Cardano (ADA) reached a 17-month high with a 15 percent increase due to the sudden increase in whale activity.

The crypto market became active again after the Fed evening, when bearish expectations increased. The volatility in the market caused altcoins to experience remarkable increases. In particular, BTC, after falling to 40 thousand dollars, made a rise again and rose to 43 thousand dollars.

BTC-driven rise and Bitcoin spot ETF expectations continue to keep the crypto bull alive. In positive market conditions, the ADA detail attracts attention. ADA broke through an important resistance point at $0.60 and anchored in a critical zone. Whale activity has brought to light the increasing demand for ADA.

Cardano (ADA) continues its climb: Whale effect!

Cardano (ADA) whale activity has revealed a transaction volume of $1.5 billion in the last 24 hours. Whale activity in ADA paved the way for the popular cryptocurrency’s 15 percent rise.

ADA, which recently surpassed the psychological resistance at $0.60, created a strong price stability. The previous evening, when BTC experienced a 3.5 percent increase, there was a big outflow from ADA.

ADA was trading at $0.5810 around 15:00 on December 13. With its debut, the popular cryptocurrency rose to $0.6795 at around 03:00 on December 14.

ADA, which made its name among the most rising cryptocurrencies of December, came to the fore when it exceeded 200 EMA (Moving Daily Average) and broke $ 0.50. The cryptocurrency, which made a big debut this month, has increased by nearly 75 percent in the last 14 days.

The rise of ADA also had a positive impact on the Cardano ecosystem. The total locked value (TVL) of all Cardano-based tokens approached $450 million earlier this week. This amount exceeded the TVL of $330 million in April, creating a new peak. Last week, TVLs of lending protocol Indigo and on-chain exchange Minswap in the Cardano ecosystem increased by over 50 percent.

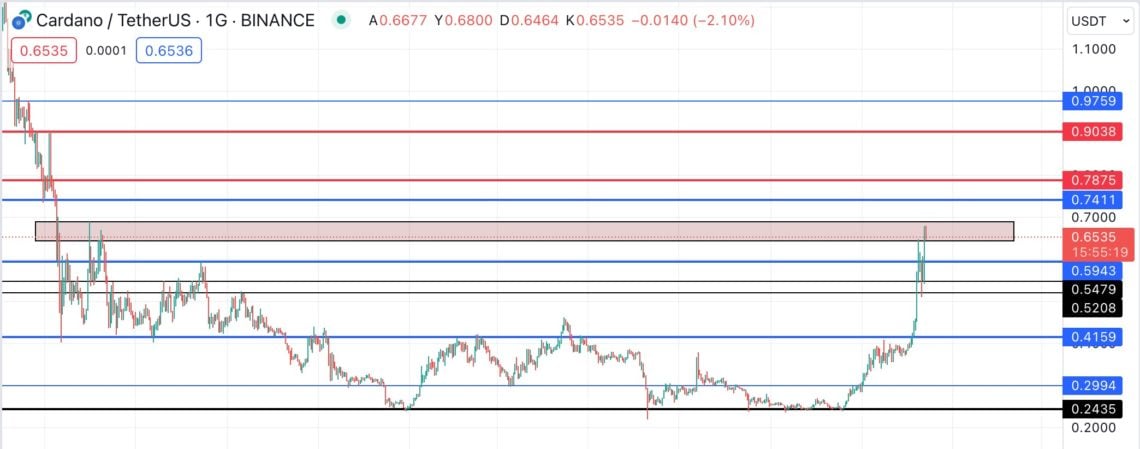

ADA has entered the critical zone between $0.64 and $0.84 according to the Global Currency In/Out (GIOM) indicator. According to GIOM, this range means the last critical zone before the psychological target of $1.

ADA entered an important breakout zone, reaching the $0.65 level. It is expected to surpass this zone and test the $0.70 resistance. Within these expectations, ADA may intensify its rise if it reaches the $0.70 resistance and breaks this region. At this point, ADA may rise to the major resistance at $0.7411. Breaking the $0.7411 resistance may highlight the buy/sell zone at $0.7875.

One of the final resistances of ADA in its journey to $ 1 stands out as $ 0.90. If it continues its bull run, ADA may target this major resistance point.

On the other hand, ADA may decline up to $0.5943 if it declines. If ADA cannot gather strength in a possible pullback, selling pressure may increase. Another support points of ADA may be $0.5450 and $0.4150.