Norges Bank Investment Management’s Bitcoin Exposure Surges

The world’s largest sovereign wealth fund, Norway’s Norges Bank Investment Management (NBIM), has reported an impressive indirect exposure to Bitcoin (BTC), now totaling $356.7 million. This figure comes from a recent analysis by K33 Research.

As of the end of 2024, NBIM’s indirect holdings included a substantial 3,821 BTC, marking a remarkable 153% increase compared to the previous year’s total of 1,507 BTC. This growth trajectory highlights the fund’s increasing engagement with Bitcoin, which was only 796 BTC back in 2020.

NBIM’s Year-End Indirect Exposure (K33 Research)

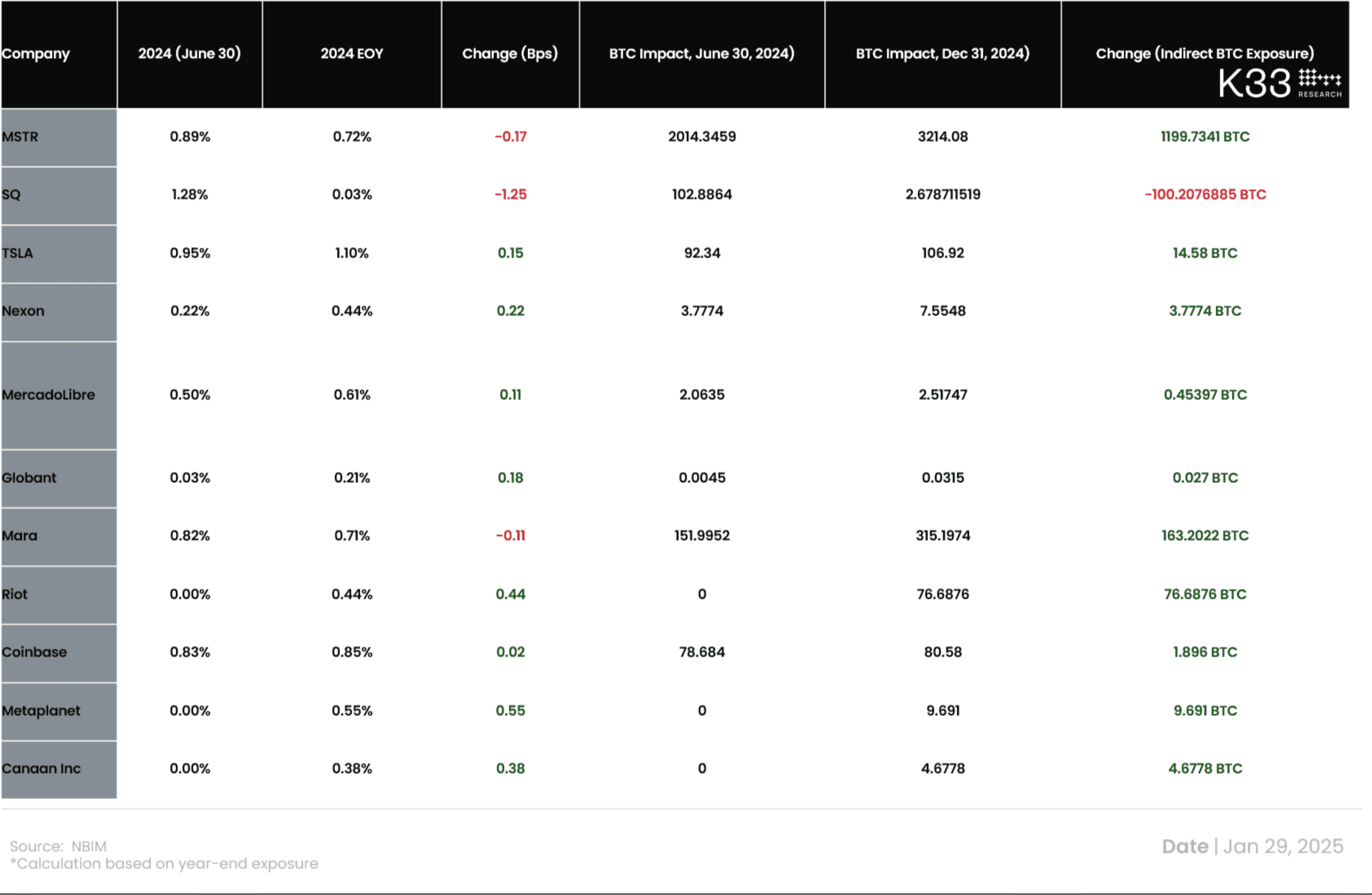

In addition to its Bitcoin holdings, NBIM has also invested in several prominent crypto-related public companies. By the close of 2024, the fund held a 0.72% stake in MicroStrategy (MSTR), valued at around $500 million, along with a 1.1% stake in Tesla (TSLA). Other investments include stakes in Coinbase (COIN), Metaplanet (3350), and Marathon Digital Holdings (MARA).

NBIM’s Crypto-Related Company Exposure (K33 Research)

Officially known as the Government Pension Fund Global, NBIM manages revenues generated from Norway’s oil and gas sector. In a remarkable year, the fund reported an all-time high annual profit of $222.4 billion, largely propelled by the ongoing artificial intelligence (AI) boom.

K33 analyst Vetle Lunde suggests that the surge in NBIM’s indirect Bitcoin exposure can be attributed to the nature of sector-weighted portfolios. As the value of crypto proxies rises, their weightings within the portfolio naturally increase. Despite these findings, NBIM chose not to provide any comments on the matter.