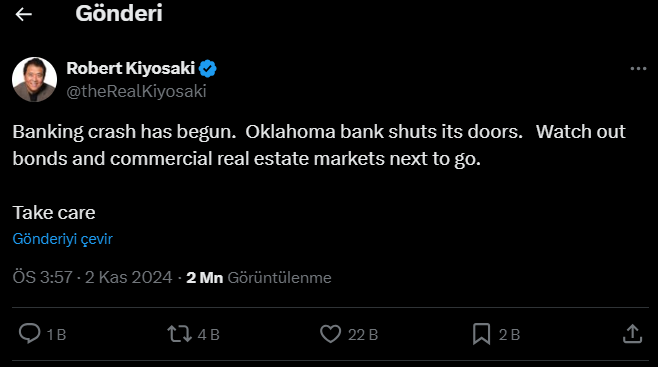

Famous American author and finance educator Robert Kiyosaki made a striking warning about the US banking sector. Bitcoin fan Kiyosaki, known for his book “Rich Dad, Poor Dad”, stated in his last post on the social media platform X that a major collapse in the banking sector has already begun. According to Kiyosaki’s statements, a recently closed bank in Oklahoma can be considered the beginning of this collapse. The famous author points out that bond and commercial real estate markets are at risk of experiencing a major decline, following the banking sector.

Criticism from Kiyosaki to the banking sector

These statements, which made quite a splash in the financial industry, once again brought up Kiyosaki’s long-standing criticisms. According to him, the US banking sector faces serious structural problems and argues that these problems also threaten the global economy. The basis of Kiyosaki’s criticism lies in the dominant role of the US dollar in the world economy. While the author describes the dollar as a “fake” product, he sees the current monetary policies of the United States as part of a “rotten and collapsed” system. As a result of this situation, he believes that the biggest economic crisis since the Great Depression of 1929 is at the door.

Kiyosaki thinks that the current monetary policies of the USA are not sustainable and argues that this situation will gradually reduce confidence in the dollar. According to him, these risks created by monetary policies seriously threaten not only the USA but also the global financial system. Especially the fact that the US dollar is the determining factor in the global economy shows that this risk may be effective worldwide.

Kiyosaki’s solution is gold, silver and Bitcoin

The solution that Kiyosaki proposes against this pessimistic scenario is to invest in assets with limited supply and intrinsic value. According to him, precious assets such as gold, silver and Bitcoin are the most reliable way to preserve wealth during this crisis. Emphasizing that metals such as gold and silver have maintained their value throughout history, Kiyosaki defines Bitcoin as “the people’s money.” He argues that Bitcoin’s decentralized structure and limited supply will make it a more valuable asset in the future. Kiyosaki thinks that since Bitcoin is not controlled by any central bank or government, it should be seen as a safe haven against economic turmoil.

Kiyosaki’s investment proposal can be considered a reflection of his distrust of the traditional financial system. According to him, while the value of fiat currencies under the control of states is decreasing day by day, assets such as gold, silver and Bitcoin, which are scarce resources, can help individuals protect their wealth in an environment of economic chaos. In particular, Bitcoin is not affected by the policies of any central bank and its limited supply makes it a preferable option in such crisis periods.

Robert Kiyosaki’s statements suggest that trust in traditional financial assets may be shaken. The fact that the bonds and commercial real estate markets carry the risk of a collapse parallel to the banking sector attracts the attention of investors. In particular, a major decline in the commercial real estate market could have a knock-on effect in the financial sector. While commercial real estate holds a large place in the portfolio of many banks, a collapse in this sector could reduce banks’ asset values and cause liquidity problems. This situation may lead the economy in general into a deep crisis.