The US and Mexico decided to suspend new import/export taxes for a month, and this development was positively reflected in the crypto money market, especially XRP Coin.

However, Canadian Prime Minister Justin Trudeau climbed the trade tension by reacting to the US customs duties harshly. Because of its strong ties with Canada’s crypto money market, it is said that this situation can have great effects on the markets.

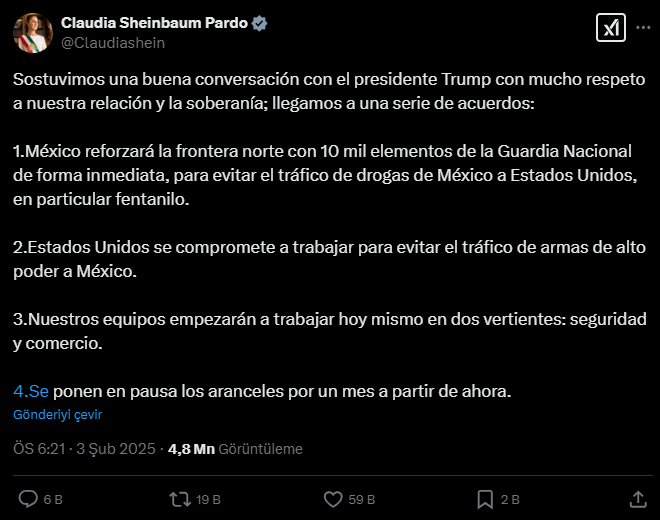

USA and Mexico reached a tax agreement

Taxes between the US and Mexico have recently led to great fluctuations in the crypto market. New customs duties on the USA, China, Canada and Mexico have caused billions of dollars of liquidations in the markets.

Although the XRP CoIN experienced an increase of over 300 %after Donald Trump’s election victory, it fell 25 %at the weekend due to the global trade war and fell to $ 2.01. However, when Mexican President Claudia Sheinbaum reached an agreement with Trump, the markets began to recover.

Sheinbaum said in a statement on social media, “We had a good meeting with President Trump. We will cooperate on trade and security issues and suspend the tariffs for a month. ” He said.

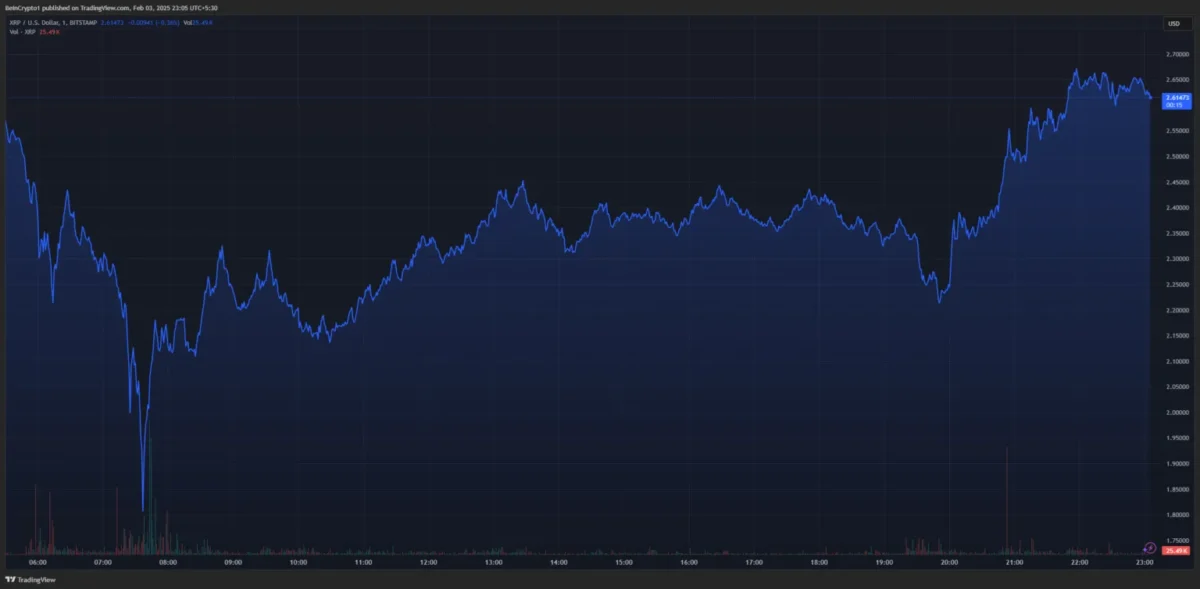

How did the XRP coin price react to the ‘Tax Agreement’ news?

Following this news, the XRP CoIN gained 6 %and the rest of the market was recovered. In particular, US -based crypto currencies such as Cardano, Chainlink and Hedera began to rise again.

Political and economic factors shape the crypto market

This development confirmed expectations that US customs duties could create purchasing opportunities in the crypto currency market. However, trade tensions are not fully finished.

Canadian Prime Minister Trudeau continues to oppose US tax policies. According to the statements, Canada is preparing to retaliate against the United States.

Canada is more intertwined than Mexico with the crypto money market. The country has a Bitcoin ETF issued by Blackrock and 40 %of corporate investors keep crypto assets.

Although an agreement has been reached between the US and Mexico, it remains unclear how trade tensions with Canada and China will be reflected in the markets. In the coming period, crypto markets are likely to experience harsh price movements due to political developments.