Donald Trump’s wind blew in the cryptocurrency market. Trump’s landslide victory is almost certain. Amidst these developments, Bitcoin recorded a new ATH due to its crypto-friendly stance. However, investors are weighing whether it makes sense to sell now. CryptoQuant CEO also explained his views on this issue following the latest developments.

Bitcoin warning from CryptoQuant CEO!

cryptokoin.comAs you follow from , today the Bitcoin and altcoin markets celebrated Trump’s victory. The leading cryptocurrency made its investors happy by reaching new heights. However, it remains unclear whether this upward trend will continue. Some analysts expect BTC to reach up to $100,000 by the end of the year. However, CryptoQuant CEO Ki Young Ju looks at it from a different perspective. Ju agrees that Bitcoin’s price will increase. However, he advises investors to sell the coins gradually.

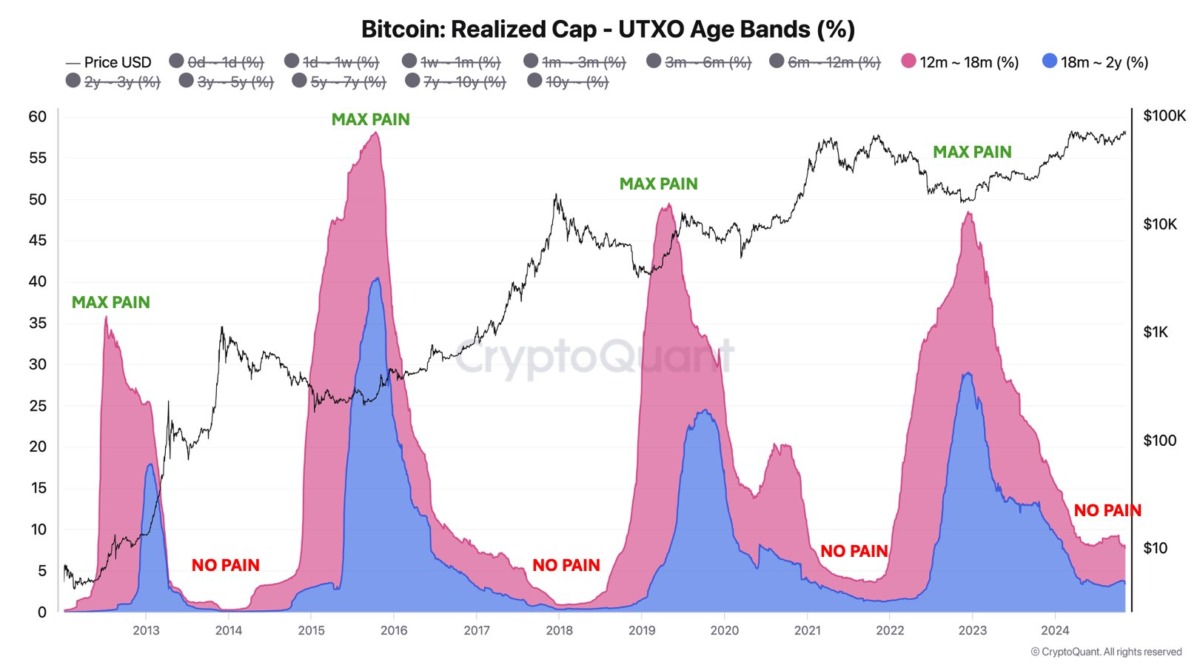

CryptoQuant CEO states that Bitcoin price could increase by 30-40% from current levels. However, he says that despite this, there will be no explosion like in the old days. Ju notes that BTC’s previous 368% increase from $16,000 is no longer possible. In this context, CryptoQuant CEO makes the following statement accompanied by a graphic:

New investors often hold BTC during bear markets and endure losses. It changes hands after about two years, when the pain subsides. Then now. It could rise +30-40% from here, but not like the +368% we saw from $16k. It’s time to think about gradual sales, not buying everything.

Crypto whales withdrew $133 million worth of BTC from Binance

According to on-chain watchdog SpotOnChain, whales withdrew approximately $133 million worth of Bitcoin from Binance in a single day. This notable accumulation of whales reflects growing confidence in Bitcoin’s resilience despite current price fluctuations. These withdrawals included 11 new wallets accumulating 1,807 BTC, representing a significant inflow of capital into private wallets. These actions stem from various strategic reasons. However, it generally indicates belief in Bitcoin’s long-term growth potential.

Election day volatility and its impact on the crypto market

The US presidential elections have led to high volatility in global markets, including cryptocurrency. Election day alone has seen turbulence in markets as investors evaluate potential impacts on regulatory policies, interest rates and the overall economic environment. In the case of Bitcoin, this has led to significant liquidations in general. Election day volatility triggered a staggering liquidation of $557 million, impacting investors holding leveraged positions, according to Coinglass. This wave of liquidations, especially political events, contributed to the unpredictability of the market. This highlights the risks associated with high leverage during volatile periods.