Gold created high volatility after reaching the $2,800 target and a pullback was delayed. Prices could go either way in November, given the US election results and next week’s Fed statement. According to technical analyst AG Thorson, if gold corrects, the initial decline is possible to be sharp. However, there is a possibility that prices will continue to pressure towards $3,000. The analyst looks at the big picture of gold, also benefiting from historical perspective.

What’s the big picture for gold prices?

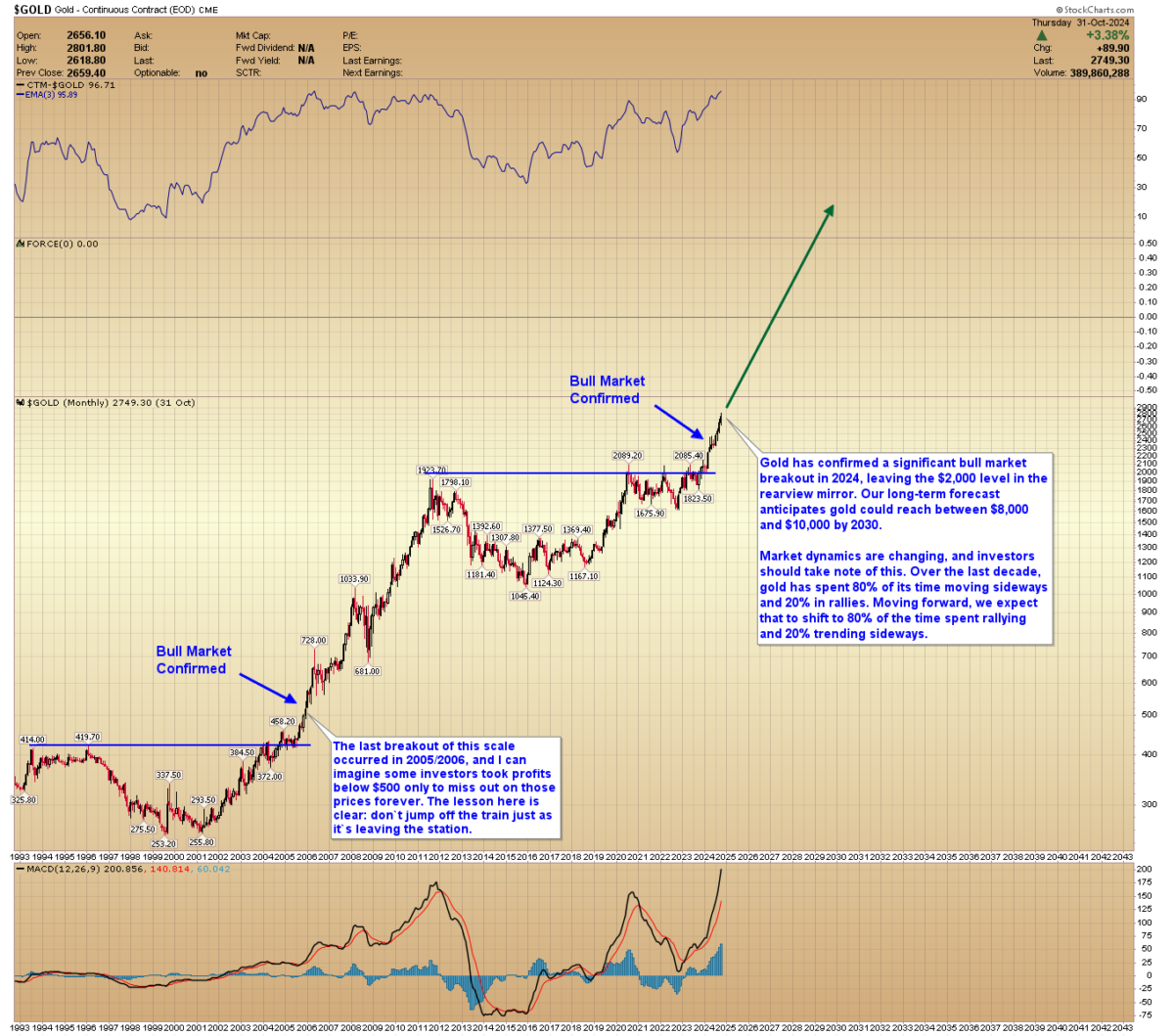

The shiny metal has confirmed a significant bull market breakout in 2024. Thus, it left the $2,000 level in the rearview mirror. Long-term forecasts predict that gold has the potential to reach between $8,000 and $10,000 by 2030. Market dynamics are changing and investors have to take this into consideration. Over the last decade, gold spent 80% of its time moving sideways and 20% rallying. Going forward, we expect this to spend 80% of the time rallying and 20% of the time remaining sideways.

