Alternative Cryptocurrencies: A Challenging Outlook Amid Trade Tensions

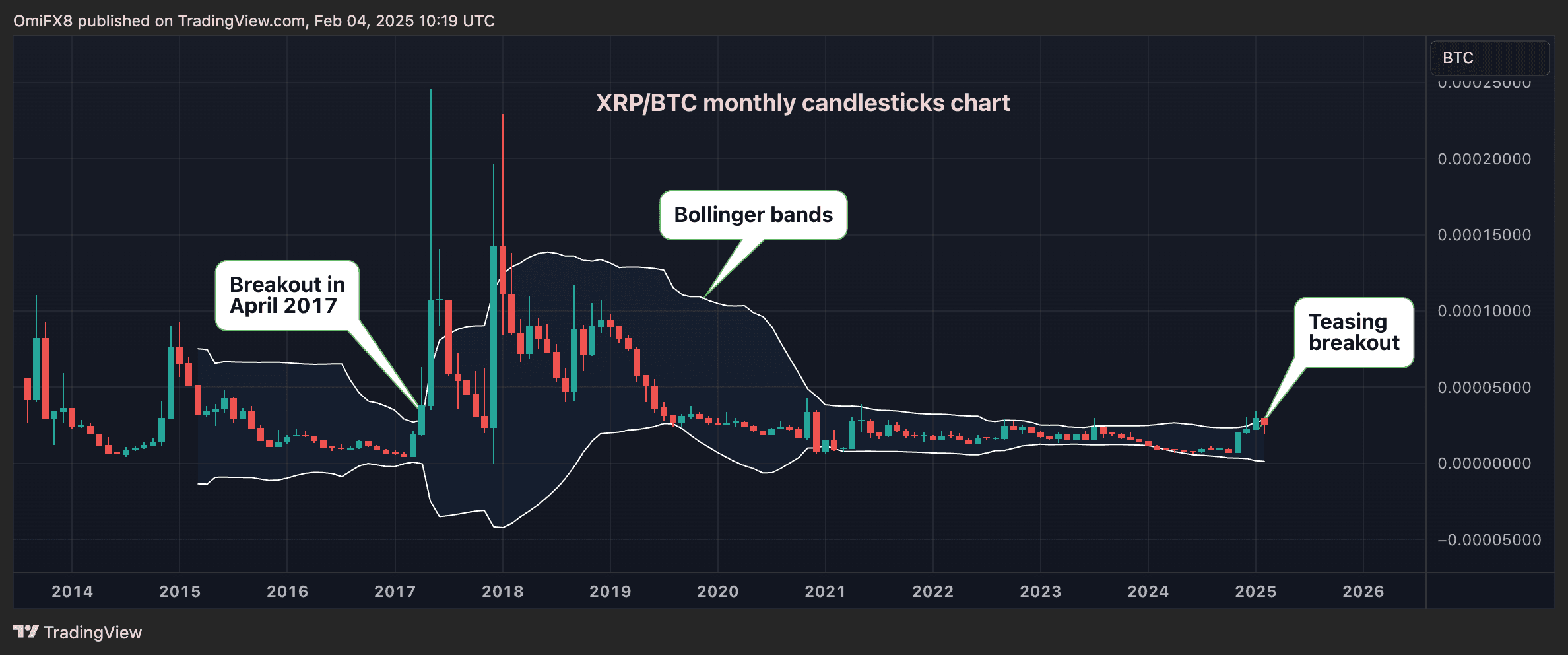

The future for alternative cryptocurrencies seems increasingly bleak when compared to the stability of bitcoin, especially in light of a potential resurgence of trade conflicts between the United States and its key trading partners. Such tensions could pose significant risks to the global economy. Despite this somewhat pessimistic backdrop, a few altcoins are displaying encouraging signs. Notably, the XRP/BTC trading pair is showing potential, as it approaches a breakout above the upper Bollinger band on its monthly chart for the first time since 2017. This movement hints at the possibility of a substantial bull run for XRP in the near future.

Bollinger Bands are volatility indicators that are positioned two standard deviations above and below the 20-period (day/week/month) simple moving average of an asset’s price. A breakout above the upper band often signifies a bullish imbalance in the market, suggesting that prices are likely to maintain momentum for several days in a phenomenon referred to as high momentum.

Traders who monitor price patterns tend to enter long positions when prices exceed the upper band, as this is interpreted as a clear sign of bullish market sentiment. Breakouts that occur after extended periods of consolidation between the bands are generally seen as more reliable indicators of future price movements.

Looking back at historical data, the XRP/BTC ratio experienced an impressive surge of nearly 200% following the Bollinger band breakout in April 2017, marking a bullish resolution after a prolonged phase of low volatility trading. This historical context raises the intriguing question: will history repeat itself?