Activity in the Ethereum (ETH) market is increasing again. Rising positive funding rates in the futures market fuel investors’ hopes for the future of ETH. According to CryptoQuant’s analysis, there was a positive atmosphere among traders. Additionally, this is a strong signal for a potential Ethereum price rally. However, whale movements and technical indicators are also involved, so the situation is not as simple as it seems. Let’s look at the details together.

Optimism in the Futures Market

CryptoQuant notes a steady rise in Ethereum funding rates. These rates show that traders’ belief in ETH’s price increase is strengthening. The fact that funding rates are positive in the futures market indicates that investors think ETH will rise and are taking positions in this direction. However, these rates have still not reached the levels seen in the big rally in March. Funding rates were much higher at that time.

According to analysts, these rates need to increase further for the price of ETH to enter a long-term uptrend. So, once a stronger buying appetite emerges among traders, the buying pressure on Ethereum will increase significantly. This paves the way for a possible rally. Therefore, market players are closely monitoring ETH’s performance and following developments carefully.

Critical Points in Ethereum Price

Ethereum has made a significant recovery this week. The price is trading above $2,500, indicating a strong upward move. However, there are also minor corrections in the meantime. Analysts say that if ETH breaks the $2,600 level, the price could quickly move towards $3,000. Breaking this resistance point is critical because breaking above this level could be the start of a long-term uptrend.

ETH’s technical indicators paint a complex picture. For example, on the 4-hour chart, the MACD indicator gives bearish signals. When the MACD line falls below the signal line, we see increased selling pressure. Still, these bearish signals could reverse if ETH surpasses $2,600. That’s why investors and traders have turned their attention to how the price will move at this critical level.

Ethereum Whale Movements and Market Impact

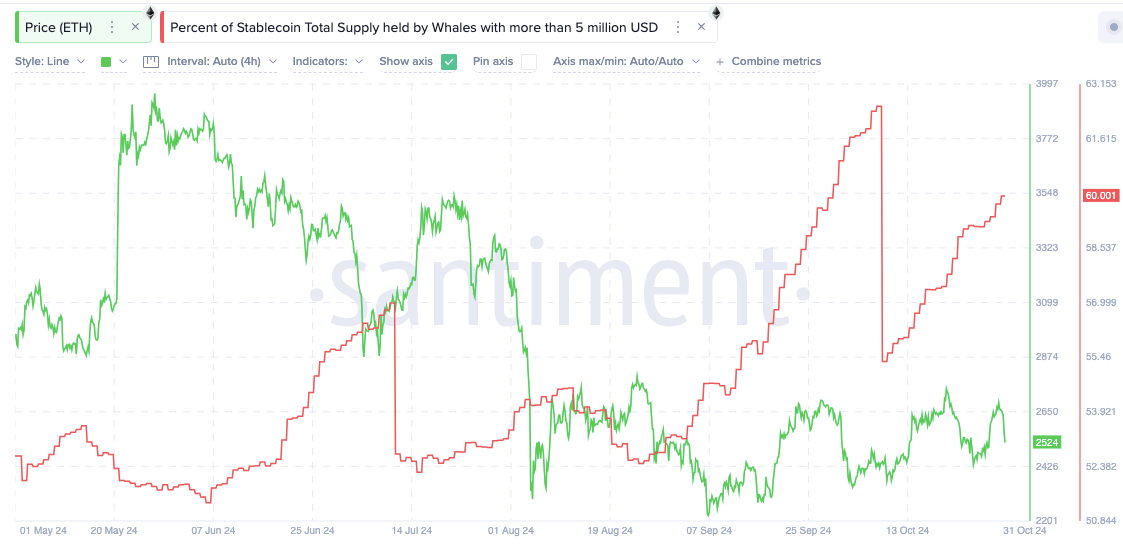

Another important factor affecting the ETH price is whale movements in the stablecoin market. According to recent data, large wallets, or whales, have increased their stablecoin holdings. These large players holding stablecoins worth more than $5 million can cause sudden fluctuations in the price of ETH. Every move of the whales, which hold 60% of the stablecoin supply, can have an impact on the market. These movements of whales can cause large changes in prices in the short term.

That’s why investors watch whale movements carefully. Particularly large stablecoin transfers can lead to sudden reactions in the ETH price. This may create sudden fluctuations in the market. Analysts emphasize that these movements may have serious effects on the Ethreum price and warn investors to be careful. As we reported as Kriptokoin.com, cryptocurrency markets are volatile and carry risks. It is important for investors to examine these risks themselves and make transactions.