This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

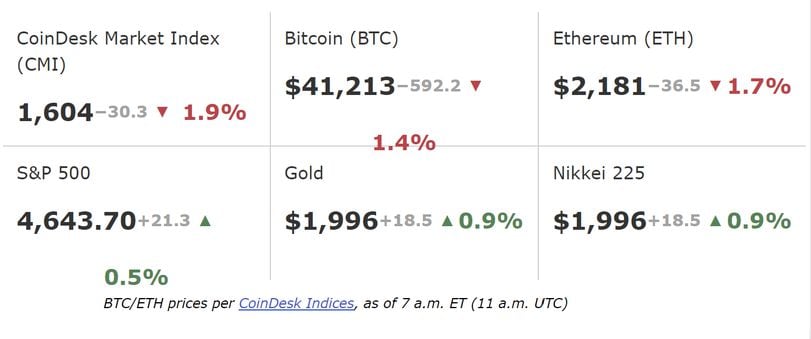

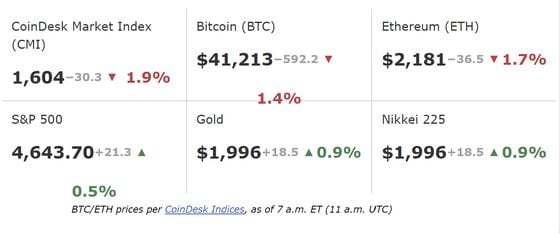

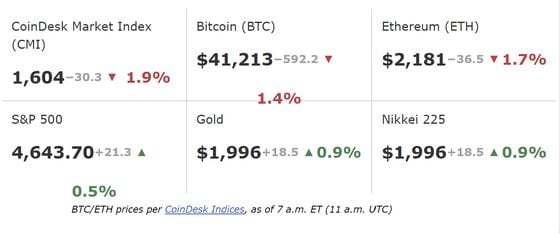

Latest Prices

Top Stories

A change to the mechanics of BlackRock’s proposed spot bitcoin (BTC) ETF opens the door for Wall Street banks, which face restrictions holding cryptocurrencies, to play a key role. BlackRock recently made it so authorized participants (APs) – a vital part of the ETF ecosystem – will be able to create new fund shares with cash, rather than only with cryptocurrency. As highly regulated U.S. banks are unable to hold bitcoin themselves, this set-up would enable the likes of JPMorgan or Goldman Sachs – firms with some of the largest balance sheets in the world – to act as APs to BlackRock’s ETF. (Whether they want to is another matter.) The cash APs use in this process can then be exchanged into bitcoin by an intermediary and warehoused by the ETF’s custody provider, as per a memo filing relating to a Nov. 28 meeting involving the Securities and Exchange Commission, BlackRock and Nasdaq.

Binance, Binance.US and Changpeng Zhao argued that the U.S. Securities and Exchange Commission (SEC) did not meet the requirements of the “Howey Test” in its suit against the two companies and their founder in a new filing Tuesday. Binance and Zhao filed a reply to the SEC alongside Binance.US, which submitted its own separate but similar filing arguing the SEC did not show that the exchanges’ U.S. customers had any contracts that would meet the definition of an “investment contract,” or that other elements of the Supreme Court case were met. It’s the latest bid to dismiss the lawsuit filed by the federal regulator in June, when the SEC alleged that Binance and Binance.US allowed the general public to buy and trade unregistered securities by listing certain cryptocurrencies and offering a staking service.

Crypto mogul Justin Sun has said that assets held on HTX and Poloniex are “100% safe” after last month’s hack that saw more than $200 million siphoned out of the exchanges.

Both exchanges have opened withdrawals for certain assets, although several altcoins remain locked. Bitcoin (BTC) and Tron (TRX) are the two digital assets that can be withdrawn. This led to both tokens trading at a premium on Poloniex over the past few weeks, which meant users would have to take a haircut of up to 10% to liquidate their asset and withdraw another.

The freeze came after hackers stole $114 million out of Poloniex’s hot wallets on Nov. 10; this was followed up by $97 million being stolen from HTX and blockchain protocol Heco Chain.

Podcast

Listen to latest news on cryptocurrency

Markets Daily Crypto Roundup

Crypto Update | What’s Behind the Weekend’s Price Correction