The last break on this scale occurred in 2005/2006. I can imagine some investors missing out on these prices forever, taking profits below $500. The lesson here is clear: Don’t jump off the train just as it’s leaving the station.

How sensitive is gold?

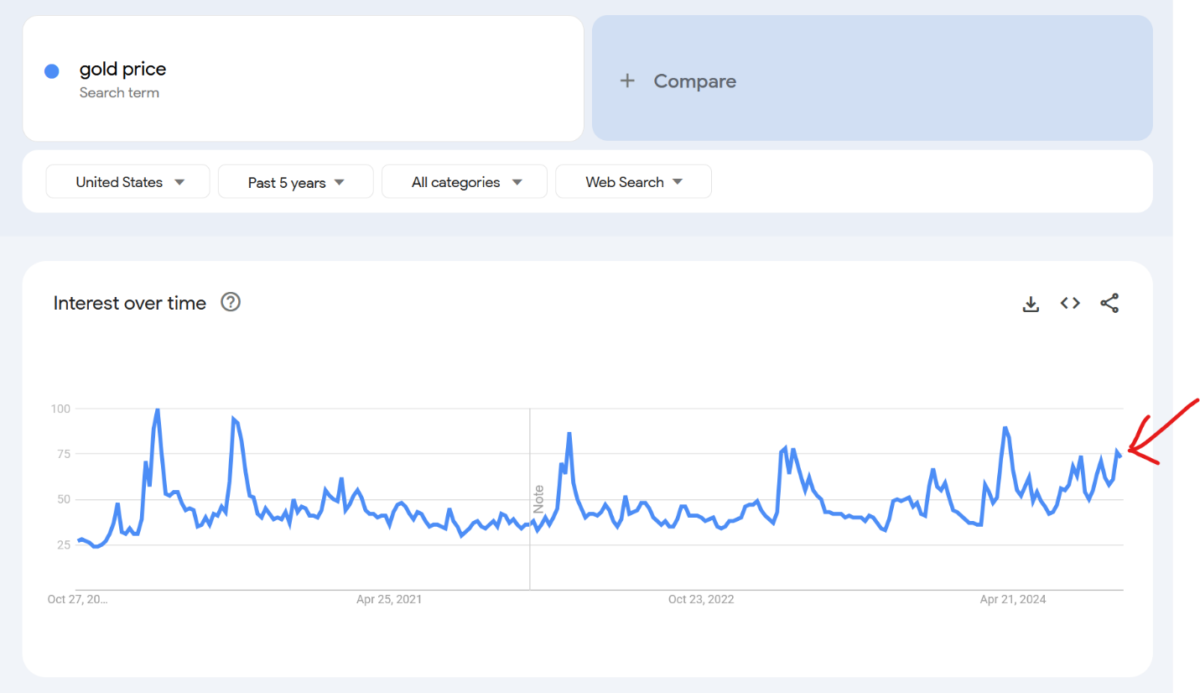

Despite reaching $2,800 and an all-time high, Google searches for “gold price” are still below peaks seen in the last five years. That’s one reason why we think prices will continue to rise.

What do the technicals show for gold?

Gold prices experienced high volatility after closing above $2,800 yesterday. Therefore, the odds are in favor of a pullback. No one can predict how prices will react to next week’s elections and the Fed announcement. A close below the 50-day EMA (currently $2,644) in November would confirm a moderate pullback. Depending on the elections, a rally towards $3,000 remains a distinct possibility.

The bull market in precious metals is just beginning. In this context, it is likely to continue until 2030. There is potential for the gold price to reach between $8,000 and $10,000. Therefore, do not lose your seat just as the train leaves the station.

The opinions and predictions in the article belong to the analyst and are definitely not investment advice. cryptokoin.comWe strongly recommend that you do your own research before investing.