflows for the sixth consecutive week, Ethereum successfully reversed its outflow trend, moving from a year-to-date deficit of $125 million to a total positive inflow of $19 million. Altcoins such as Solana and Avalanche continue to attract investor attention with inflows of $3 million and $2 million, respectively. These alternative cryptocurrencies demonstrate resilience and sustainable appeal within the broader cryptoasset market.

What about blockchain stocks?

In a surprising development, Blockchain stocks witnessed their biggest weekly inflow on record, reaching $126 million. This underlines the increasing integration and acceptance of Blockchain technology into traditional financial markets, paving the way for continued innovation and investment in this area. As the cryptocurrency world continues to evolve, investors continue to stay alert and develop strategies to adapt to the ever-changing dynamics of this dynamic market.