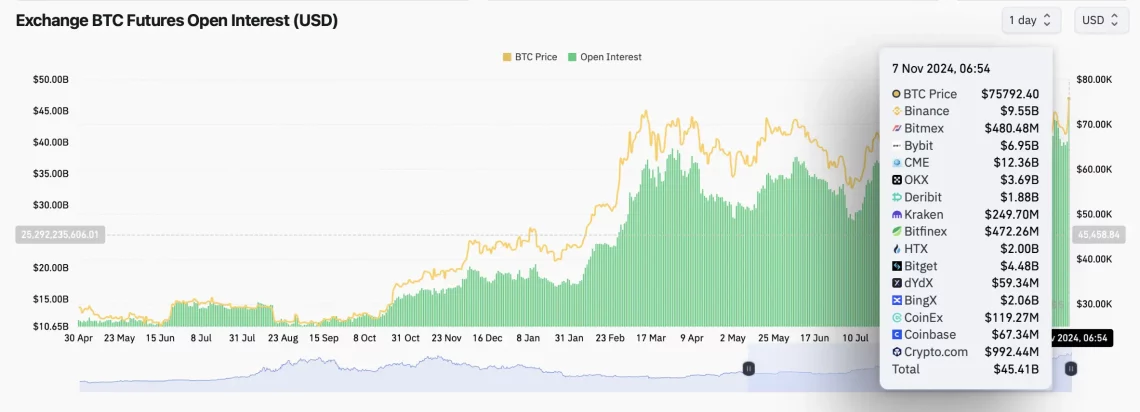

Bitcoin Open Interest (OI) amount reached $45.4 billion after Donald Trump won the US presidential election.

While the price of Bitcoin climbed to $75,000, the Open Interest (OI) amount also reached an all-time high. Many analysts suggest that Bitcoin has further upside potential. Bitcoin OI (total number of derivative contracts) on November 6 BTCWith the peak renewal of , it increased by 13.3 percent to 45.4 billion dollars. Open Position increases when it exceeds the number of closed contracts during the day.

Crypto investors do not expect the Bitcoin price to drop to $73,679 anytime soon. If such a decline occurs, short positions worth $1.26 billion will be liquidated. “Bitcoin is at a crucial point in the bull market,” veteran investor Peter Brandt wrote in a post on November 6. BTC“It will settle between 130 thousand and 150 thousand dollars in August or September next year.” he said.

Positive comment from analysts for Bitcoin (BTC)

Although Bitcoin’s all-time high has started to cause bearish concerns among some investors, analysts do not agree with this view. Crypto analyst Rajat Soni stated that we are just at the beginning of the upward trend:

“We are so early in Bitcoin adoption that we can still exchange BTC for paper money ($, €, £, etc.) because most people think fiat currencies are backed by tangible value.”

Similar to this view, analysis firm CryptoQuant stated that Bitcoin has not yet risen excessively. “Bitcoin’s new peak does not mean that it is overvalued compared to its cost basis,” the company said in its X post dated November 6, stating that Bitcoin’s Market Value / Realized Value (MVRV) ratio is still far from its peak levels.

The higher the MVRV ratio, the more it signals that Bitcoin is overbought. When Bitcoin ATH was at $73,679 in March, its MVRV ratio was approximately 2.87. At the time the news was published, Bitcoin’s MVRV score was at 2.19.