In the crypto world, debates are growing over the crypto asset listing fees of centralized exchanges Coinbase and Binance. In particular, the claims of TRON founder Justin Sun and Fantom founder Andre Cronje provide remarkable information about the listing processes and fee demands of these two major exchanges. Justin Sun fueled this debate by claiming that Coinbase, the largest crypto exchange in the US, charged him 500 million TRX (about $80 million) to list TRON. This directly contradicts statements made by Coinbase CEO Brian Armstrong, who claimed that listing assets on the exchange is free.

Heavy listing demands on Coinbase

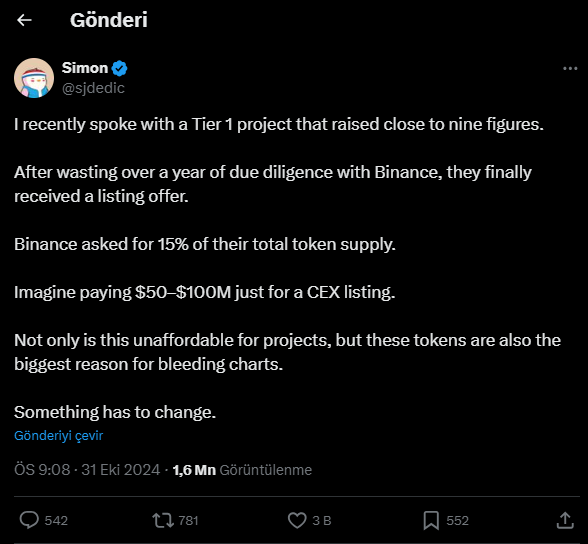

These discussions escalated further with Moonrock Capital CEO Simon Dedic’s criticism of the high fee demands of centralized exchanges. Dedic announced that a high-capital project received a listing offer from Binance in exchange for a 15% token supply after long research and investigations. Dedic stated that a listing fee between $50 million and $100 million creates an unaffordable burden for projects, and this causes token prices to drop rapidly.

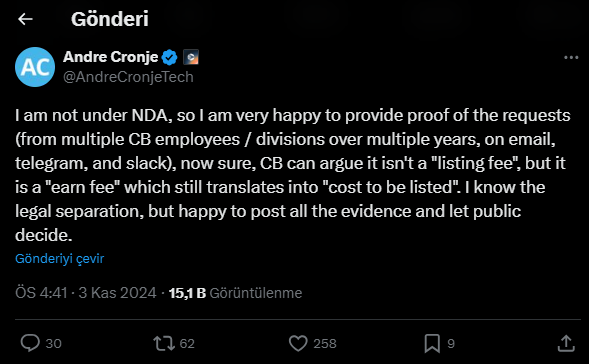

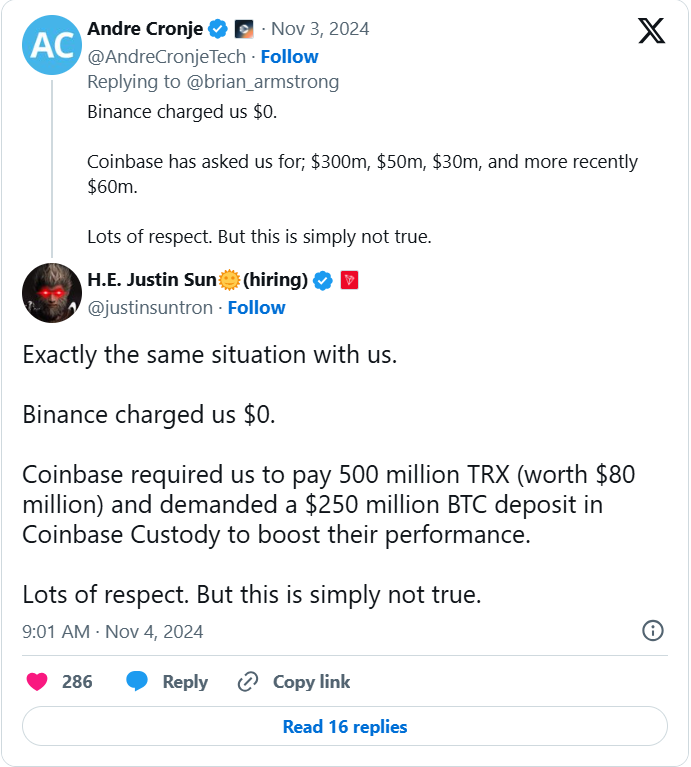

Coinbase CEO Armstrong took advantage of this criticism and joined the discussion by making a statement stating that listing on his own exchange was free. However, opposing Armstrong’s statement, Cronje claimed that Coinbase demanded high amounts from him at different times, such as $30 million, $50 million, $60 million and $300 million to list Fantom.

Cronje stated that he is ready to share the necessary documents with the public to prove these fee demands. Even though Coinbase did not directly call these requests a “listing fee”, he argued that the expenses were reflected under the name of “earnings fee” and stated that this should be considered a de facto listing fee. Justin Sun also stated that he experienced a similar situation and claimed that Coinbase demanded 500 million TRX tokens to list TRON, as well as a $250 million Bitcoin collateral in Coinbase Custody in order to increase performance.

Binance co-founder made a statement

Yi He, co-founder of the Binance exchange, responded to the discussions about listing fees and explained that Binance implemented a rigorous screening policy during the listing process and that it was not possible to bypass this process in exchange for any amount of money or tokens. Yi He stated that during Binance’s process of listing the projects, attention was paid to the token distribution and that a certain rate such as 20% or 15% was not requested. He also stated that there are certain rules for practices such as airdrop in Binance’s listing processes. Yi He thanked Cronje and stated that such misunderstandings could arise in a competitive environment.

These events reveal how strong centralized exchanges are in the crypto ecosystem and how projects can undertake serious financial burdens to access these platforms. Centralized exchanges are an important marketplace for projects because they generally have high transaction volumes and a large user base. However, allegedly high listing fees pose a serious obstacle to small and medium-sized projects being listed on these exchanges. However, the fluctuation and decline of token prices after listing on Binance and Coinbase also increases the effects of these costs.